Hey everyone, hope you have enjoyed this Chinese New Year holiday! For this week’s article, I thought we could go through the basics of placing trades (on any brokerage!). I will run through what each of the settings means and when they should be used in placing your trades. For this post, I will be using the tiger brokers app as an example. That said if you would like me to go through a specific broker in the future, do let me know! Let’s begin : )

[Hi everyone! If you are looking to sign-up for tiger brokers you can use my link. This will give you up to 60 commission free trades and a free apple share! T&Cs apply and promotion is accurate as of 2 Feb 2022.]

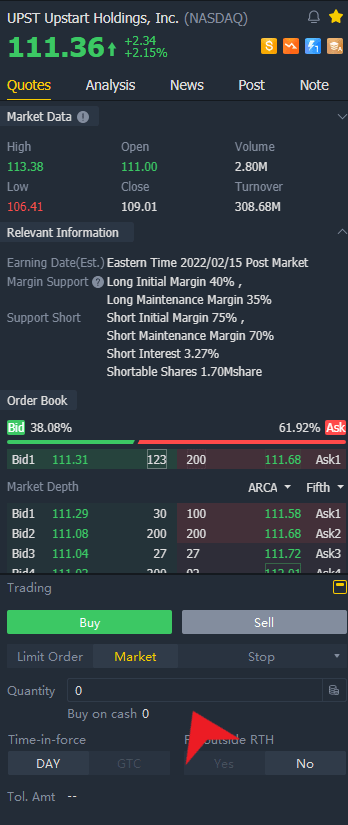

Bid-Ask Spread

The bid-ask spread is probably the most important concept when placing a trade. It is the price at which one is willing to buy or sell the shares. The bid-ask spread is the difference between the bid and ask prices. Let us define a few more keywords:

- Quote: Price at which one is willing to buy or sell.

- Bid: Price at which one is willing to buy.

- Ask: Price at which one is willing to sell.

An easy way to understand bid and ask is that the bid is the price you can sell while the ask is the price you can buy. The ask price is also always higher than the bid price. Well then you might ask, does that mean I have to buy on the offer side and sell on the bid side? And the truth is…NO! We should always aim to set our trades on the desirable* side of the spread, as anyone who does not do so many accumulate much higher costs after many trades. We shall jump right into an example in the next paragraph.

*We should buy orders on the bid side and sell orders on the ask (offer) side.

Let us use the example of Upstart Holdings (UPST). As can be seen above there is a bid-ask spread of $112.00/$113.00. If you want to buy 100 shares of the stock and you bought on the ask side of the spread versus buying on the bid side of the spread, you would have incurred an additional cost of $100. Imagine doing this many many times, imagine how it adds up! Furthermore, for stocks with low liquidity (typically less well-known stocks with low trading volume), the bid-ask spread tends to be much larger. Hence, to minimise the additional costs incurred, we should always buy/sell on the right side of the bid-ask spread. I will cover some orders that can help you achieve that in the next section.

Types of Orders

In this section, we will go through the main types of orders needed for buying and selling shares. Each of them has its drawbacks and limitations and is suitable for different situations.

Market Order

The simplest of orders, Market Order is used to buy or sell at the bid or offer price. Market orders are most likely to fill, and it also tends to be the quickest to fill. However, the market order provides no price protection and may fill at a price that deviates away from the current bid-ask spread. All you would need to do is to set the quantity of the number of shares you would like to purchase (see red arrow above).

Market orders are suited for long-term buy and hold investors who are less concerned about the small cost differences compared to the returns in the long run. Such investors do not mind paying a slight premium for a (basically) guaranteed fill on their trade.

Limit Order

The next most common order type, Limit Order is an order to buy or sell shares at a specified price or better. A limit order ensures that the order will not fill at a price less favourable than the limit price. However, if the quote price does not reach the limit price, the order will not fill.

When placing a limit order after selecting buy or sell, you would then need to indicate the limit price. When setting a limit price it is prudent to have a target price in mind. If you set a limit price too far away from the current quote, it is unlikely for the order to be filled. Afterwards, you would also need to indicate the quantity of the number of shares you would like to buy/sell.

Limit Orders are suitable for investors who have a specific entry price in mind. If one has a target price (buy/sell) in mind it is recommended to use such a method. It is also suitable for those who want to get in at a price that does not deviate too far from the quote price. However, it is important to remember that such orders are not guaranteed to fill.

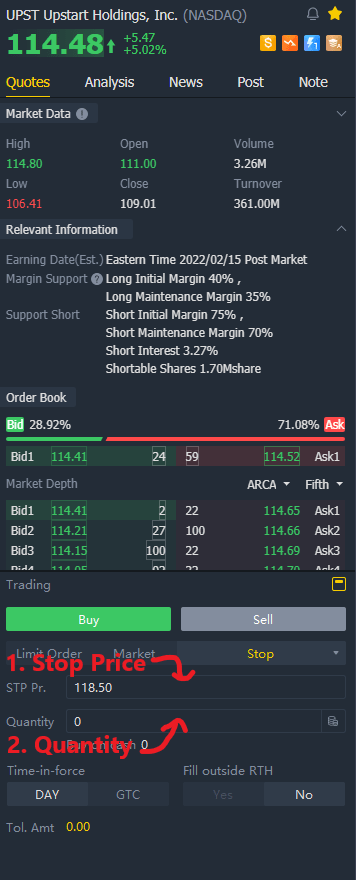

Stop Loss Order

The last type of order we will cover, the Stop (Loss) Order, is an instruction to submit a buy or sell market order when a specific stop price is triggered. Such orders, as the name suggests, are used to limit losses. This can be done by placing a sell stop order below the current price to limit loss or profit taking on a long stock position. Conversely, a buy stop order is placed above the market price, and is used to limit a loss or help protect a profit on a short sale.

Firstly, you would need to enter a stop price. As discussed above such price should be above or below the market price, depending on the scenario. In addition, you would also need to indicate the quantity of the number of shares you would like to buy/sell. Do note that a Stop order does not guarantee a trigger, but once the market price hits the stop price, it will be guaranteed to fill. As it is filled as a market order, the trade may execute significantly away from its stop price.

Summary

Here is a summary of the types of orders described above. Do let me know if you would like me to go through more elaborate order types (e.g Stop Limit orders) in the future!

| Order Type | Characteristics |

|---|---|

| Market Order | Guaranteed to fill / Fills the quickest May not fill at a desirable price |

| Limit Order | Not guaranteed to trigger or fill Fills at a price equal or better than the limit price |

| Stop Loss | Not guaranteed to trigger, but once triggered guaranteed to fill May not fill at a desirable price |

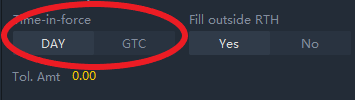

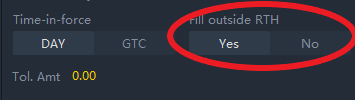

Time-in-force

After setting up the order type and details, you would encounter this setting called ‘Time-in-force’. Time-in-force means the time your trade would be active (if it has not been filled) before it is automatically cancelled by the system. There are two options under Time-in-force, ‘DAY’ and ‘GTC’. ‘DAY’ means that orders are cancelled if the trade does not execute by the end of closing day. On the other hand, ‘GTC’ stands for Good-Til-Cancelled, which means the trade remains active until the trade has been executed or manually cancelled by the individual.

‘DAY’ orders are usually the default used by most people who want to only place those orders for that particular trading day. On the other hand, ‘GTC’ orders are for those who have a particular target price in mind and do not mind waiting days/weeks for the orders to fill at that price (such a setting saves them the time of setting the same order every trading day).

Fill outside RTH

The last setting ‘Fill outside RTH’, is the simplest setting among all those previously discussed. RTH stands for ‘Regular Trading Hours’ and by indicating yes or no, it allows you to trade outside the normal trading hours. Such hours outside normal trading hours are the Pre-market and Post-market hours.

However, there are risks of trading outside regular trading hours. First, with lower volume being traded in pre and post market, there will be less liquidity and increased volatility, with larger bid-ask spreads which may give you unfavourable fills especially using market orders. That said, some people do like to trade outside RTH for various reasons, such as in the event of earnings releases (that happens before the market opens or after the market closes).

The above sections should cover most of the functions needed for most investors, albeit there are more sophisticated order types. Do note that the interface may vary slightly depending on which broker you use, but the main functions should be there. In addition, once a trade is filled you would not be able to revert the said trade, so do always check before placing your trades! Hope you found this brief post useful in covering the gist of placing orders! Thank you for reading and do feel free to suggest new blog post topics you would like me to cover in the future : )

-Rice