Phrase of the Week

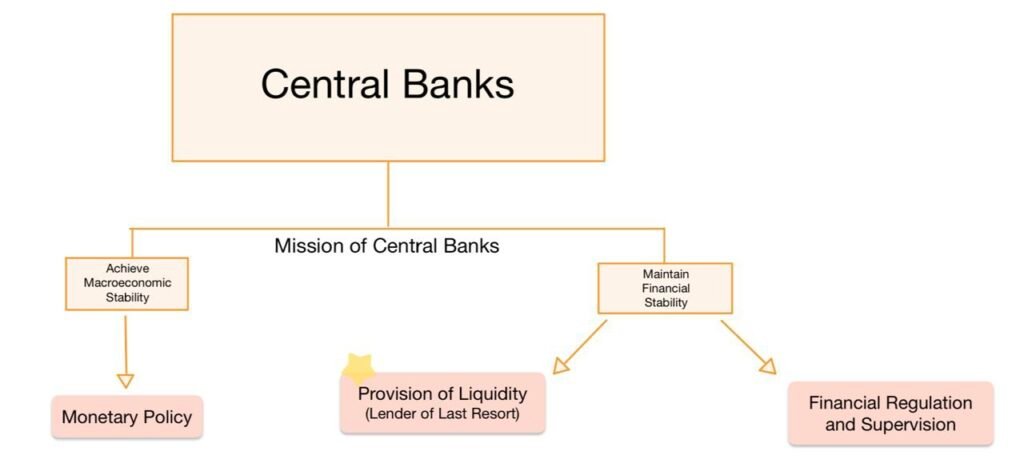

Hey everyone! In this week’s phrase of the week, we will talk about the Lender of Last Resort. So what is it? Before we talk about it, let us talk about the Central Bank. A Central Bank is a financial institution that stands at the centre of a country’s (or countries’) monetary and financial system. There are two main goals of the Central Bank, a) achieving macroeconomic stability and b) maintaining financial stability.

To achieve macroeconomic stability, the Central Bank will use monetary policy tools, such as increasing/decreasing the short-term interest rates (used by the Federal Reserve in the United States) or through exchange rates (used by the Monetary Authority of Singapore (MAS)).

On the other hand, the Central Bank ensures financial stability through two methods. Firstly, it does it through financial regulation and supervision to ensure institutions within the financial system take an appropriate amount of risk-taking, which prevents a financial crisis from occurring. Secondly and more importantly, the Central Bank can use a method known as ‘Lender of Last Resort’. Now that you have a better idea of the entire structure, let’s see how the Central Bank uses it to maintain financial stability.

What does Lender of Last Resort mean?

So what is the Lender of Last Resort? In short, it is the Central Bank providing liquidity to financial institutions when they do not have alternative sources of funding in the event of a financial market disruption or crisis to stabilise the financial system.

How does the Lender of Last Resort work?

The Central Bank engages in Lender of Last Resort to financial institutions as a last resort.

In the event of a financial panic, the institution has mostly long-term illiquid assets which are financed by short-term liabilities (such as deposits). When such a crisis occurs, many depositors would want to withdraw their deposits from the institution. However, given the illiquid nature of their assets, they are unable to sell off their assets to raise cash to pay back the deposits leading to bankruptcy. This is known as a bank run. It can lead to ripple effects throughout the financial system as other individuals might worry about such an instance happening at their financial institution and may ask to withdraw as well, which can lead to other institutions failing as well. This results in a self-fulfilling prophecy as when they fail, they will have to liquidate their assets at a discount and may be unable to pay the depositors back.

As such through Lender of Last Resort, the Central Bank provides such institutions with cash through short-term loans to pay off its depositors while taking collateral (such as loans) from them. This allows them to pay back depositors and quell the panic, which can help to avert such a crisis.

Effectiveness

However, how effective is the Lender of Last Resort? Well in many cases, it has been pretty effective. An example would be during the 2008 global financial crisis when Central Banks around the world had to use the Lender of Last Resort to quell the panic happening throughout the financial system. Without it, the panic might have continued and could have worsened the situation.

That said, it is not to say that the Lender of Last Resort is a perfect strategy. For one, with it in place, moral hazard might occur as financial institutions might be willing to take on much more risk than they normally would as they believe that the Central Bank will ‘bail’ them out in the event of a crisis occurring.

Secondly, a caveat of the Lender of Last Resort is that it can work only if the financial institutions that the Central Banks are lending to are solvent. As Central Banks should only lend when good collateral is provided and they are confident that the lenders are able to pay back in the future, institutions that are unable to provide good collateral (such as those with illiquid assets that have gone bad) will not be provided with loans, and will inevitably fail. Hence it is essential for the banks to judge if the institutions are insolvent or illiquid.

Lastly, as the name suggests, such a tool is, after all, a last resort. Such a strategy is typically used in dire situations. Instead, other strategies such as monitoring and regulation of financial institutions might be a better alternative, as it can help prevent them from reaching that state in the first place. As the saying goes, ‘prevention is better than cure’.

Conclusion

In conclusion, the Lender of Last Resort is an important strategy of Central Banks and while sometimes may be viewed as controversial, has undoubtedly played a pivotal role in dealing with financial crises. Hope you have found this article insightful. If you did, be sure to share and suggest what other topics you would like to learn more about in future articles!

In addition if you would like to know more, I highly recommend the book ‘The Federal Reserve and the Financial Crisis’ by Ben Bernanke, Former Chair of the Federal Reserve of the United States.

Cheers!

-Rice