Hey everyone, with the rise in popularity of robo advisors, I thought I would make an article on them. While they are great investment tools, I would give a word of caution before you invest with them. Let’s dive right in!

What are Robo Advisors

Let us start with the basics. Robo Advisors or robos are digital platforms that provide automatic, algorithm-driven financial planning services with limited human supervision. While robos differ from each other, they typically offer portfolios based on your risk index (which is how much risk you are willing to take), although some do offer other types of portfolios such as thematic portfolios as well as income portfolios.

Most of these robos have the characteristics of a simple to use app to do all your investments. Typically, they have a relatively easy set-up, with low to no minimum sums required. We shall explore their advantages and limitations in the next section.

Thematic Portfolios are portfolios that align certain themes to your investments. For example, ESG and Clean Energy as well as a focus on China Equities.

Income Portfolio: Those that give a fixed relatively low returns (~1.0% per annum) but with little to no risk attached.

Advantages of Robo Advisors

The first widely touted advantage of Robo Advisors is the ease of use. For those who are less financially savvy and do not know where to start, robos offer the simplicity that other investment engines do not. You can think of it as an actively managed fund, where instead of deciding what you want to invest in, the robo will help you invest in the various securities based on the settings (risk tolerance, portfolio selection etc) that you have set. For those without any financial knowledge, the simple to use nature of robos is very appealing.

Another reason would be the lower minimum investment sums. For those just starting their portfolios, or for those who are only able to invest small sums of money periodically, robos might be deemed as a better alternative. It allows the individuals to invest for as low as $1 per deposit! This is not feasible for other alternatives such as buying any securities through brokers. Buying through brokers will incur commission fees, and that would not make financial sense to invest small sums of money. In addition, others like mutual funds/stocks may have minimum sums (or lots).

For those living in Singapore, another advantage of (certain) Robo Advisors is the option to invest your SRS and even OA monies. For those looking to achieve a higher return than the guaranteed in SRS (0.5%) and OA (2.5%) accounts. I won’t go into the specifics in this article, but I have briefly covered them in my other article for OA monies. Here is a list of the various robos that you can invest your SRS and OA monies in:

- Endowus, CPF OA and SRS

- MoneyOwl, SRS

- StashAway, SRS

While the investment options are currently limited, I foresee other robos will allow investing with OA and SRS as a feature in the future.

Lastly, robo advisors can auto-rebalance your portfolio to the targeted portfolio allocation. Compared to DIY for example, it requires more effort and discipline to carry out as you would have to rebalance it on yourself. Hence for those who are less disciplined in sticking to an investment strategy, robos might be a better choice for you.

Limitations of Robo Advisors

However, when it comes to the disadvantages of robos, there are many as well. Firstly, robo advisors limit the options of the securities you can invest in. While some offer more and more portfolios and others (like Endowus) even allow you to invest in specific funds, the majority are limited to broad-based portfolios which vary in allocation depending on your risk tolerance. Well, what is the problem? Those who are not keen on investing in particular sectors or securities (for example investing in the China Market), would not have the option to not invest in those that they lack conviction in. In other words, one would have to have full conviction in the portfolio of the robo advisors.

This leads me to another problem of a lack of transparency. Just like advisors/actively managed funds, it is up to the robos’ discretion on investing and rebalancing of our portfolio. In addition, many do not share or share a limited aspect of their research/ investment methodology, typically just referring to them as an ‘intelligent framework’ or ‘financial models’.

A combination of the above two disadvantages of robo advisors may put off a lot of people. I will give an example of this in the next section.

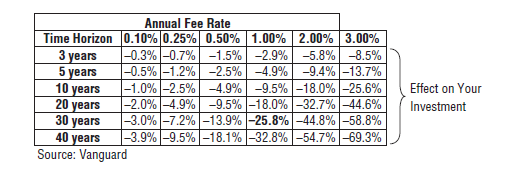

In addition, robo advisors charge high fees compared to DIY. Whilst the fees may seem cheap to a regular advisor, investing on your own is much more affordable. Comparing an average robo’s fee for their broad-based portfolio, it typically varies from 0.30% – 0.80%. On the other hand, let us take a worldwide ETF for a highly diversified stock portfolio (ticker ISAC). It has a much lower expense ratio of 0.20%. Now you may counter, such robos offer other securities such as bonds. However, I would counter that having a three-fund portfolio (also known as a lazy portfolio) will achieve similar exposure and by extension, results. [Do let me know if you’d like an article on the three-fund portfolio!]

Above is a table I find very useful in showing the compounding effect of higher fees on your investment. Just let that sink in for a moment.

Still not convinced? Well, robo advisors also lack the human touch. For many investing with financial advisors, they would want advice and reassurances on their investments and how it can tie in with other aspects such as inheritance, taxes, finances etc. However, robos do not do much in the sense of reassuring you in market downturns and allay your fears. Robo advisors can be thought of as a budget airline as compared to a financial advisor, with more stripped-down services and more self-service aspects. Should you expect constant advice on your portfolio and finances, robos may not be the one for you.

A cautionary tale: be warned.

As mentioned in the section above, I will be giving an example using a case study of one of the Robo Advisors, StashAway. I would like to preface this by saying that this is not a critique of their strategies but more of a word of caution on what to expect. This is to say that you need to have both conviction in their methodology and be on board with their practices before investing with any robo advisor.

Robo advisors do reoptimise their portfolio once in a while, depending on their investing strategy. Reoptimisation means a reallocation of securities in the portfolio. This could be done by increasing/decreasing the weightage of certain assets, or even buying new assets or selling out of old ones. Now, let us take a look at the reoptimisations done by StashAway this year.

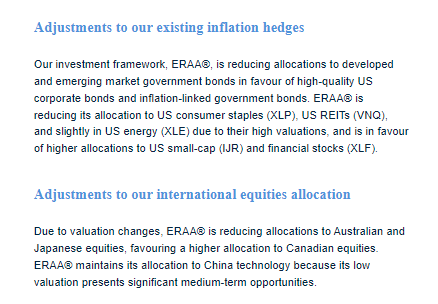

On 28 January 2022, StashAway announced a reoptimisation, where they are reducing allocations to international equities. However, they did mention that they would ‘maintain its allocation to China technology because its low valuation presents significant medium-term opportunities’

In addition, StashAway has created article(s) and resources in the past (such as this) that talks more about China’s growth and policies, and even reaffirming that they are ‘staying invested in China and have even increased our portfolio’s allocations to China equities to take advantage of the lower stock prices’ saying that in the long term, they expect Chinese stocks to recover.

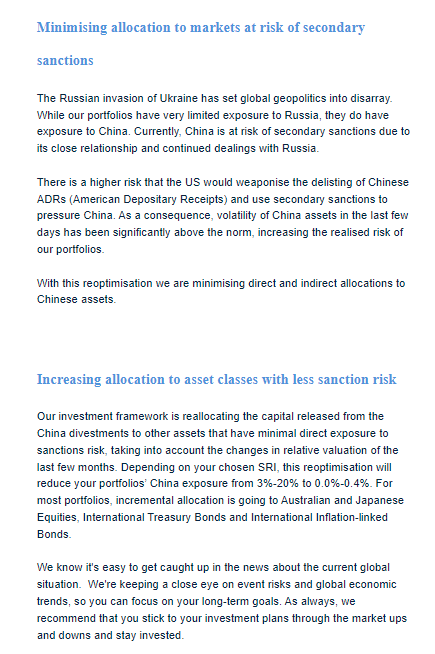

However, barely two months after their January optimisation, on 14 March they announced that they are reoptimising the portfolio again to significantly reduce their China exposure, citing ‘higher risk that the US would weaponise the delisting of China ADRs and use of secondary sanctions to pressure China’ despite their previous mentions of staying committed to the medium to long term investments in China. While their concerns should not be ignored, it seems like they are timing the market rather than holding onto their conviction they had from 2021.

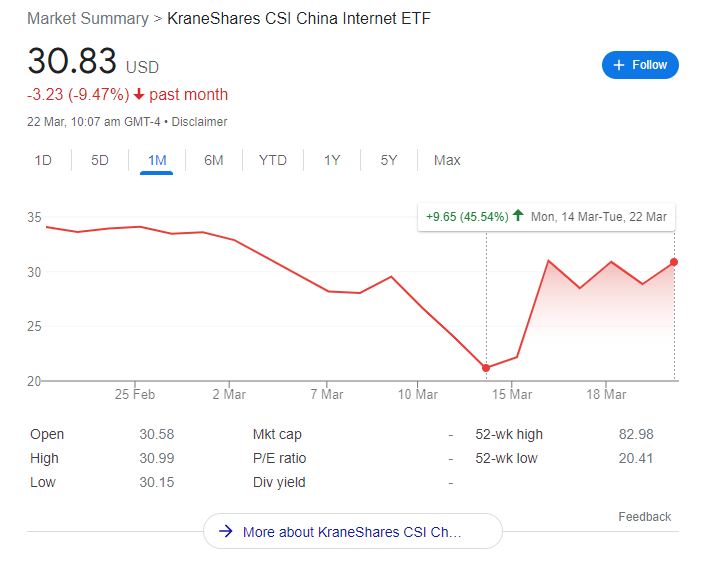

[Also sidetracking a little, days after their latest reoptimisation, the Chinese government pledged to support the Chinese capital markets. Their China investment (KWEB) is up ~45% at the time of writing. Talk about bad timing!]

For me, when any (robo) advisor advises one thing (stick to investment plans) and yet does another (selling off their Chinese stake), it will get me to second guess such investments. To practice what you preach is something I value and this lack of transparency (sudden change in tune and not giving investors the option to opt out of reoptimisations) is something all investors should be cautious about. While only time will tell if such a strategy is beneficial to investors, I believe that robo advisors should give you peace of mind in your investments and such a strategy just does not seem to line up with that. Nonetheless, do let me know your thoughts on this!

In addition, for many, while investing with robo advisors is the easiest way to invest, it begs the question of what is the best way to invest? Should you trust your money with those that are deemed professionals or get hands-on and invest yourself?

According to an article by Ben Johnson at Morningstar, it is noted that ‘In general, actively managed funds have failed to survive and beat their average passive peer, especially over longer time horizons. Only 26% of all active funds topped the average of their passive rivals over the 10-year period ended December 2021’. While there is limited data on the performance of robo advisors so far, I would be cautious of how many would beat passive fund investments in a long time horizon*.

To me, DIY investing should be the superior option. Not only does it cut out the additional management fees, but you can also customise your investments based solely on your needs and goals. After all, who knows you better rather than yourself? Such hands-on experience also allows one to understand market fluctuations and downturns, preventing investors from making the mistake of ‘buy high sell low’ where one panic sells out of their investments. I believe that conviction in your investments can only be done when you and only you decide to invest.

*The reason for comparing robo advisors to actively managed funds is that based on your needs both aim to invest your money through active portfolio management. Although robos do offer slightly more customisability by allowing investors to allocate based on their risk tolerance.

Conclusion: Should you use Robos?

Well then, should you use robo advisors? With the advantages and disadvantages mentioned previously, one should consider if the robos suit their investment needs and if the disadvantages are a dealbreaker as well. In addition, no two robos are alike, and it is recommended to learn more about all the options available and find out if their strategies align with yours.

| Advantages | Disadvantages |

|---|---|

| Easy to use | Limited investment options |

| Low to no minimum sum | Lack of transparency |

| Invest your OA/SRS money | Higher fees |

| Auto rebalancing, less discipline needed | Lacking the human touch |

Like all other investments, one should do their due diligence before making any decisions. Hope you found this article useful, and if you did be sure to share it with others too. Cheers!

-Rice

very informative article!

Cheers!