What is a Star?

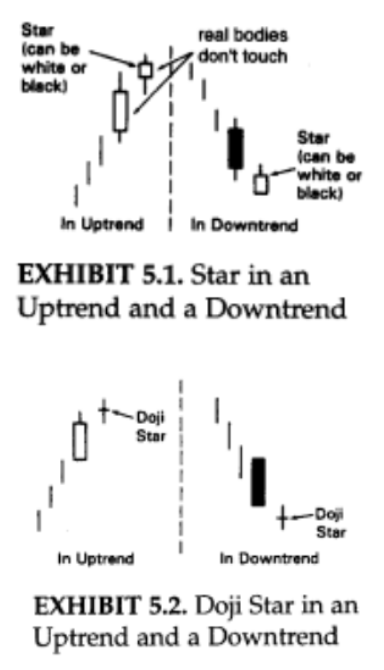

A small real body (white or black) that gaps away from the large real body preceding it (fig 5.1)

- Star’s real body can be within the prior session’s upper shadow

- Real bodies don’t overlap

- If star is a doji instead of a small real body, it is a doji star

- Star, especially a doji star, is a warning that the prior trend may be ending (fig 5.2)

The star’s small body represents a stalemate between the bulls and the bears with a shift from buyers/sellers being in control to a deadlock between buying and selling forces. It can occur due to a decrease/increase in buying force and increase/decreasing in selling pressure, whereby the rally’s prior power has slightly dissipated.

Types of Stars

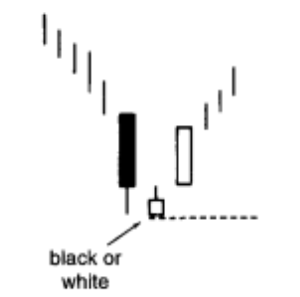

#1 The Morning Star

It is a bottom reversal pattern with the following criteria:

- Candle 1: An extended black real body

- Candle 2: A small real body that doesn’t touch the prior real body. (Suggests that the sellers are losing the capacity to drive the market lower)

- Candle 3: A white real body that pierces deeply into the first session’s black candle. (Suggests that the bulls have seized control)

- The pattern must follow a decline

Lowest low of the three lines that form the pattern should be the support. Decisive factor is that the second candle should be a spinning top and the third candle pushes well into the first (black) candle. Gaps are a feature, but not necessary for the success of this pattern

Limitations of Morning Star and Workaround:

As morning star is a three-candle pattern, one has to wait until the close of the third session to complete the pattern. This means that we will only get the signal well after the market already had a sharp bounce. An option is to wait for a correction to the morning star’s support area to go long.

Another potential use is intraday charts (eg 15min intervals) as there is not much difference between the open and close of the 15-minute session.

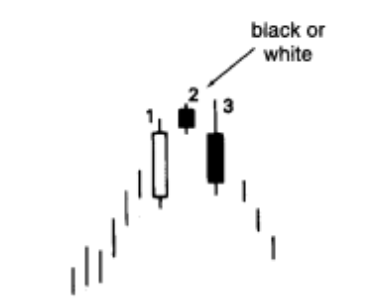

#2 The Evening Star

Bearish counterpart of the morning star pattern. The criteria are:

- Candle 1: An extended white real body

- Candle 2: A small real body that doesn’t touch the prior real body (Star). (Suggests that the buyers are losing the capacity to drive the market higher)

- Candle 3: A black real body that pierces deeply into the first session’s white candle. (Suggests that the bulls have seized control)

- The pattern must follow a rally

- Real body of candle 2 must be above the high of real bodies of candle 1 and 3 for a reversal signal

Second Gap between the second and third real bodies are not necessary for the success of the pattern.

Factors that evening/morning star can be a reversal (in increasing likelihood)

- No overlap among the first, second and third real bodies

- Third candle closes deeply into the first candle’s real body

- Light volume on the first candle session and heavy volume on the third candle session. Show a reduction of the force for the prior trend and an increase in the direction force of the new trend.

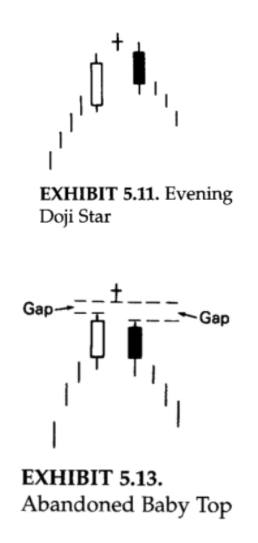

#3 Evening Doji Star

Same as the Evening Star, there is a doji instead of a small real body as the second candle is called an evening doji.

If there is an evening doji star where the doji session does not overlap with the shadows of the first or third candles (i.e. the shadows do not touch), then the top reversal is known as an abandoned baby top (see fig on left, bottom). Such a pattern is very rare.

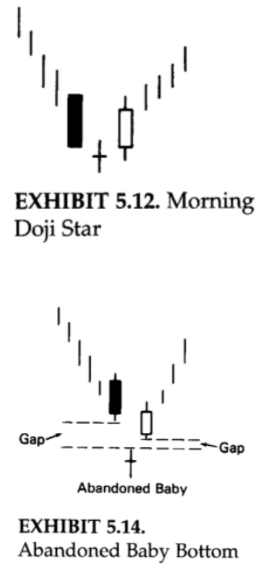

#4 Morning Doji Star

A morning star that has a doji as the star portion (the second candle of the three candles) is a morning doji star.

If there is a doji that has a gap before and after it (where the shadows do not touch), it should be a bottom. The pattern is referred to as an abandoned baby bottom (fig right, bottom). It is also extremely rare.

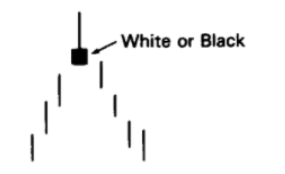

#5 Shooting Star

A shooting star tells us that the market opened near its low, then strongly rallied and finally backed off to close near the opening. I.e. the session’s rally could not be sustained

- Small real body at the lower end of its range with a long upper shadow

- Color of body can be black/white

- A bearish reversal signal, hence comes after a rally

- Ideally the shooting star’s real body must gap away from the prior real body (although gaps are not necessary)

- Gravestone Doji is a specific and more bearish version of a shooting star

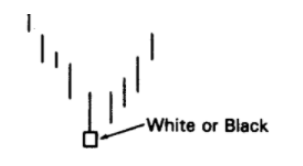

#6 The Inverted Hammer

- Not a star, but similar to the shooting star

- Long upper shadows and small real body at the lower end of the range

- Color of body can be black/white

- Comes after a decline (a bottom reversal line)

Requires a next day bullish confirmation:

- Next day opening over the inverted hammer’s real body or Close the next day over the inverted hammer’s real body

- Means those who shorted at the opening/closing of the inverted hammer are losing money, sparking a covering of shorts

- Confirmation is needed as the long upper shadow gives it a bearish hue

Other Points to Consider

- Doji portion has long upper and lower shadows

- Reflects that the market is losing its prior directional bias

- “Century Marks” is a round $100 figure that can become support or resistance

- A series of long upper shadows (long lower shadows) signal that the bulls are not calling all the shots (bears are not calling all the shorts) in an uptrend (downtrend)

All image credits goes towards the book “Japanese Candlestick Charting Techniques” by Steve Nison. Nison, S. (1991). Japanese candlesticks charting techniques: A contemporary guide to the ancient investment techniques of the Far East. New York Institute of finance.