Hey everyone! This week, I decided to cover a topic slightly different from the norm. Today we will be covering two categories in which random events fall: Mediocristan and Extremistan. Let’s find out more!

Mediocristan

According to Taleb, it is a process dominated by the mediocre, with a few extreme successes or failures (say, income for a dentist). No single observation can meaningfully affect the aggregate. Also called “thin-tailed”, or member of the Gaussian family of distributions.

Imagine randomly selecting 1000 ducks from the total duck population and taking the total height of the 1000 ducks. Afterwards, we will add Lanky Quackers to the sample, the tallest duck ever who is about three times the height of a regular duck. The total height of the population remains barely unchanged, and Lanky Quackers’ height only takes up a small proportion of the total height (roughly 0.30%) which is considered negligible. Other examples of Mediocristan would be weight, IQ, age.

Extremistan

Taleb states that it is a process where the total can be conceivably impacted by a single observation (say, income for a writer). Also called “fat-tailed”. Includes the fractal, or power-law, family of distributions.

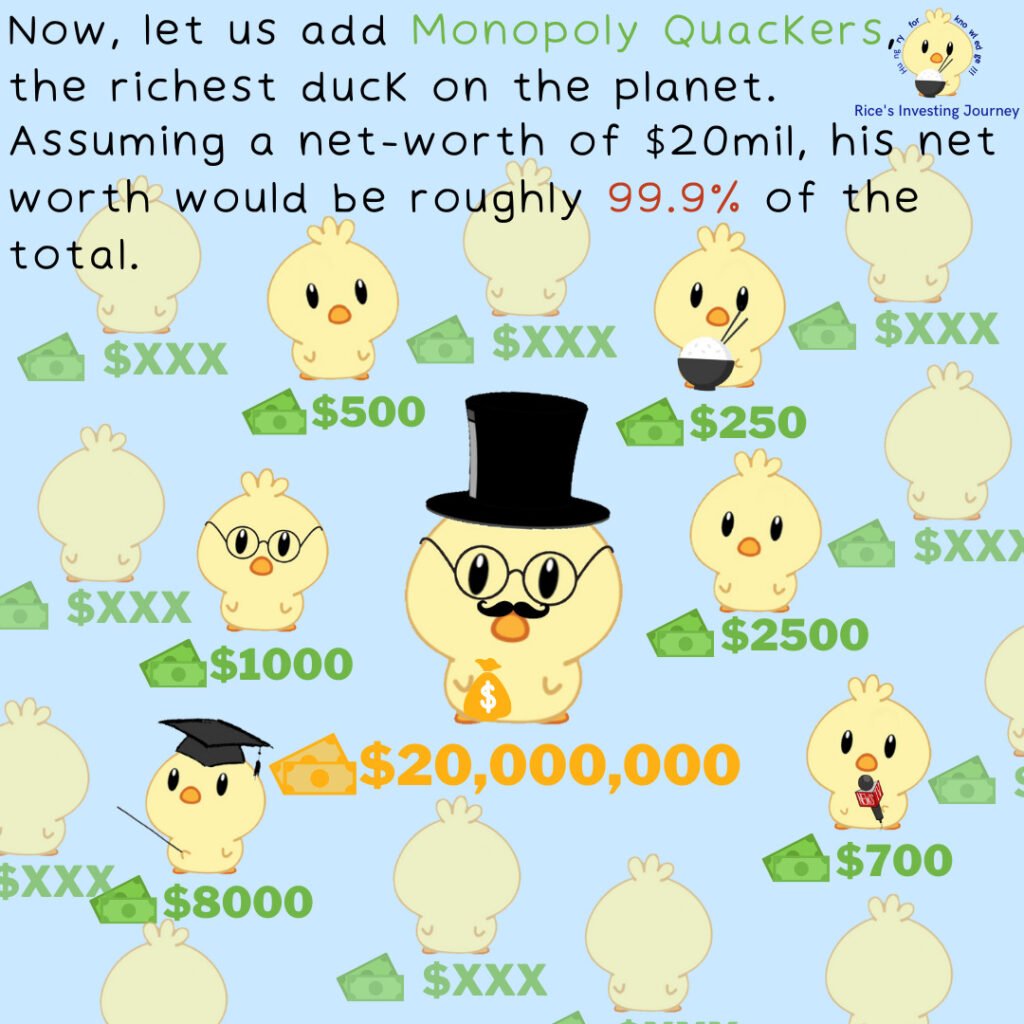

Let me give an example of Extremistan. We will take 1000 ducks from the duck population and calculate their total net worth. Then let us take Monopoly Quackers, the richest duck and add him to the sample. The total net worth of the animals in the sample would be much higher than it once was and Monopoly Quackers with its $20 million net worth represents a large proportion of the sample. As one can tell, this is an example of Extremistan, where one single observation (Monopoly Quackers) significantly affects the total (net worth).

Other examples of Extremistan would be book sales per author, damage caused by earthquakes, sizes of planets, stock ownership, inflation rates and many more.

Do not confuse Mediocristan with Extremistan

When considering random events, it is imperative to differentiate between the events and which categories do said events fall under. We should not compare Mediocristan events with Extremistan events — that would be akin to comparing apples to oranges.

“Mediocristan is thin-tailed and affects the individual without correlation to the collective. Extremistan, by definition, affects many people. Hence Extremistan has a systemic effect that Mediocristan doesn’t. Multiplicative risks—such as epidemics—are always from Extremistan. They may not be lethal (say, the flu), but they remain from Extremistan.”

— Nassim Nicholas Taleb, Skin in The Game

As Taleb mentioned, Mediocristan events only affect a single person/instance rather than the total, whereas Extremistan has a systemic effect that affects the total. A systemic effect is an effect that affects the entire sample as a whole, rather than one part.

So remember, whenever you see an article that says “The true risk of Covid-19? Not much more than a regular bath”, remember that they are comparing apples to oranges and you cannot lump Mediocristan and Extremistan events together. Unfortunately (or fortunately), your bathtub does not have multiplicative risks like a virus. Your bathtub is not trying to kill you — the virus is.

Summary

As you can see, in Mediocristan only the collective will affect the total, whereas a single observation in Extremistan can severely affect the total. Typically Mediocristan observations are predictable and obvious, whilst Extremistan observations are typically unpredictable and extreme. This is why most (although not all) Black Swan events fall under Extremistan.

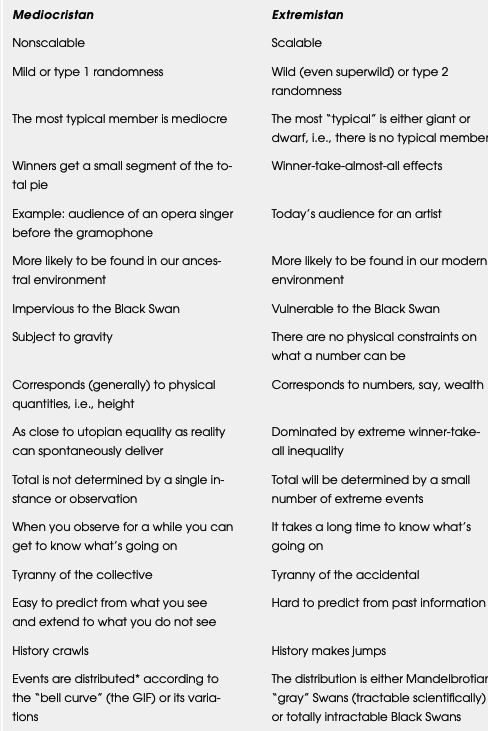

Below are the key differences between Mediocristan and Extremistan:

As we wrap up this article I thought I would like to end it with this quote;

One may be risk loving yet completely averse to ruin

Nassim Nicholas Taleb, Skin in The Game

Small risks have their benefits. However, large risks (those that have irreversible effects and carry tail risks) do not. Such a saying has helped me to navigate in my decision making, allowing me to take risks without ruin. The central idea of this article came from the Incerto series (specifically The Black Swan and Skin in the Game) by Nassim Nicholas Taleb. I highly recommend everyone to give it a read.

Anyways thank you for sticking to the end of the article. Hope you found this article insightful, cheers!

-Rice

What an interesting read! will try to incorporate what you have written into my daily life !

Glad you found the post insightful. Cheers!