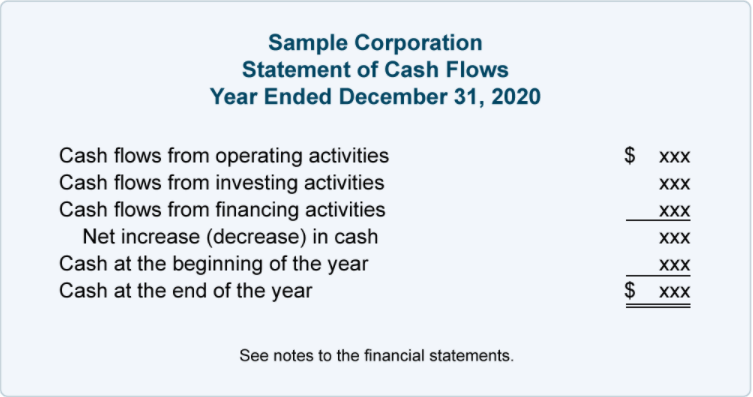

Cash Flow Statement

The cash flow statement reports the impact of a firm’s activities on cash flows over a given period of time. It shows the inflow and outflow of cash in a business.

Contents!

ToggleDefinitions

#1 What is amortization?

Practice of spreading an intangible asset’s cost over that asset’s useful life.

Examples of intangible assets that are expensed through amortization:

Patents and trademarks

Franchise agreements

Proprietary processes, such as copyrights

Cost of issuing bonds to raise capital

Organizational costs

It is expensed on a straight line basis where the same amount is expensed in each period over the asset’s useful life.

#2 What is depreciation?

Expensing of a fixed asset over its useful life. Fixed assets are tangible assets (ie physical assets that can be touched)

Examples of fixed/tangible assets that are commonly depreciated include:

Buildings

Equipment

Office furniture

Vehicles

Land

Machinery

Depreciation = Original Cost – Salvage/Resale Value. The difference is depreciated evenly over the years of the expected life of the asset.

Depreciation of some fixed assets can be done on an accelerated basis, meaning that a larger portion of the asset’s value is expensed in the early years of the asset’s life. For example, vehicles are typically depreciated on an accelerated basis.

#3 Working Capital = Current Assets – Current Liabilities

#4 Accounts Receivable

Money owed to a company by its debtors.

If this amount increases YOY, that means there is less cash flowing into the business and more money being owed. Since the money is being owed as debt, it is not yet cash. Hence an increase in accounts receivables is recorded as decrease in cash flow.

A positive amount of accounts receivable on the cash flow statement means that the accounts receivable is being paid off faster than it is growing.

#5 Acquisitions, net

Looking for companies that do not spend a large amount here. (Maybe can research why they spent such a large amount?). A red flag can be if the amount spent on acquisitions is larger than the amount spent reinvesting back into their own business.

#6 Other Financing Activities

Amount of money the company raised by getting new debt.

Cash at Beginning of period = Cash at Beginning of the year

Cash at End of the period = Cash at End of the year

Cap X = Capital Expenditure = Investments in Property, Plant and Equipment

Free cash flow can be used by the management for repurchasing stock, dividend payouts etc.

#7 Net Change in Cash

Net Change in Cash = Net Cash from Operating Activities + Net Cash from Investment Activities + Net Cash used/provided by Financing Activities

Things to look out for

- Look for companies where they are able to pay out dividends without borrowing to pay the dividends.

- Look at the operating cash flow and free cash flow and compare to the growth rate on earnings. Should be similar.

- Look for positive net change in cash or if there is a reason for a -ve value (eg an acquistion).

- Look for positive free cash flow, increasing YOY to invest back into the business.

- Net income positive and increasing YOY.

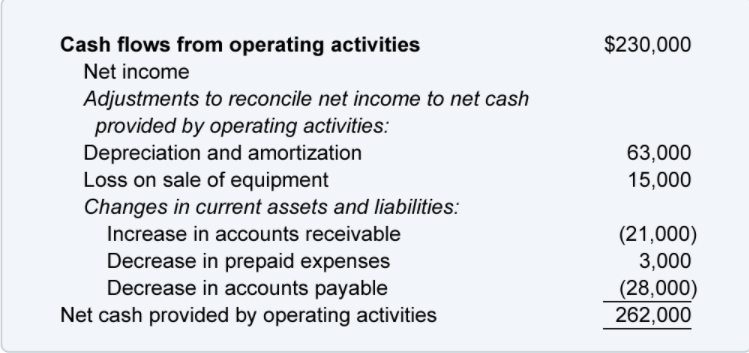

Cash flow from Operating Activities

- Number should not be negative (ie must be positive) and should be greater than the net income (which is taken from the income statement). –> Means that you are losing cash

- Net cash provided by operating activities to be increasing.

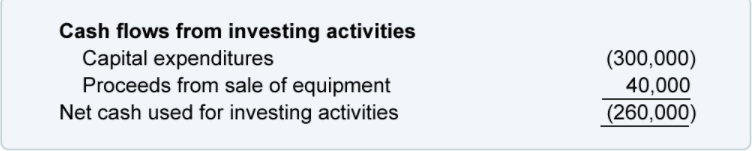

Cash Flow from Investment Activities

- Look for companies that used a far smaller % of their net income for capital expenditures*.

*Capital Expenditures: Outlays of cash or the equivalent in assets that are more permanent in nature ( >1 year). This could be property, plant and equipment or patents.

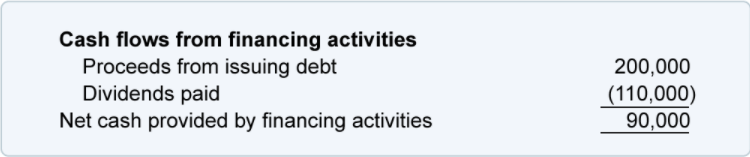

Cash Flow from Financing Activities

- Look for companies that repurchases or retires its shares. (Can be found under cash flow statement > cash from financing activities > Issuance (retirement) of stock, net)*

- Avoid companies taking on a large amount of debt (large value of “Other Financing Activities”) as they may be unable to pay off such a large amount of debt.

fantastic points altogether, you just gained a new reader. What would you recommend about your post that you made some days ago? Any positive?

Thank you for your support, glad you enjoyed the article! May I know which post you are referring to?