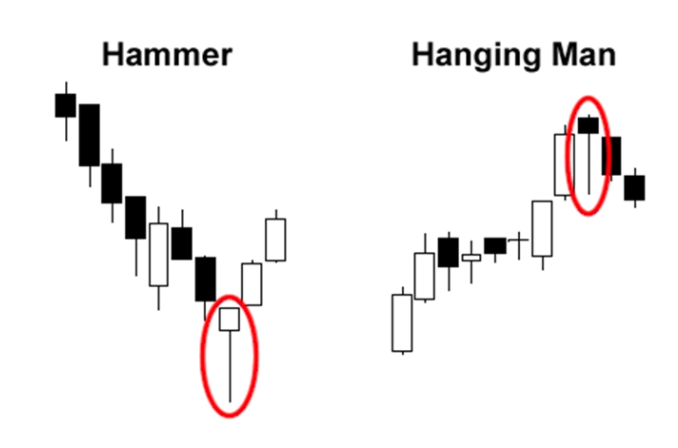

Hammer/Hanging Man (Umbrella Lines)

A single candle pattern that signals a reversal of the preceding trend. The characteristics of a Hammer/Hanging man are:

- Real body is at the high of the trading range. The color of the real body is not important

- Long lower shadow that should be at least twice the height of the body

- It should have none or a very short upper shadow

- Longer the shadow, shorter the upper shadow, smaller the the real body; the more meaningful the umbrella lines

What are the differences between the Hanging Man and Hammer?

While there are similarities between the two umbrella lines, here are some of the differences between them:

- Hammer comes after a decline, Hanging Man comes after a rally

- Hammer is valid even from a short-term decline but Hanging Man should emerge after an extended rally, preferably at an all-time high

- Hanging Man should be confirmed, Hammer need not be

#1a Hammer

A lower shadow of two or three times the height of the real body is necessary to show that the market has been pushed down sharply during the session, but the bears lost control and the market closed at or near its session highs. It is okay if the hammer has a little upper shadow

When to enter

We can wait for a correction within the hammer’s lower shadow (using the hammer’s lows as a potential purchasing area).

Other Uses

Hammer can be used as a potential support. We can use the lower shadow of the Hammer to gauge a support line, in the case that the support is solid, the hammer should become the support. However, if support is breached, our bullish outlook would have been voided.

#1b Hanging Man

Important to wait for bearish confirmation with the Hanging Man. Minimally, there should be a lower opening under the real body of the hanging man (but a close beneath the hanging man’s real body is preferred). Hanging man should be at an all-time-high (or at least a high for a significant move).

A cautionary signal before a Hanging Man could be that bullish candles prior have upper shadows, and there is a decreasing slope of rally highs.

When to enter

- After a confirmation of the hanging man

- Avoid buying at the opening/closing of the hanging man (highs of the move)