In this week’s article, I will talk about one of the newest brokers, Syfe Trade! I will go through 10 things one should know about Syfe Trade and who should use it. Read on to learn more!

What is Syfe Trade?

So…what is Syfe Trade? According to their website, Syfe Trade is a brokerage platform which allows you to invest in US stocks and ETFs at a low cost. As Singapore’s first neobroker, it touts low fees and simple to use interface as its main selling points. Furthermore, it has the ability to do fractional trading which I will cover later. Syfe is well known as a robo-advisor offering a range of portfolios, and has recently forayed into the broker sphere as well.

As of now, Syfe Trade is only available in Singapore, but they do accept overseas clients on a case by case basis. In addition, they have plans to expand to other countries in the region such as Hong Kong.

Next, we will cover the 10 important things (pros and cons) of Syfe Trade for those who are interested in using them as a broker. These points include unique features of Syfe Trade as well as personal observations from using them for the last couple of months.

Pros of Syfe Trade

For the first 6 points, I will be covering the pros of Syfe Trade.

#1 Commission-Free Trades

One of the perks touted is the 5 free trades every month*. For the 6th trade onwards, it will be at $0.99 USD per trade**. With the exception of a few brokers (e.g. TD Ameritrade), most brokers do not offer commission-free trades.

*After the first three months, clients will enjoy two free trades a month instead of five. More details can be found here.

#2 Low Fees

Secondly, Syfe Trade also offers competitive rates. As mentioned earlier, it costs $0.99 USD** after using up the monthly quota of commission-free trades. While not the cheapest, this is relatively lower than other brokers in Singapore (as a comparison, Tiger Brokers cost ~$2 a trade).

In addition, there are no other fees that some other brokers charge, such as inactivity fees, withdrawal fees or currency conversion fees. Such minimal fees are desirable for many investors as fees can eat into one’s profits.

**After the first three months, each trade will cost $1.49 USD instead. More details can be found here.

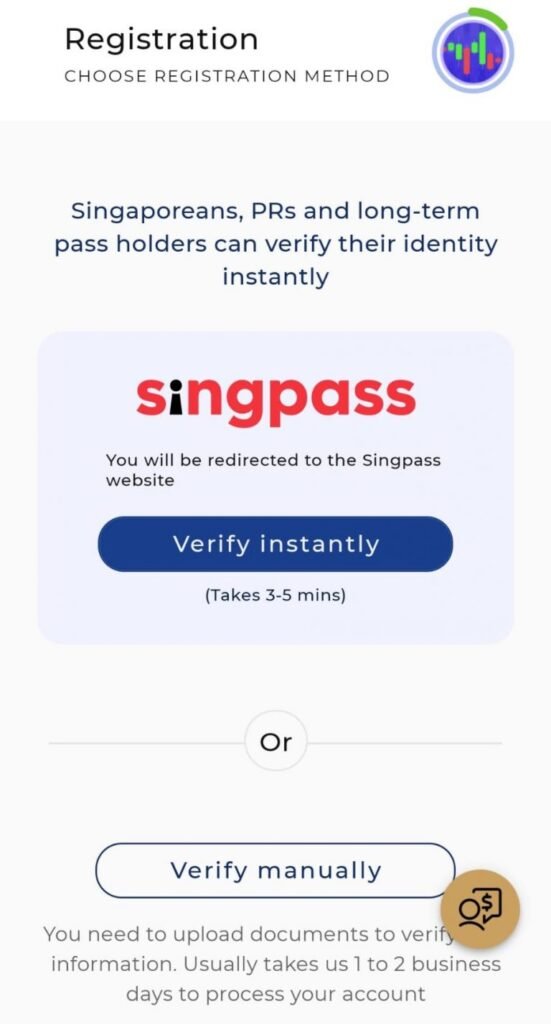

#3 Simple sign-up process

Another positive of Syfe Trade is their straightforward sign-up process. When creating an account, it can be done via Singpass and will only take approximately 5 minutes to complete. (However, it would take longer if done manually as they have to process your account)

Afterwards, you will have to complete a Financial Assessment of Investment Knowledge. There are only a few questions and it is a relatively smooth process. Lastly, you will need to sign a few forms (similar to other brokers) and agree to various T&Cs. And you’re done! It is that simple. For a more in-depth look at the sign-up process, you can take a look at this article by Dollars and Sense.

#4 SIPC Protected and Monetary Authority of Singapore (MAS) regulated

In addition, Syfe Trade is not only SIPC protected, but also MAS regulated. In the event of the brokerage failing (in this case Syfe Trade), SIPC protects the securities customers of its members up to $500,000 (including $250,000 for claims for cash). Hence you can be assured that your money and stocks are safe.

#5 Fractional Trading

Syfe Trade also offers fractional trading. What is that you ask? Simply put, instead of buying whole number shares, you can buy a piece of a share. For example, company ABC is trading at $2,000 a share, instead of paying $2,000 a share, you can pay $200 to buy 0.1 shares of ABC company.

With Syfe Trade, this means you can buy a partial share of any listed stock for as little as $1. This is a feature that is not too common and only offered by a few other brokers such as IBKR.

#6 Real-time stock quotes

Finally, Syfe Trade offers complimentary real-time stock quotes. This means that you can observe the current (live) price movements of the security. While most brokers provide real-time data, some only provide it as an add-on (such as IBKR). Such a feature is very useful for placing orders especially when trading (as it is more sensitive to price movements).

Cons of Syfe Trade

Next, I will go through some of the negatives of Syfe Trade. Most of these drawbacks are based on comparison with other popular brokers (Tiger Brokers, IBKR, TD Ameritrade).

#7 Bare-bones Features

One drawback of Syfe Trade compared to its counterparts is that it is very basic and lacks many sophisticated features. For example, Syfe Trade only offers a basic line chart to show price movements, unlike other brokerages which offer various chart types and more advanced charting tools (e.g. Indicators).

In addition, unlike other brokerages, Syfe Trade does not support trading of derivatives such as options. Syfe Trade also does not support trading on margin. This means that you are unable to trade on borrowed funds (from the broker) to buy financial instruments. This means by extension that you are unable to do short selling with Syfe Trade as well (short selling requires the use of a margin account).

Hence, if you would like to use any of the features mentioned above, it would be recommended to use other brokers instead.

#8 Limited Stock Market Coverage

Another drawback is that Syfe Trade only allows you to invest in the US Stock Market (US-listed Stocks and ETFs). If you would like to trade stocks listed in other markets such as the Singapore Exchange (SGX) or the Hong Kong Exchange (HKEX), you will not be able to do so.

Hence, Syfe Trade would only be suitable for those who want to trade securities solely on the US stock exchange.

#9 Limited Commission-Free Trades

While Syfe Trade offers commission-free trades, there is a limit on the monthly free trades. During the promotional period, one would get 5 free trades a month for the first three months. However, this drops to 2 free trades after the promotional period. However, some might find the free trades insufficient if they do many more trades a month.

Hence, for those who do more trades than the limits stated, you might be better off looking for brokers that give unlimited commission free trades (e.g. TD Ameritrade).

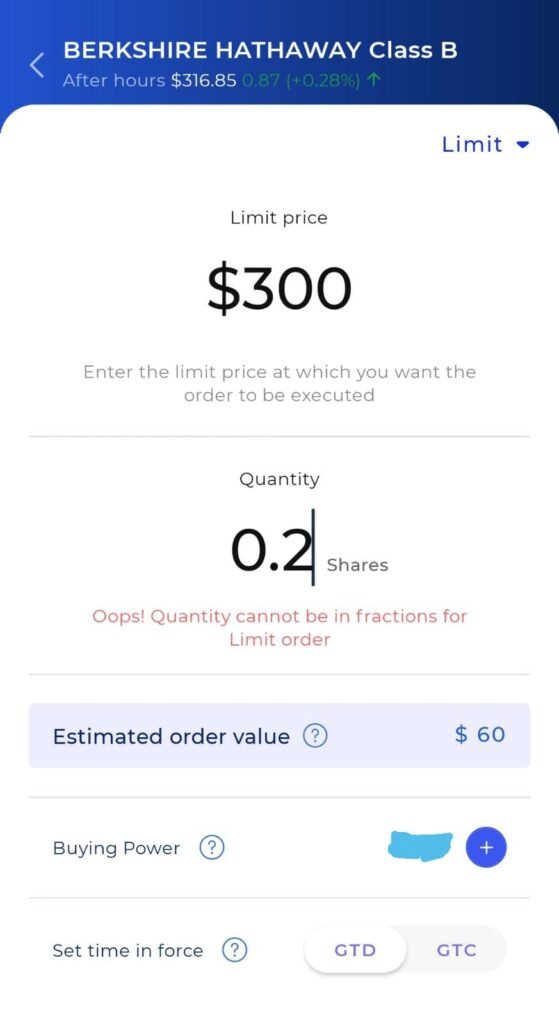

#10 Limit order does not support fractional shares

Lastly, Syfe Trade’s fractional trading is not supported for Limit Orders.

As shown above, limit orders (where you can set the price to buy/sell) cannot process fractional trades. This means that if you would like to buy fractional shares, you can only do so using a market order. However, this means that you might not get a good fill price as compared to limit orders.

For those who are dollar-cost averaging (DCA) periodically, do take note of this limitation! (e.g. If you DCA $500 monthly, this means that you are unable to DCA the full amount for limit orders or you have to use a market order for fractional shares)

[For those who want to use limit orders for fractional trading, a better brokerage option would be Interactive Brokers (IBKR). I will be covering them in a future article so stay tuned!]

Should you use Syfe Trade?

Now that you have seen 10 important things about Syfe Trade, this begs the question, are they the right broker for you? To answer the question I have created a quiz to help you decide! You can take the quiz here.

Hopefully, the quiz gives you a better idea of whether you should a) Avoid b) Try or c) Use Syfe Trade. But in short, Syfe Trade is recommended for passive investors who need a simple interface to buy/sell their investments. Such investors only do a few trades a month as part of their DCA strategy.

Referral

If you choose to use Syfe Trade, why not get some benefits in the meantime. Syfe Trade has a welcome bonus where you can receive a $60 SGD cash credit!

To get the $60 cash credit, you would need to fund your account for $1,000 or more and make your first trade within 30 days of creating your account. The cash credits can then be used to make further stock purchases. Read more on the promotion here.

You will also enjoy the 5 commission-free trades monthly for the first 3 months, as well as a lower cost ($0.99 USD) after using up the commission-free trades.

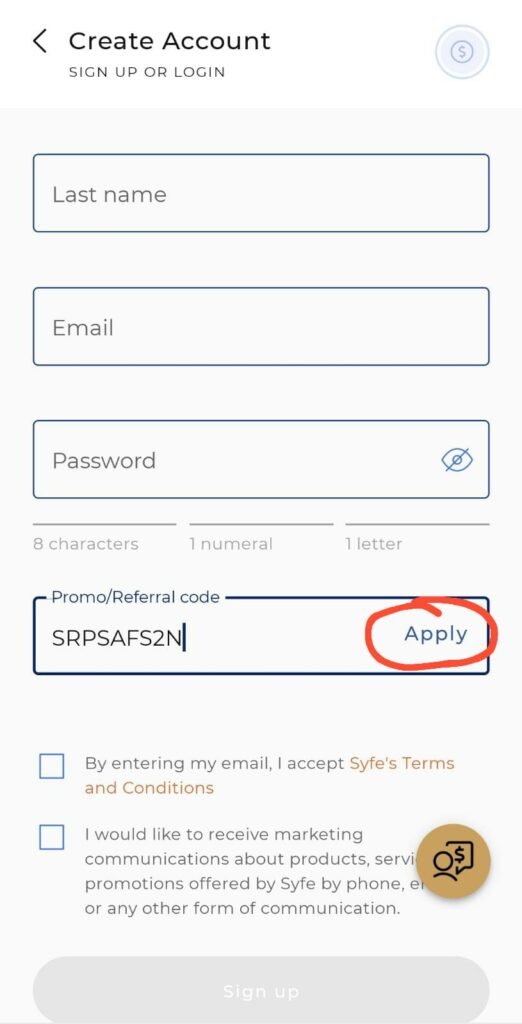

What’s more, you can get a bonus of $10 cash credit when signing up by using my referral code SRPSAFS2N. (I will get some cash credits as well and that would really support my future articles)

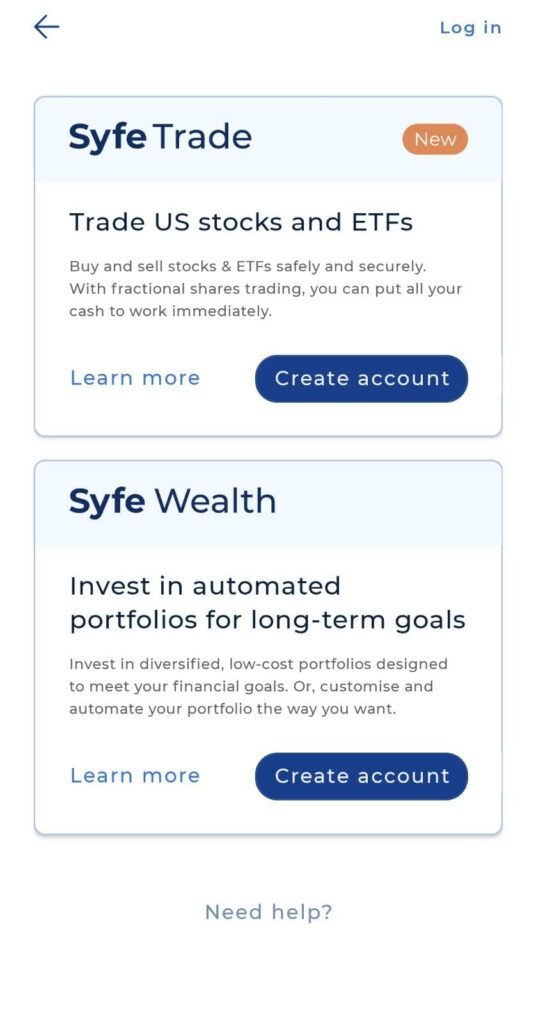

For those completely new to Syfe, this is how you can create an account!

Firstly, you will click on ‘Create Account’ under Syfe Trade.

Fill in the details above and input my referral code in the ‘Promo/Referral code’ section and click apply.

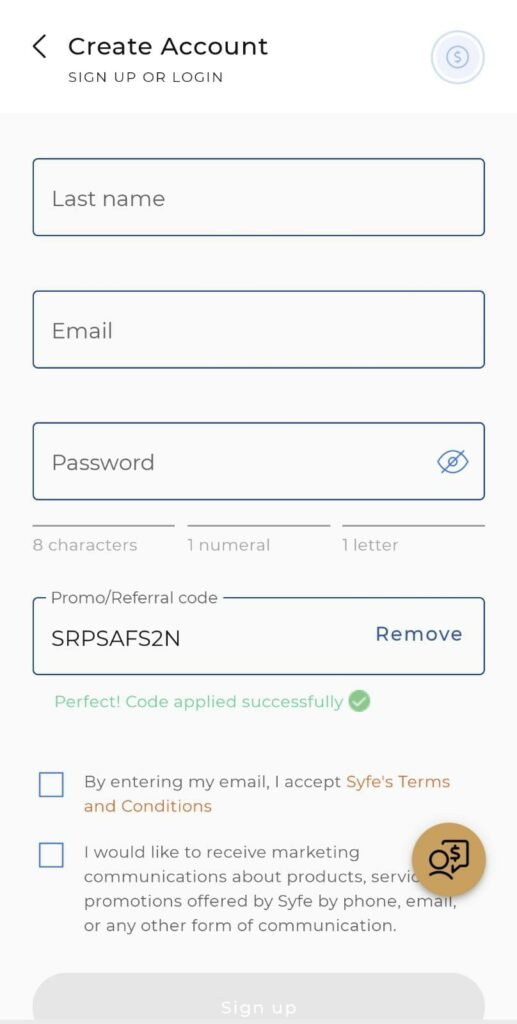

Once successfully applied, it will give a message ‘Perfect! Code applied successfully’.

Afterwards, simply accept the T&Cs and Sign Up! Do note that afterwards you have to fill in other details and you can refer to the sign-up process linked in point 2.

And that’s it! Hope you found this article and allow you to decide if Syfe Trade is the broker for you. If you would like me to do reviews of other brokers, do let me know in the comments below. Once again, thank you all for reading. Cheers!

-Rice