In this second part of continuation patterns, rising and falling three methods as well as separating lines would be covered. If you missed the first part, you can check it out here where other continuation patterns such as windows, tasuki and gapping plays.

5. Rising and Falling Three Methods

The three methods are two long candles enveloping three small candles (however between 2 – 5 real small bodies are fine). The three small candles should be ideally opposite colored from the first long real body.

The trend before the three methods should continue once the three methods are completed. For example, the trend for the rising three methods should continue higher after the rising three methods is completed (and vice versa).

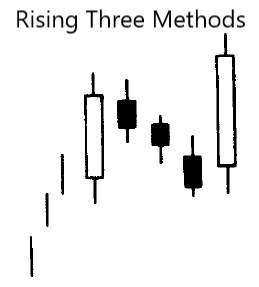

Rising Three Methods (Bullish)

The rising three methods pattern is as follows. It is similar to the Western bull flag or pennant formation.

- A long white candle

- It is then followed by a group of falling small real body candles. Ideally there are three small candles but two or more than three is acceptable. They must hold within the white candle’s high low range.

- Finally, the pattern is completed with a strong white real body which closes above the first day’s close. It should also ideally open above the close of the previous session.

For the first and last candles (the long white candles), it should ideally have the strongest volume of all the sessions that make up the rising three methods. In addition, one can think of the risk & potential profit for the rising three methods, with the risk being the low of the first long white candle.

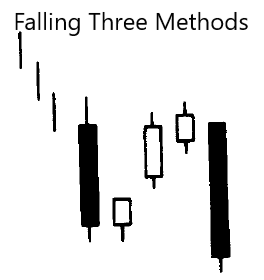

Falling Three Methods (Bearish)

On the other hand, the falling three methods occur in a downtrend. The pattern is similar to a bear flag/bear pennant formation. The pattern is as follows.

- A long black candle

- It is then followed by a group of rising small real body candles. Ideally there are three small candles but two or more than three is acceptable. They must hold within the black candle’s high low range.

- Finally, the pattern is completed with a strong BLACK real body which closes below the first day’s close. It should also ideally open under the close of the previous session.

One should also think of the risk & potential profit for the falling three methods, with the risk being the high of the first long black candle.

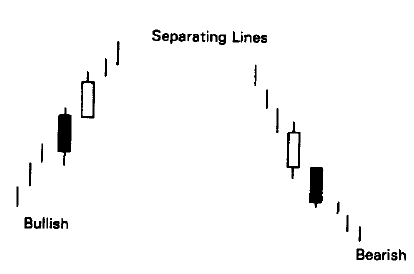

6. Separating Lines

Separating lines are two consecutive sessions where the second session has the same opening as the previous candle. Both session’s candles are of opposite colours. Separating lines are a rare pattern. In addition, it is not necessary to view an exact same opening for the pattern as variations of it can also prove useful.

Taking the bullish separating lines, the rationale is that the long black real candle has bearish implications. However, with the next session’s open gapping high enough to open at the previous session’s close, it proves that bears have lost control of the market — especially if the session closes as a white candle. The bullish separating line typically occurs during a rally (and vice versa).

Conclusion

If you would like to learn more of such Japanese Candlestick Patterns, I highly recommend the book ‘Japanese candlestick charting techniques’ by Steve Nison. The content covered in this article is covered in depth in Chapter 10 of his book.

Cheers!

-Rice