What is a Candlestick?

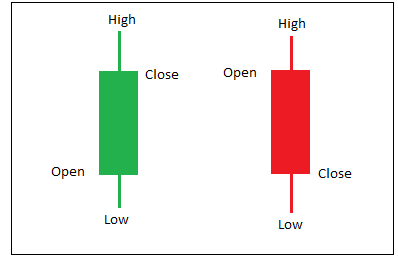

Type of price chart used in TA that displays the high, low, open and closing prices of a security for a specific period.

- Rectangular sections are known as the real body, representing the range between the session’s open and close

- Thin lines above and below are the shadows, representing the session’s price extremes

- Shadow above is the upper shadow

Shadow below is the lower shadow

Characteristics of the Candlestick

- When the real body is black (or red), it means that the close of the position is lower than the open

- When the real body is white (or green), it means that the close was higher than the open

- Peak of the upper shadow is the high of the session

- Bottom of the lower shadow is the low of the session

- If candle has no upper shadow, it is said to have a shaven head

- If the candle has no lower shadow, it is said to have a shaven bottom

Limitations of Candlesticks

- Does not provide price targets, require western technicals or trend analysis to forecast price targets

- Candlesticks and by extension reversal patterns does not signal the extent of the move, only the reversal of a trend

Price Target: Analyst’s prediction of a security’s future price