Save money and money will save you. Throughout our lives, we have been constantly reminded to save. Remember the times where we were asked to put our leftover money into a piggy bank? That action in itself is the start of our saving journey! As we move into our teens, we might have items that we want but we do not have enough money for. We decided to set aside a portion of our allowance over many months, accumulating sufficient money for us to buy this prized item. Sounds familiar? Well, that is in fact our first step at budgeting! Through these small experiences in our formative years, the concept of saving and budgeting has never once been regarded as unimportant. However, there is much more to saving than we might be aware of!

Well, in my post today I shall attempt to further explain why this painful habit remains of utmost importance!

What is budgeting and saving?

Now, while budgeting and saving share some similarities, we should not confuse them with each other.

Budgeting is a plan to coordinate and manage one’s finances and expenditures over a period of time.

On the other hand, saving refers to the money one has left over after subtracting their expenditures from disposable income over a specific period of time.

Budgeting can be thought of as the process that leads to savings (the ‘result’).

Budgeting and Saving to achieve Financial Independence (FI)

Now, besides investing, budgeting and saving is another core pillar* to achieve Financial Independence (FI).

Well, what is FI? Financial Independence is the status of having sufficient income to pay for one’s living expenses for the rest of one’s life without having to be employed or dependent on others.

This forms the basis of the FIRE (Financial Independence, Retire Early) movement where people aim for extreme savings and investment to allow them to retire much earlier than what a typical budget/retirement plan can achieve.

Budgeting will allow us to plan our spending and allocate the remaining of our income as savings. Savings, together with our investments, will form the bulk of the assets to be used as living expenses when we achieve FI. Savings is the more liquid version where it can be immediately spent on expenses such as food, bills, transport, insurance etc. On the other hand, investments need to be liquidated (sold off) before they can be spent.

*However it is important to note that saving is different from investing. Saving is putting aside money to reach your goals (typically low or risk-free). Investing is putting your money into a security with the expectation that the value will grow over time but it does carry some risk.

Why are we terrible at budgeting and saving?

Now you might lament, “I wanna budget and save but I find it sooo difficult!”. If that sounds familiar, you might fall under the category of ‘Spendthrifts’ where they tend to spend money irresponsibly. Such behaviour boils down to two main factors; human psychology and a lack of planning.

Human Psychology

Our human psychology is a result of our habits and upbringing. For some of us, we might be born in a house with loose spending habits which may carry on till much later in our lives. In other cases, some derive joy from spending as it gives them a feeling of gratification, or gives them an outlet to release their stress or celebrate their achievements. Regardless of the reason, such habits accumulate over time and numb one’s spending habits, causing them to spend more with less care!

Hence, we should aim to break such habits and cultivate better spending habits. Now let us look at the other aggravating factor, the lack of planning.

Lack of planning

A second aggravating factor is a lack of planning. As the saying goes, ‘If we fail to plan, we plan to fail’. Many of us do not have clear goals in mind when it comes to saving. This could be due to procrastination or in other cases, the lack of awareness of the importance of planning. A lack of planning results in many lacking a budgeting plan. Without a clear budgeting plan in mind, it is difficult for us to have any meaningful savings.

Now, after covering the factors which contribute to our problems in budgeting/saving, we shall discuss how we can do so in the next section.

How should we budget or save?

You might ask, how should we then budget and save? Let me go through some ways you can do so!

#1 Spend below our means

The first and easiest way to do so would be to spend below our means! What does that mean? For example, if we earn $4000 monthly, we should be spending less than $4000 a month. In doing so, we are effectively ‘setting’ our budget to be below our monthly income, with the remaining unused income becoming our savings.

Furthermore, even if we get bonuses and pay raises we should try to maintain our expenditures. It is more difficult to reduce our spending than increase our spending. By maintaining our current spending habits, it will give rise to even greater savings.

Well, you might be thinking, “this is easy!”. And indeed it is! Spending below our means is the most fundamental plan we should have and is something we should all start from. Once we can spend below our means, we can work on more elaborate budgeting and savings plans which I will cover in the next few points.

#2 Separate needs from wants

One way to help us save would be to separate our needs from wants. Needs are items that are considered necessary for survival, such as food, housing costs, medical fees etc. On the other hand, wants are items not needed for survival and are typically for personal enjoyment, such as travelling, entertainment, luxury goods and more.

After separating our needs from wants, we can try and cut down the number of wants. A simple technique that I find very useful would be to sit on such purchases for a couple of weeks. If the ‘itch’ from buying the item fades, it just shows that you do not need the item. In doing so it will help you cut out any unnecessary purchases!

#3 50-30-20 Rule

The 50-30-20 rule would be a more structured plan than the previous methods. It involves dividing after-tax income and allocating it as follows: 50% on needs, 30% on wants and the remaining 20% on savings.

While we can tweak the percentages slightly to fit our needs (e.g. 20% wants, 30% savings) We should try and keep to the same breakdown or better. (by better I mean a larger % of savings). Such a plan would guarantee we have a fixed budget for each type of spending. It also guarantees that we would save a fixed amount of our post-tax income.

Personally, I would have a fourth part in the rule for investing. I would probably allocate a larger % to investing compared to wants and savings as I believe in compounding my money from young. While savings are likely to be worth less due to inflation, investing can help us beat inflation and grow our money. (I have done several articles on investing, and if you would like to start you can check out the one I did on ETFs which I believe is the best investment choice for a passive investor)

For the savviest budgeters and savers let us look at the next plan which may be more suited for those who are more meticulous.

#4 Have a goal

Remember how in school we were asked to do target setting for our results? Just like in school, we should have clear goals for our personal finances! Our goals can be simple, such as saving to buy a house or saving for retirement. However, our plan should have two important components, time horizon and the amount necessary.

By having a clear time horizon and the amount we need to save for, we can then have a rough gauge of how much we would need to save monthly. Having a clear goal would then allow us to create a budget plan.

#5 Have a budget plan

After coming up with our goal, we can start to formulate our budget plan. Firstly, we would need to know the % of our income to set aside as savings (or a combination of investments for goals with a long time horizon).

Additionally, we can further break down our needs and wants into further compartments. For example, a simple one would be to break down the fixed and variable expenditures. Fixed expenditures could be stuff like rental and insurance, while variable expenses can be things like clothing and food.

Having such a budget plan will allow us to adjust our spending habits and track which areas we would have to reduce our expenditure. We will talk about some tools that will help us with our budgeting plan in the next section.

Tools to help us budget or save.

One of the simplest tools that I use to track my budget and savings would be Google Sheets! We can make use of the available templates to help us. You can do such templates by:

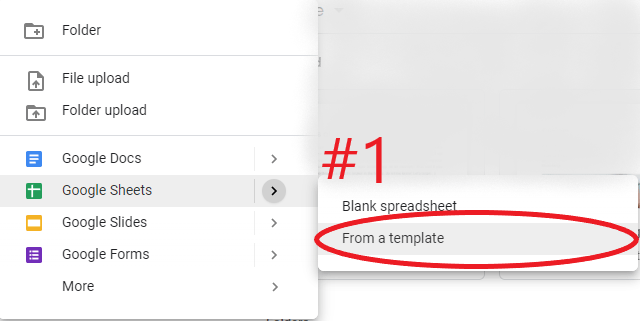

- Under Google Drive click “New”

- Hover on the right arrow under Google Sheets and click “From a template”. (See #1)

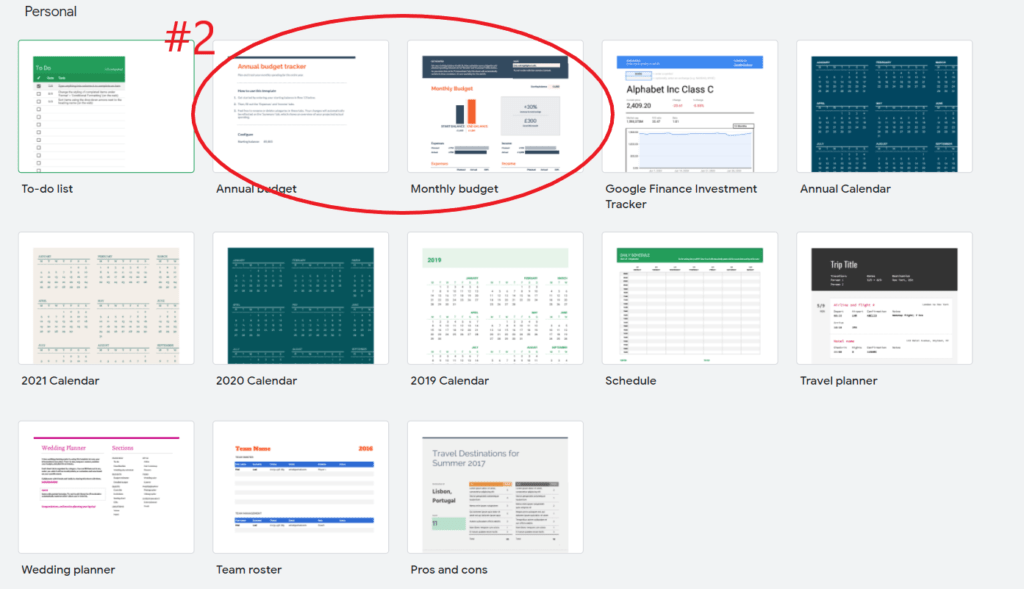

- Under the “Personal” section, you can choose from two templates, “Annual Budget” and “Monthly Budget” (See #2). Each has slightly different uses but I prefer using the annual budget one.

And there we have it! A simple budget tracker to track your various expenditure and savings at the end.

Another tool to consider would be mobile budget tracker apps. A simple to use (and free!) app would be the Monthly Budget – Expense Tracker app. It covers the basic functionalities needed in a budget plan.

In the future, I would be doing in-depth reviews of the various tools mentioned here! In addition, do let me know if you have other budgeting tools that you would like me to give a review/tutorial on.

That’s it for this week’s blog post! Hope you found this useful to start taking charge of your own finances and save for a better future. Do note that having and sticking to a budgeting and savings plan is not easy. However, don’t give up! Like investing we should have the discipline and a focused mindset for us to achieve our goals of improving our finances. Cheers!

-Rice

Hey everyone, just in case you are unable to find the Google Sheets templates I have made a copy and linked them here! Do check them out! 🎉

Annual Budget Template:

https://docs.google.com/spreadsheets/d/1sXsc8gK4w2-WEQt_fhalZfQqBm98Pw8kyHmYxzJwkWc/edit?usp=sharing

Monthly Budget Template:

https://docs.google.com/spreadsheets/d/15tfr1Btv_ZoQQWXzERziHM-znjfWCY_3BaMzunU8bgM/edit?usp=sharing