Contents!

ToggleHow to Analyse Balance Sheets

What is a Balance Sheet?

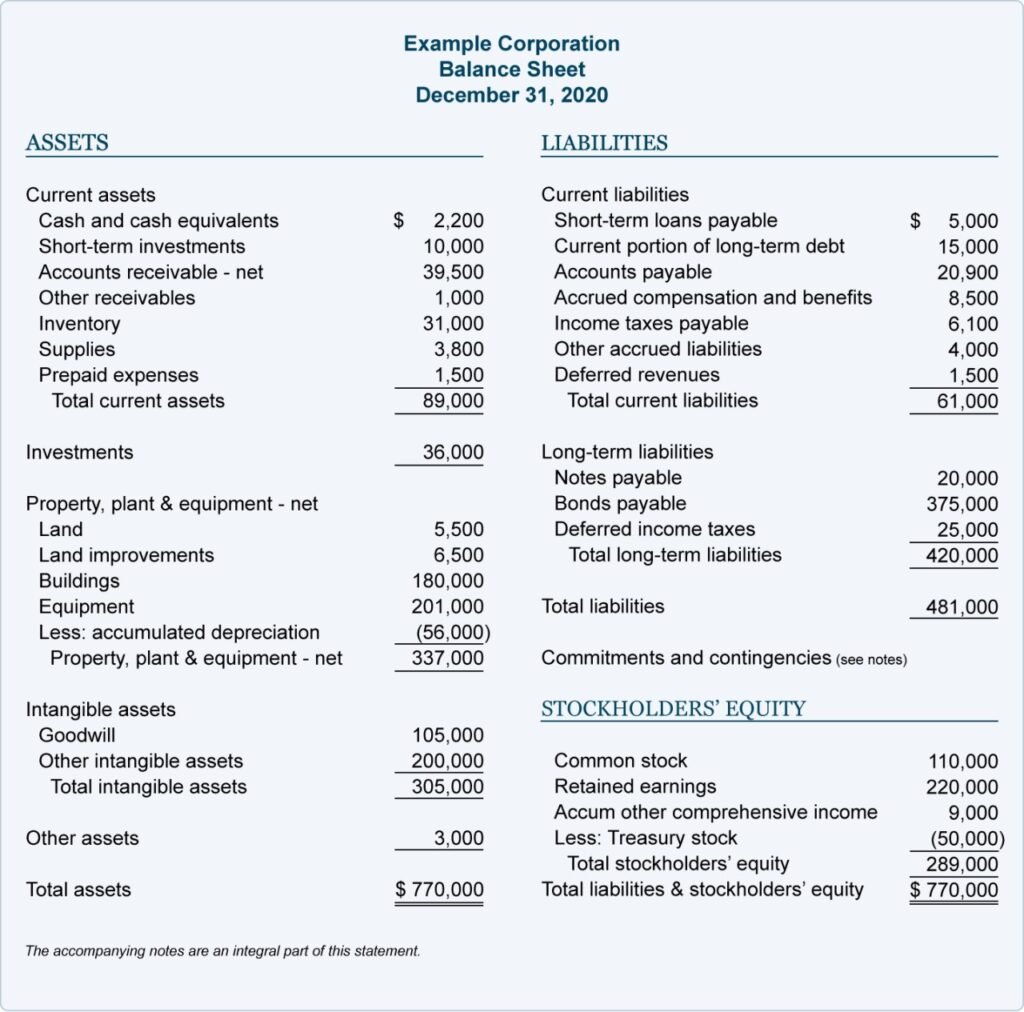

A financial statement that report’s a company’s assets, liabilities and shareholder’s equity at a specific point in time. It can only be for a single date, whereby the total assets and total liabilities are always equal on the balance sheet.

You can find the balance sheet of the company on various websites such as Yahoo! Finance, Seeking Alpha and Reuters.

Definitions

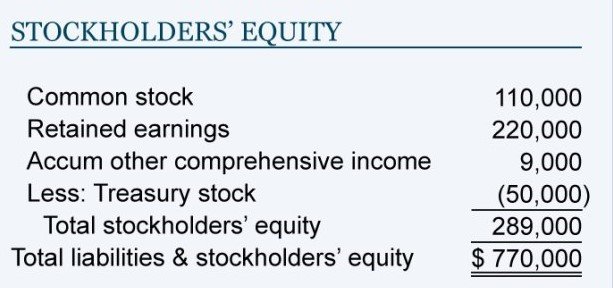

Total Assets – Total Liabilities

It is also the total preferred and common stock + paid in capital + retained earnings – treasury stock

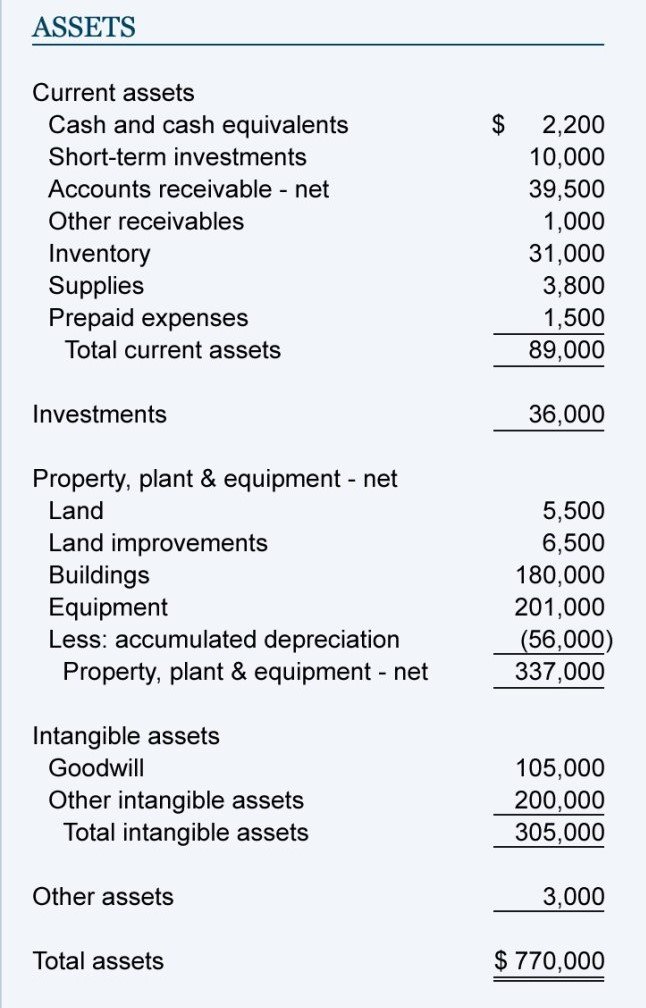

Cash and other assets that are expected to be converted to cash within a year

Long-term assets where the full value won’t be recognised until at least a year

Money owed to the business. (Receivables – Bad Debt)

Eg if a company buys over another company for 12bil but the company book value is 10bil, 2bil is considered goodwill.

Not a physical Asset, Examples are: Goodwill, Brand name etc

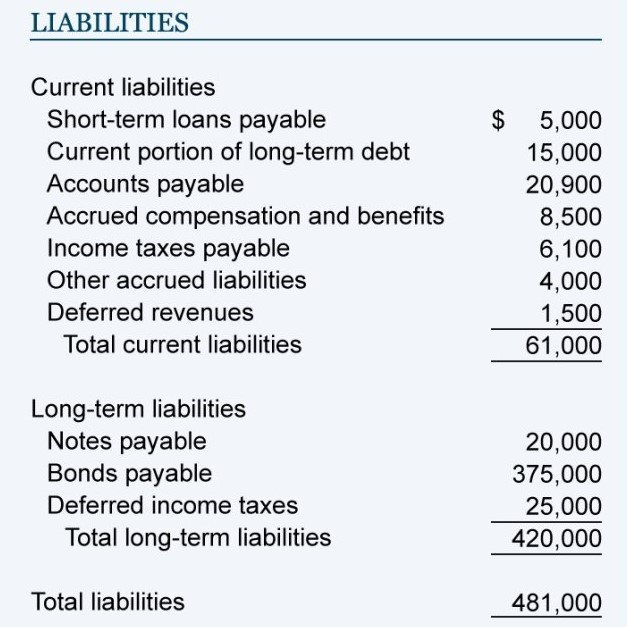

What the Company Owes. They are not only the debts of the company, but also reserves of various kinds and the equity/ownership interest of stockholders

What the company expects to be paid off in the next 12 months

What the company owes not within the next 12 months

Current + Non-Current Liabilities

Amount owed to creditors or suppliers

Expenses that the business has that has not been paid

Amount that the business has received, for services or products that have not yet been delivered

Tax that is assessed or is due for the current period but has not yet been paid

Services not expected to be performed this year

Amount of net income the business generated after paying out all of its dividends.

Unrealised gains/losses that the firm experienced

WHAT TO LOOK FOR ON A BALANCE SHEET

Assets

#1 Current Ratio should be 1 or more. Typically the higher the ratio, the more liquid the company.

#2 Return on Asset Ratio should be high. In addition, we should also look for the firm’s value of assets to increase. This suggests that there is a higher cost of entry which allows the firm to have a durable competitive advantage.

#3 We should look for Total Cash and Total Current Assets have been increasing over the years.

#4 Looking for Total Stockholders’ equity is increasing (i.e. the total assets is increasing faster than the total liabilities)

Liabilities

#5 We should look for firms that require little or no long-term debt to maintain business operations.

#6 Debt to shareholders’ Equity Ratio (Total Liabilities / Shareholders’ Equity). Adjusted ratio should be below 0.8 or lower (lower the better), but with the exception of financial institutions.

# 7 We should look for companies that do not have preferred stock in capital structure.

#8 Look for high and consistent growth of a company’s Retained Earnings.

#9 We should look for companies with presence of treasury shares on the balance sheet and with a history of share buybacks.

Shareholders’ Equity

#10 Look for high return on equity (anything > 15%). However, this is the exception of companies with long history of strong net earnings but negative shareholders’ equity.

#11 Try and avoid companies that use a lot of leverage to help them generate earnings.