Hi everyone! I’m sure many of us tune in to the news regularly, be it reading articles online or watching newscasts to keep up to date on the latest happenings. When it comes to financial and market news, we are even more spoilt for choice. From stock market updates to company analysis, the amount of information we can take in is never-ending. Or is it? While we think we have been gaining essential information on the market, what we have been taking could be noise instead.

What is Noise?

Well then, what is noise? Noise is the opposite of factual and reliable information. It comes in many forms, including rumours or even a particular person’s views. In addition, technical analysis is also considered as ‘noise trading’.

Typically noise comes from sell-side individuals, who are typically brokers and analysts that are tasked with selling products such as shares and bonds. Such individuals tend to appear on television or write articles to ‘sell’ their views.

What is Information?

Information on the other hand is data gleaned directly from the market, which shows how the markets are actually moving.

Noise and Information are on extreme ends of the spectrum and it would be crucial for us to identify the differences between them. We shall talk about the importance of cutting out the noise in a later section.

Now, let us take a look at some examples!

Example #1

From this headline, it is clear that the article is the opinion of the writer’s views where he/she is recommending one growth stock to buy and another to sell. Hence such an article would be considered noise.

This can be further supported by this excerpt, where the author mentions that one should buy the dip given the high analysts’ estimates going into 2022.

[While such analyst pieces may not necessarily be wrong, they may turn out to be unreliable. We should always do our due diligence (with data available) and make our own decisions.]

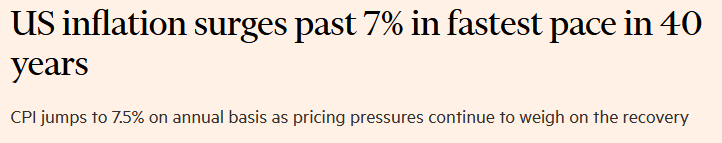

Example #2

This is factual – it is a report on the US inflation rates measuring the consumer price index (CPI). Such inflation numbers affect various securities such as treasury notes. Using the data given, we can draw links to how such data will affect the various markets and their securities.

Example #3

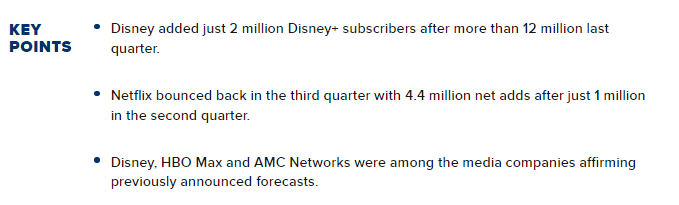

Lastly, let us look at this headline, released after Disney’s earnings in Q4 2021. It reported that ‘Growth is slowing for streaming services’. This is after Disney+ reported a much lower number of new subscribers than the previous quarter. While growth has slowed for the last quarter, this does not suggest that growth is slowing down for Disney (long-run speaking) nor is it representative for all streaming services.

That said, there are some parts of the article that are considered as information. Looking at the first two key points above, it did report statistics of Disney + and Netflix subscribers respectively based on their reported earnings. From such statistics, we will be able to draw conclusions on the company’s earnings and how they may affect its stock price.

Importance of identifying differences between noise and information

Cutting out the noise not only saves time but also simplifies our thought process. This allows us to rely on our own knowledge and think for ourselves.

Now you may wonder, what is the importance of identifying noise and information? Well, differentiating between noise and information will allow us to cut out the noise. Noise, as it is mostly one’s opinions, may not be grounded in facts, and worse still tends to be unreliable. Information, however, is factual and is reliable, allowing us to draw our own conclusions from it. Let me describe the benefits of information and the shortcomings of noise next!

Listening to the noise is not only time consuming, but can sway our opinions on a particular issue. Instead of simplifying our thought process, listening to opposing opinions that seem to hold merit it will just leave us confused as a result. In addition, listening to noise may further worsen our confirmation bias, as we look for sources that support our views. (This is especially dangerous if the information and the noise leads to opposing views)

We should rely on our own knowledge and think for ourselves, and relying on information alone will allow us to formulate conclusions as accurately as possible. Formulating such conclusions on our own will give us the conviction to stay true to our decisions. This is especially true for the contrarian investor/trader where they take a view that opposes that of the herd.

Contrarian: A person who opposes or rejects popular opinion, especially in stock exchange dealing.

Applying such techniques in real life

When reading various news sources, it is imperative for us to filter out the noise and focus only on the information. By reading the headlines, we can usually determine if the article is likely to be mostly noise or information. However, as can be seen from our examples above, there may be articles with both noise and information in them.

In addition, opinion pieces tend to be noise as they are opinions of the writers themselves. Additionally, we can look up the writer’s background and determine if they are sell-side individuals, which suggests that articles written by them may have agendas behind them.

Hope you found this article useful, and manage to apply it to your trading/investing routine! As usual, do your due diligence before making any decisions. Relying on others’ opinions will not yield any good results.

In the aftermath of the US market sell-off yesterday, I would like to end of with this quote;

“We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful”

Warren Buffett

With the doomsayers out in full force, we should be prudent on what we listen to. Rely on facts, not fear and opinions to make your trading and investing decisions. See you next week!

– Rice