Contents!

ToggleWhat are Options?

Hey all, this week we will cover a new topic: Options! What are options? An option is a contract that gives the owner, the holder, the right, but not the obligation, to buy or sell an underlying financial security or instrument at a specific strike price on or before a specified date, depending on the type of option. Options are also a type of security known as a derivative, where the price is dependent on or derived from the price of an underlying asset.

In this post, I will be going through the basics of options and give examples in the context of Stock options (while briefing touching on the other types of options).

How do Options Work?

An options contract involves a buyer and a seller, where a buyer will pay a premium to own the contract, while the option seller would receive said premium. By owning the contract, it will give the option buyer the ability to exercise the rights depending on the type of contract (Call or Put options).

Imagine a restaurant owner A. He wants to set up a new outlet for his restaurant, Burgers Paradise. He read that in the next 5 years, the government is planning to build a new town in ‘Tengah’. He believes in the potential of the new town and wants to set up an outlet there. As such, he reaches out to realtor B indicating his interest in buying a piece of land situated in the heart of Tengah for 300k. However, he would only need the land within 4 years as he only needs a year to build his restaurant. In addition, he only wants to buy the land if the government decides to build the new town. As such, A draws up a contract with B, with a price of 300k with an expiry in 4 years for the rights, and not the obligation to buy the piece of land. In addition, to compensate realtor B for the uncertainty, he pays an amount (the premium) regardless of whether he chooses to buy the land or not. In other words, restaurant owner A enters into a call option contract with realtor B, with the land in Tengah as the underlying.

Types of Options

There are three main types of options, namely simple underliers, index underliers, and derivative underliers.

- Simple Underliers

- Some individual commodities or financial security. Eg buy or sell some commodity (bushels of corn, barrels of crude oil) or security (stock, currency, government bond)

- Index Underliers

- Price index (Eg SPX). They are always cash-settled

- Derivative Underliers

- Are themselves derivatives. Eg Futures: futures on a simple underlier or futures on an index. So an option on a futures contract is simply a contract giving the buyer the right to buy the futures contract at a certain price.

- Are themselves derivatives. Eg Futures: futures on a simple underlier or futures on an index. So an option on a futures contract is simply a contract giving the buyer the right to buy the futures contract at a certain price.

For a stock option, the underlying is typically a round lot or 100 shares. Hence, the cost of a stock option contract is the option contract multiplied by 100. (A stock option is also a type of simple underlier)

For a futures option, the underlying is uniformly one futures contract. In addition, the underlying of a futures option is the futures month that corresponds to the expiration month of the option. One exception would be serial options, where the underlying contract for the option is the nearest futures contract beyond the expiration of the option.

Types of Contracts

Call Options

What is a Call option? A call option is a contract that gives the owner the right, not the obligation, to buy the underlying at a particular strike price. For a stock option, the owner of the call has the right to buy 100 shares. The owner of a call will pay the exercise price (aka buy a lot of shares at the exercise price).

Put Options

Conversely, a put option is a contract that gives the owner the right, not the obligation, to sell the underlying at a particular strike price. For a stock option, the owner of the put has the right to sell 100 shares. The owner of a put will receive the exercise price (aka sell a lot of shares at the exercise price).

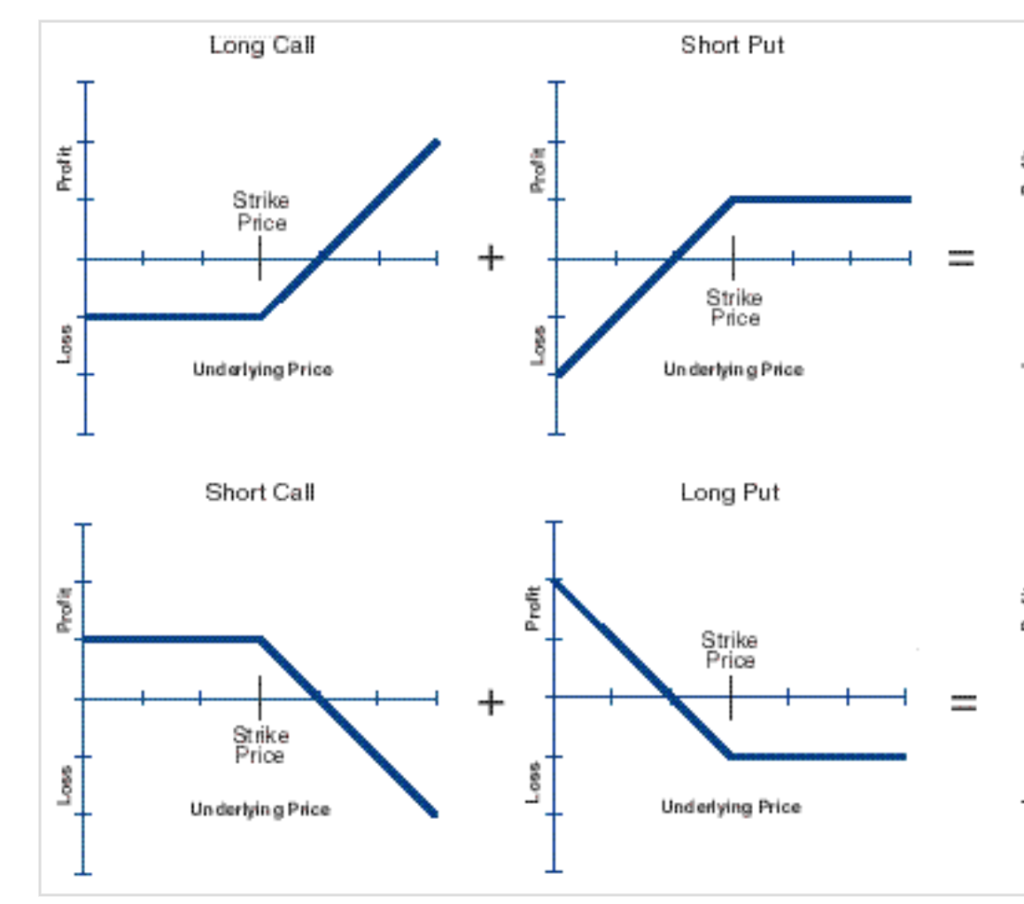

Profit and Loss (PnL) Charts

To understand call and put options better, traders have come up with something know as the Profit & Loss (PnL) Charts. Such charts depict the profit or loss as the underlying price changes at expiration. For this section we will go through the four main charts, namely Long Call, Long Put, Short Call and Short Put.

A trader who purchased an option is long the option. Conversely, a trader who is sold the option is short an option.

Do note that being long/short and option is different from a long/short market position. For example, a long put position is a short market position.

Expiration Date & Strike Price

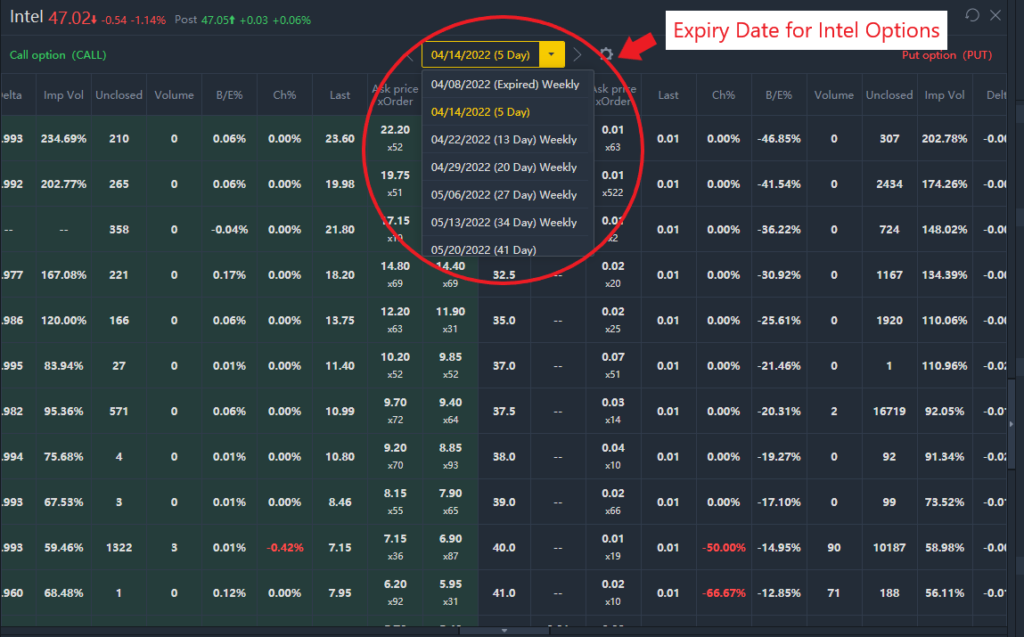

The expiration date is the date on which the owner of the option must make the final decision on whether to buy (for a call option) or sell (for a put option). Typically, the option’s expiration date occurs on the third Friday of every month. However, most tickers have expirations every Friday (also known as weeklies [W]). An exception would be legal holidays that fall on the third Friday of the month, such as Good Friday. In such instances, the last trading day is the preceding Thursday.

While there are no fundamental differences between stock options weeklies and monthlies, there is typically a much higher open interest (OI) for monthlies (big institutions use them to hedge their long positions).

[As seen in the example above of Intel’s options (ticker INTC) there are various options with their expiry dates on Fridays with the others labelled ‘Weekly’]

Open interest is the total number of outstanding derivative contracts, such as options or futures that have not been settled for an asset

For a Futures option, typically the option’s expiration date would be roughly a month prior to the futures expiry month.

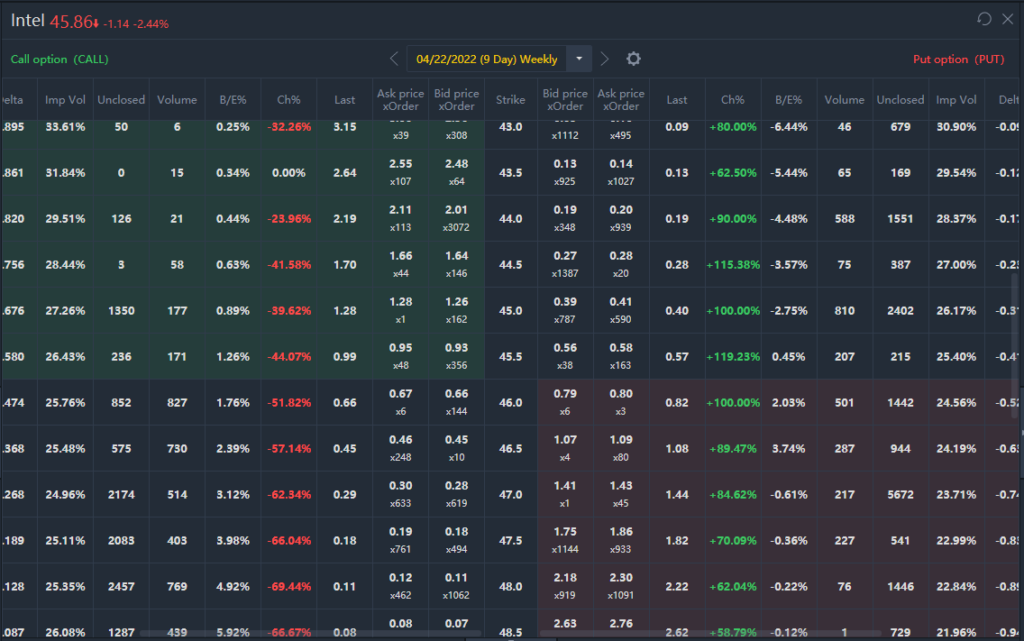

The strike price or the exercise price is the price at which the underlying will be delivered should the holder of an option choose to exercise his right to buy or sell. Typically, the range of strike prices offered for an option will be within a bracket of its spot price. The strike price intervals are usually $0.50 or $1.00. However, this can vary depending on the stock’s price.

[As seen in the example above of Intel’s options (ticker INTC) there are various options with their strike prices at intervals of $2.50]

Spot Price is the current price in the marketplace of the given asset

Exercise and Assignment

For an option buyer (holder), they will be given the right to exercise the option. Conversely, the option seller (one who received the option premium), will be assigned when the option is exercised. Here is a summary table to explain this relationship better.

| Exercise / Assigned | Meaning | Option Buyer / Seller |

|---|---|---|

| Exercise a call | You choose to buy at the exercise price | Option Buyer |

| Are assigned a call | You choose to sell at the exercise price | Option Seller |

| Exercise a put | You choose to sell at the exercise price | Option Buyer |

| Are assigned a put | You choose to buy at the exercise price | Option Seller |

Ways to settle an option

In this section, we will cover the three main ways an option will be settled when it has been Exercised / Assigned.

Cash Settlement

Cash settlement is primarily used for index contracts where it is not practical to deliver the underlying contract (for example SPX options). The cash settlement is equal to the difference between the exercise price and the underlying price at the end of the trading day. Cash settled options are typically European style, which I will cover in the later section.

For example, an individual sold an SPX call with a strike price of 4400. At expiry, SPX is at 4415. Assuming that the assigned originally sold the call for a premium of $5, the assigned individual’s net loss would be 4415 – 4400 + 5 = $10. Total loss would be $10 * 100 = $1000.

Physical Settlement

Physical settlement means that the option will settle into the underlying asset. Stock options always settle into the physical underlying.

For a Call option, a physical settlement means that the exerciser pays the exercise price and in return receives the underlying.

For a Put option, a physical settlement means that the exerciser receives the exercise price and in return must deliver the underlying.

For example, an Intel 40C option was exercised.

- The exerciser would have to pay 100 * $40 = $4000 and receive 100 shares of the Intel stock.

- The assigned person would receive 100 * $40 = $4000 and deliver 100 shares of the Intel stock.

Settlement into Futures Position

Settling into a Futures Position means that the exerciser ends up buying or selling the futures at the exercise price. Position is then subject to futures-type settlement.

Exercise Style (American vs European Options)

In this section, I will cover the two types of options, American and European options.

American Options can be exercised on any business day prior to expiration. On the other hand, European Options can only be exercised at expiration. As such, American options are always more valuable than European options

Note that American and European in this case do not refer to the geographical location of where the options are listed on. Generally, options on Futures and individual stocks tend to be American while options on indexes tend to be European.

In the money, At the money, Out of the money

In this section, I will be referring to ‘In the money’ as ITM, ‘At the money’ as ATM and ‘Out of the money’ as OTM.

Firstly, an option typically has an Intrinsic value. A call option with a strike price of 40 and with the underlying contract trading at 45 has an intrinsic value of $5. On the other hand, a put option with a strike price of 40 and with the underlying contract trading at 30 has an intrinsic value of $10. Below is a table on how intrinsic values are calculated.

Intrinsic value is the difference between the underlying’s security price and the option’s strike price. It cannot be negative.

For a call option, it has intrinsic value when the spot price is higher than the strike price. Conversely, a put option has an intrinsic value when the strike price is higher than the spot price.

| Call / Put | Calculating Intrinsic Value (>=0) |

|---|---|

| Call | Spot Price - Strike Price |

| Put | Strike Price - Spot Price |

In addition, an option typically also has an Extrinsic Value. The extrinsic value exists as market participants are willing to pay this additional amount to enjoy the benefits given by an option. For example, a call option with a strike price of $40 is trading at $15 with the underlying trading at $50. As the intrinsic value is $10, the extrinsic (time) value must be 15 – 10 = $5.

An option is ITM when it has a positive intrinsic value. On the other hand, ATM options are when the strike price is equal to the spot price and does not carry an intrinsic value. Lastly, OTM options are options with no intrinsic value. All unexpired options carry an extrinsic value. This can be illustrated in the table below.

Extrinsic Value (or time value), is the additional amount of premium beyond the intrinsic value that traders are willing to pay for the option.

| Type of Option | Value of Option |

|---|---|

| Out-the-Money (OTM) option | Extrinsic Value |

| At-the-Money (ATM) option | Extrinsic Value |

| In-the-Money (ITM) option | Extrinsic Value + Intrinsic Value |

In addition, looking at this option chain below, it can be observed that ITM options are coloured in green and red (for calls and puts respectively) while OTM options are greyed out. While this may differ for different brokers, most of them offer some sort of colour coding for easy identification.

The Greeks

Greeks are symbols assigned to various risk characteristics that an options position entails. The Greeks include Delta, Gamma, Theta, Vega and the mini Greek, Rho. Greeks are essential in understanding how options price moves and the risk associated with the option. If you would like to learn more on the Greeks, do check out my Introduction to Greeks

Why Options?

Now, why should you trade options? Options can be used for a wide range of reasons, including trading, hedging, and speculating.

In addition, options offer traders the use of a leveraged position, as traders would only need to put up a small amount (the premium) in contrast to the contract value (such as 100 shares of the underlying stock for stock options). This means that while leveraged positions can magnify the gains greatly, they can magnify one’s losses as well. Hence, options traders use a variety of option strategies that can help to limit the downside risk. One example would be Put Credit Spread (PCS) and Call Credit Spread (CCS) where the max loss is in the difference in strike prices of the spread.

Hedging is an investment aimed at reducing the risk of adverse movements in one’s investments.

Speculating refers to the act of conducting a financial transaction that has substantial risk of losing value but also holds the expectation of a significant gain or other major value

Leverage results from using borrowed capital as a funding source when investing to expand the firm’s asset base and generate returns on risk capital. Leverage is an investment strategy of using borrowed money—specifically, the use of various financial instruments or borrowed capital—to increase the potential return of an investment

Conclusion

As we come to the end of this post, I hope that you can take the time to answer a few short questions in the form below. This will allow me to create more content related based on the responses and feedback I get. Your opinions matter a lot to me, and I appreciate everyone of you who takes the time to support my blog!

And there we have it! I hope you find this article insightful and useful as a crash course into options. In addition, I will attach/link some of the resources I used below when writing the article. Such resources are very useful and I highly recommend you to give them a read as well. Thanks for reading, cheers!

-Rice

A highly insightful read on options. Many of the points and some examples used were based off of this book, so do give it a read if you want a more in-depth explanation of options.

If you are interested to read the book, you can find it here:

Option Volatility and Pricing by Sheldon Natenberg

This is a guide by Investopedia, highly recommend you to check it out!

easy and fast read! thanks for summarising all there is to know about options!

Cheers! Glad you found it helpful 🙂

Greetings! Very useful advice within this article! It’s the little changes which will make the most important changes. Thanks a lot for sharing!

Cheers! Glad you found the article useful