Contents!

ToggleWhat is an Income Statement?

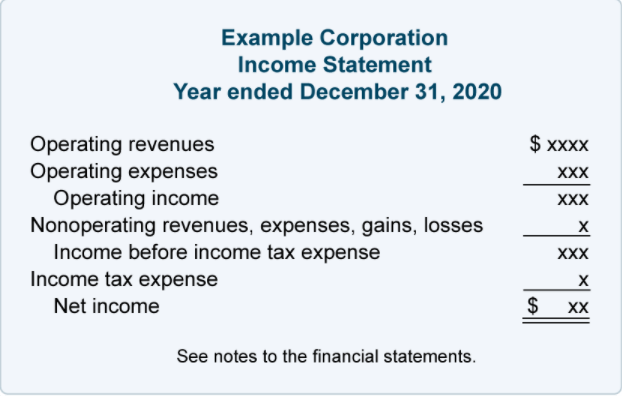

An income statement, also known as the “Profit & Loss statement” summarizes a firm’s revenues and expenses over a given period of time.

It shows the profit or loss of a business as well as the gross and operating margins.

You can find the balance sheet of the company on various websites such as Yahoo! Finance, Seeking Alpha and Reuters.

DEFINITIONS

The past 12 consecutive months of a company’s performance data

The profit post expenses

The after tax net income

Sum of all the direct and indirect expenses and all general and administrative expenses of a company. This also includes marketing and paying of employees salary etc

Total revenue – cost of revenue (e.g. cost of goods sold). It is the also known as the company’s profits after deducting the cost of producing and distributing products.

(Gross Profit / Total Revenue) * 100%

Gross Profit – Operating Expenses. It can either refer to an operating profit or loss. (Loss would be reported as -ve)

(Operating Income/Total Revenue) * 100%

Amount of interest that is paid (eg on bonds, loans, line of credit)

Other expenses/income that is not related to the core business

Company’s Income after all incomes have been deducted, but before income tax has been subtracted

Amount of taxes paid

Net Income/Number of outstanding shares

Share Price/ EPS

OTHER THINGS TO NOTE

- Date on breakdown refers to the year ending on that date

- Top line, total revenue aka the top line

- Bottom line, net income

THINGS TO LOOK FOR

- Total Revenue should be positive and increasing in value

- Net Income

- L.F. Increasing net income

- High % of net earnings to total revenue

- We should be looking for increasing Gross Profit as the gross profit margin will be higher

- Gross Profit Margin

- L.F. Companies with constantly higher gross profit margins. GPM of 40% or higher tends to have a durable competitive advantage

- Operating Expenses

- Avoid companies with high research costs, high SGA and high interest cost on debt

- Operating Margin: A good operating margin is ~15%. Higher the operating margin the better.

- SGA in % [ (SGA Expenses/Gross Profit)]*100%

- L.F. consistent SGA %, lower the better.

- 30% to 80% is an acceptable range, avoid close to or excess of 100%

- We should look for an Operating Income or Loss that is positive and increasing in value

- Little or no Interest Expense

- Should be <15% of operating expenses for consumer products category

- In an industry, the company with the lowest ratio of interest payments to operating income is most likely to have a durable competitive advantage

- Net Earnings show a historical uptrend. A high % of net earnings to total revenue is preferred.

- We should look for a consistent and upwards EPS trend

- L.F. a lower depreciation cost as a % of gross profits (~10% or less is desirable)

Look for all of these conditions to be fulfilled. Increasing revenue may not be desirable if net income is decreasing. This suggests that their operating expenses might be increasing at a faster rate