Hey everyone! As the year is coming to a close, many of us would have one thing on our minds (besides the usual new year’s resolutions) — GST increase! In this article, I will talk about the changes, what it means for us as consumers, and other things we should take note of. Let’s begin 🙂

What is GST?

In case you aren’t familiar, the Goods and Service Tax (GST) is a broad-based consumption tax levied on the import of goods, as well as nearly all supplies of goods and services in Singapore. However, there are some exemptions to GST such as the provision of financial services, supply of digital payment tokens, sale and lease of residential properties, and the importation and local supply of investment precious metals.

In other countries, GST is also known as the Value-Added Tax (VAT).

Changes to GST in 2023 (and beyond)

So, what are the changes to GST in Singapore in the new year? Firstly, GST rates will increase from the existing rates of 7% to 8% from 1st January 2023. This is set to increase by another percent to 9% in 2024.

While the GST increases are widely reported and talked about changes to the Goods and Service Tax, another change that is set to affect many of us is that GST will now apply to low-value goods bought from overseas. This refers to items with a value of $400 or less. In other words, most of our online purchases (many of which are shipped from overseas) will be subject to the prevailing GST rates!

Lastly, GST is also applicable to all types of business-to-consumer (B2C) non-digital services such as telemedicine, online counselling, and legal/consultancy services.

What do these changes mean?

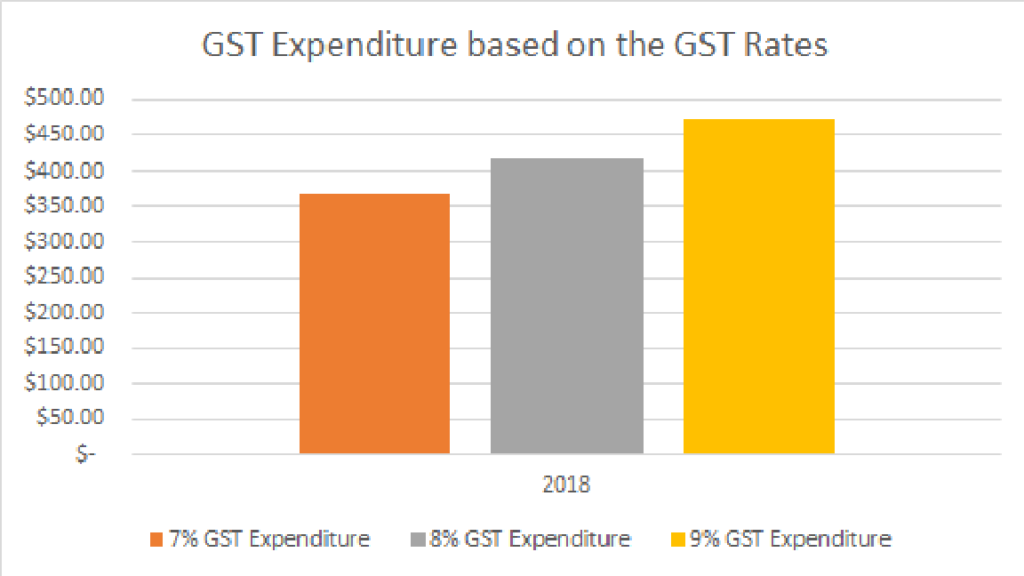

These changes would mean we as consumers have to pay more. But how much more? Let us look at some statistics to estimate the additional costs arising from GST hikes. Based on the latest expenditure data from the Department of Statistics Singapore (2018), individual monthly expenditures for 2017/2018 came to $1,628, while households had a monthly expenditure of $5904.50 in 2018. Taking out non-GST taxable components such as healthcare and education, the household expenditure for 2018 came to $5242.2. Based on the data, the year-on-year increase in expenditure due to the GST hike is roughly $52 (This is based on the increase of 1% in 2023 and another 1% in 2024. From 2025 onwards the additional expenditure amounts to roughly $104).

*The assumption is that the data provided is not inclusive of GST yet. Also assumes the whole component is subject to GST (hence the real value is likely to be lower than the estimates)

Government’s response to GST increase

Why is the Government increasing GST rates?

Now, with the changes to the Goods and Service tax looming over the heads, you might wonder what is the Government’s rationale for the change. According to the Ministry of Finance (MOF), it is to meet Singapore’s expanding social, security, and other needs. One of the main reasons is the increasing expenditure on healthcare as a result of a rapidly ageing population as the Government predicts 1 in 4 Singaporeans will be aged 65 and above in 2030. Secondly, another reason is the need to spend more on affordable childcare and early childhood education to give future generations a better start in life. Lastly, in this increasingly globalised world, we are facing more threats such as terrorism and there is a need for more investments to keep Singaporeans safe.

Now that we know the rationale behind the changes, let us look at some measures the Government is taking to help alleviate the pressures from the GST hikes.

What is the Government doing to offset GST expenses?

To cushion the impact of the goods and services hike and changes, the Government has announced the $6 billion Assurance Package (previously announced in 2020). This comes in various forms of relief such as; cash payouts, GST vouchers, Medisave top-ups, and Community Development Council (CDC) vouchers. According to Finance Minister Lawrence Wong, the assurance package aims to cover at least five additional years of GST expenses for most Singapore households and about ten years for lower-income households.

Most recently, many Singaporeans would have received cash payments from the $1.5 billion Support Package, ranging from S$300 – 500. Here is the summary of the various reliefs that the Government is doing to alleviate the impact of the GST hikes.

| Who benefits? | Total Amount ($SGD) | Payout Period | |

|---|---|---|---|

| Cash payout | All 2.8 million adult Singaporeans aged 21 and above | $700 to $1,600 | Over five years, starting in 2022 |

| GST Voucher – Cash(Senior’s Bonus) | About 850,000 lower-income senior Singaporeans aged 55 and above | $600 to $900 | Over three years, starting in 2023 |

| Additional GST Voucher – U-Save rebates | About 950,000 Singaporean households in HDB flats | $330 to $570 | Over four years, starting in 2023 |

| MediSave top-ups | All Singaporean children below age 21 and seniors aged 55 and above – about two million total | $450 | Over three years, starting in 2023 |

| Community Development Council Vouchers scheme | All 1.3 million Singaporean households | Two tranches of $200 each | In 2023 and 2024 |

What should we do as consumers?

In light of the changes to GST, what can we, as consumers do? For starters, we can bring forward our planned purchases to this year. An example would be making an online purchase of the items (items are from overseas) this year but only receiving them in the next year. If the items are considered ‘low-value goods’, you would not have to pay any GST on the items if you bought them this year, whereas such goods would be subject to the new GST rate of 8% if purchased next year. Even for big-ticket items, you would only have to pay the prevailing GST rate instead of the increased rate! This may seem like pocket change to some, but this amount can turn out to be quite a sizable amount for high-value items.

Another thing we can do as consumers is to buy second-hand/support small businesses where possible. In such instances, their taxable business turnover is unlikely to exceed $1 million per annum which means they are exempt from the Goods and Services tax. If their prices are comparable to their larger counterparts, this will result in sizable savings for us as consumers!

Lastly, one simple thing we can do as consumers is to simply spend less! After all, unless the purchases are necessities, many of the things we buy are more of ‘wants’ rather than ‘needs’. I’ve previously made an article on the importance of budgeting which I believe is something many of us should embrace going into the uncertain economic climate of 2023.

Conclusion

Now that we have come to the end of the article, what would you, as a consumer do? Do share your thoughts and plans in the comments below! I have also attached the expenditure excel sheet for all the data used in this article (base data in the first sheet taken from Department of Statistics Singapore). Once again, thanks for reading and have a good New Year!

Cheers!

-Rice