Hi everyone! 2021 has finally come to a close and as we usher in the new year, other than the typical new year’s resolution I thought we could look at 2021 in summary. 2021 has been a year of huge ups and downs, with a lot of uncertainty closing of the year. Here we look at some of the major issues that have happened in the past year, and how they would affect us going forward.

Global

As we head into 2022, let us not forget the ongoing covid-19 variant and the discovery of a new variant – Omicron – nearing the end of the year. First detected on November 9th in South Africa, it has led to a quick response from across the globe, with many countries shutting their borders and tightening restrictions all around. However, nearing the end of the year we are yet again grappling with a surge in cases, with rising case numbers to new highs in the past few months in Europe and The United States.

Whilst studies have suggested that Omicron has a much higher infection rate than previous strains, the severity of the infection is largely diminished, especially for those that have been vaccinated and received a booster shot. However, this has undoubtedly put a damper on the easing of measures and global air travel, with the new variant causing concerns of returning to pre-pandemic conditions.

2021 has also been a big year for cryptocurrency, with many cryptocurrencies such as Bitcoin and Ethereum hitting all-time highs. It has been one of the most talked-about investments of the year, with various new investments rising in popularity, such as Cryptocurrency ETFs as well as the growing NFT space. That said, we should expect regulation in the cryptocurrency sphere as many governments are looking into ways to regulate this fast-growing industry. For example, various cryptocurrency exchanges had to seek permits in Singapore to operate. Most notably Binance has closed their cryptocurrency trading platform as the Monetary Authority of Singapore (MAS) has ordered Binance to stop providing payment services in Singapore. On the other hand, other countries such as China, have announced that all cryptocurrency transactions in the country are illegal, which stops crypto-related activities in China.

An extension to cryptocurrencies is the rise of the Metaverse, which blew up ever since Facebook changed its name to Meta Platforms. According to Investopedia, the metaverse is “a digital reality that combines aspects of social media, online gaming, augmented reality (AR), virtual reality (VR) and cryptocurrencies to allow users to interact virtually.

Dubbed the next big thing, investors are looking to cash in on this new concept through companies such as Meta, Apple, Nvidia, Microsoft, Google, Roblox and many more. With the rise of the metaverse, new investment opportunities have popped up, with Metaverse centred ETFs and many other companies jumping on the bandwagon to embrace the Metaverse with many big-tech firms investing heavily into R&D for Metaverse centred products. That said, it will be way further into the future before we see how this new concept takes form and how the Metaverse would become a part of our daily lives.

US

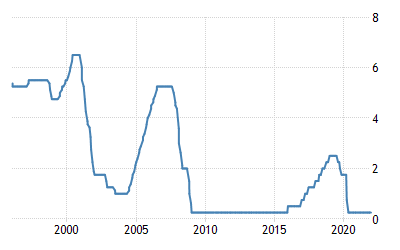

One huge news of 2021 in the US is the Fed’s tapering and rate hikes going into 2020. As a result of the pandemic, the Fed has adopted an “easy” monetary policy cutting the funds rate (see left) to a range of 0 – 0.25%, and adopting Quantitative Easing (QE), purchasing large amounts of treasuries and securities.

However, with the easing of restrictions and the aim of returning to pre-pandemic normalcy, the Fed has begun cutting the purchases of bonds (starting from Nov 2021) and seek to reduce bond purchases going in 2022. In addition to the scaling back of Covid-19 pandemic stimulus efforts, Fed officials on Dec 15 have set the stage for a series of rate increases beginning in spring, with most expecting three quarter-percentage-point increases. This is in part due to much higher and persistent inflation levels than officials had expected, with the CPI rising 6.8% over the last 12 months (as reported in Nov 2021), much higher than their target of 2%.

That being said, the low interest rates and the rise of retail investors into the US stock market has allowed the S&P 500 to close 27% higher in 2021, while the Dow Jones Index and Nasdaq rose 19% and 21% in the past year. In addition, the three major indexes have also closed the year at new all-time highs, with the S&P 500 closing at record highs 70 times in the past year.

Singapore

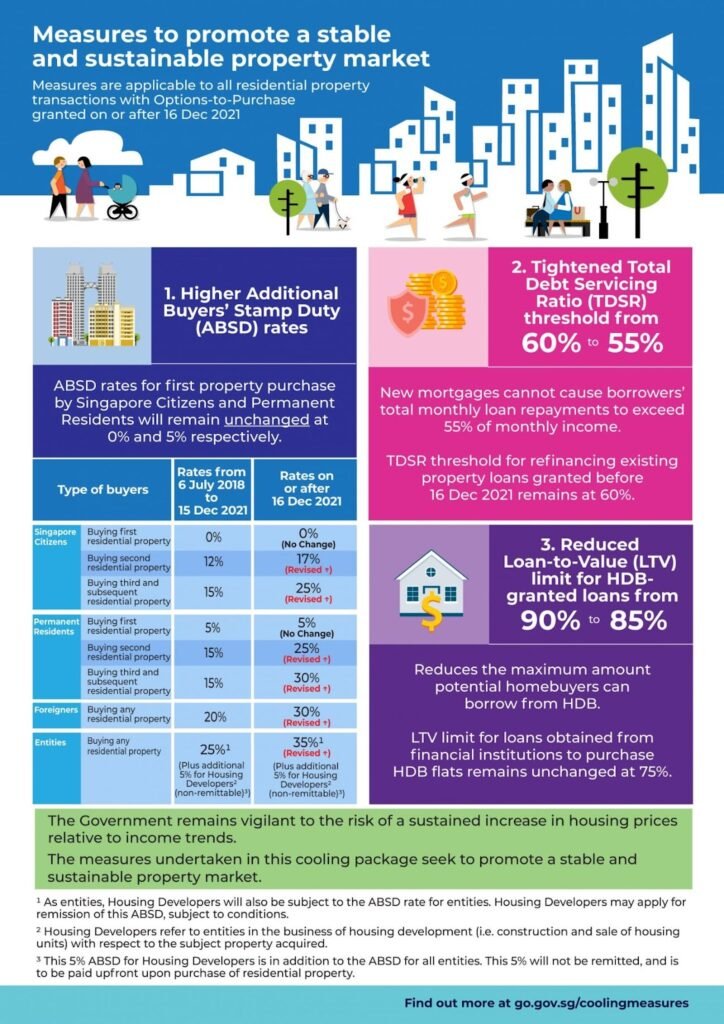

Back home, amid a property boom with soaring property prices in Singapore, the government has moved to cool the housing market with measures such as raising the ABSD rates and tightening the total debt servicing ratio (TDSR) threshold.

As seen above the ABSD rates for second and up residential properties as well as foreigners and entities have gone up as of 16 Dec.

In addition, new rules have also been imposed on public housing in prime locations, such as the increasing of the minimum occupation period to 10 years (instead of the standard 5 years). In addition, owners of these new flats in prime and central districts will also not be allowed to put the whole flat up for rent after 10 years, even though flat owners are permitted to do so after five years under current rules. Furthermore, future owners of such flats will also have to pay a percentage of the unit’s resale price to HDB, and this varies from one development to another.

Another huge news going into 2022 is the planned GST hike, with more information slated to be announced in Budget 2022. The GST rate hike, first proposed in 2018, seeks to raise GST from 7 to 9%. However, given the impact of the coronavirus on the economy, the increase did not take place in 2021, but is likely to occur soon, given that the economy is emerging from Covid -19.

What’s Next?

Going into 2022, it presents both opportunities and uncertainties. With the rising interest rates and with no end in sight for the pandemic, it will be interesting to see how 2022 will play out. Hence, it is important for us to be cautious and do due diligence before investing in anything and have sufficient emergency savings as well. Any thoughts on 2022? Do let me know in the comments below!

Once again, thank you for reading. Do share this post if you found it useful : )

Happy New Year!

– Rice

Yet again another helpful post! would definitely be exciting to see how these events will affect the new year! in any case happy new year rice!!

Thank you so much for the support, happy new year! 🙂