What is it?

It is the first of multiple candle line patterns and is a major reversal signal with two opposite color real bodies composing this pattern.

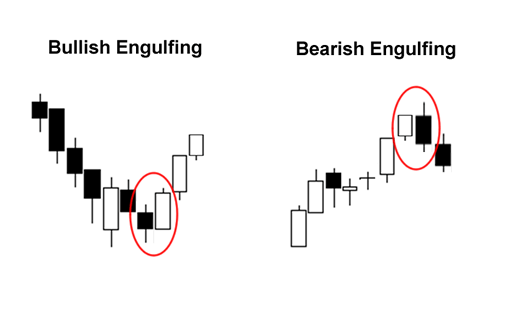

Bullish/Bearish Engulfing Pattern

- Clearly definable uptrend (bearish engulfing pattern) or a clearly definable downtrend (bullish engulfing pattern), even if the trend is short

- Two candles comprise of the engulfing pattern, where the second real body must engulf the prior real body (need not engulf the shadows)

- Second real body of the engulfing pattern should be the opposite color of the first real body.

- Exception is that doji engulfed by a large white body could be a bottom reversal (in downtrend)

- Doji engulfed by a large black body could be a top reversal (in uptrend)

Factors to improve likelihood of engulfing pattern

- First day has a very small body and second day has a very long body

Reflects a dissipation of the prior’s trend force and the large second real body proves an increase in force behind the new move

- Appears after a protracted or very fast move

Creates an overextended market (overbought/oversold)

- Heavy volume on the second real body of engulfing pattern

Uses of Engulfing Patterns

#1 Can be used as a support/resistance

- Use the high of a bearish engulfing pattern as resistance

- Use the low of the bullish engulfing pattern as support

(This is especially useful if the market has moved too far from the lows [bullish engulfing pattern] or highs [bearish engulfing pattern])

#2 Point of entry

As we need to wait for the close of the second session to determine the engulfing pattern, we should wait for a possible correction to the support/resistance for bullish/bearish engulfing pattern to enter a long/short position