Hey everyone! For all those investing in the US stock market, I’m sure you have heard of American Depositary Shares (ADS) and American Depositary Receipts (ADR). Today I will be going through everything about them and cover the various ADR/ADS listed on US stock exchanges, and any implications of trading them compared to typical US-listed stocks.

What are American Depositary Receipts?

According to the US Securities and Exchange Commission (SEC), an American Depositary Receipts or ADR is a security that represents shares of non-US companies that are held by a US depositary bank outside of the United States.

What are American Depositary Shares?

According to the SEC, American Depositary Shares or ADS, are used to represent an interest in the shares of a non-US company that have been deposited with a US bank. It is similar to a stock certificate representing the shares of stock.

Such shares can be traded over-the-counter (OTC) or on other major US stock exchanges such as the New York Stock Exchange (NYSE).

Differences between ADR and ADS

Now, before we dive more into ADS, I thought we should clarify the differences between ADS and American Depositary Receipts (ADR). While ADS and ADR tend to be used interchangeably, both terms have slightly different meanings.

ADR is a negotiable certificate that evidences ownership interest in ADS, while ADS is the actual underlying share that the ADR represents. ADR represents a bundle of ADSs, while ADS is the actual share available for trading on the stock exchange.

However, for simplicity’s sake, I will be using ADR and ADS interchangeably for the rest of the article.

ADR Process

Now how does ADR work? Well, a broker will buy shares of the foreign company on their local stock exchange. The foreign shares would then be delivered to a custodian bank in the US. The ADRs are then created by a depositary bank on the basis of those shares held by the custodian bank. The issued receipts can then be traded OTC or on the major stock exchanges in the United States.

Like all stocks listed on the US exchanges, ADRs are listed in USD, traded in USD and the dividends are all paid in USD, which mitigates some (but not all) forex risk. We will explain more on the implications of ADRs later in the article.

Types of ADR

There are two main types of ADR, “sponsored” and “unsponsored”.

Sponsored ADRs are those where the non-US company enters into an agreement directly with the US depositary bank. This means that Sponsored ADRs will receive support from the company itself, such as earnings reports in English, in addition to their native language.

On the other hand, Unsponsored ADRs are set up without the cooperation of the non-US company. It could be initiated by a broker-dealer wishing to establish a US trading market.

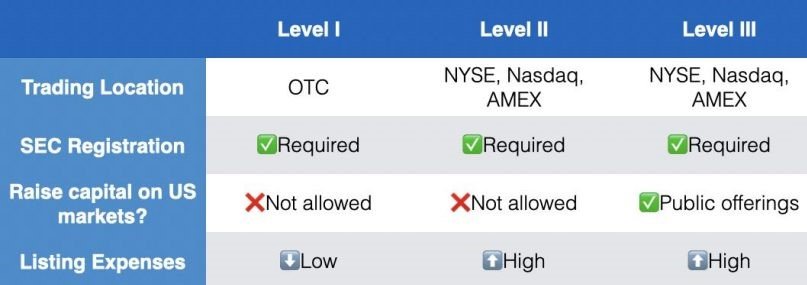

In addition, there are 3 Levels of ADR programs, with increasing requirements such as filing more forms and filing annual reports with the SEC. That said higher level ADR programs have more leeway and rights (such as raising capital on the US markets).

Above is a summary of the differences between the ADR program levels.

Why ADR?

Well, you might ask, what is the point in investing in ADRs? Why not just invest in the foreign shares of the company instead? As previously mentioned, ADRs are listed in USD and one will not have to deal with currency conversions.

In addition, it provides an ease for investment as many of these ADRs are listed on the large US stock exchanges, which are supported by the majority of brokers whereas some brokers may not have access to some stock exchanges (typically smaller exchanges from emerging markets).

In addition, ADR holders may also surrender ADRs in exchange for receiving shares of the non-US company. Such transactions are typically performed by brokers, so do check with your broker on the process if you would like to do so. (That said, there is an Ordinary Shares to ADR ratio that you should be aware of, more on that in the next chapter).

Investors also do not need to worry about the price differing too much from the foreign exchange listed one due to arbitrage.

Implications/Risks of ADR

Before investing in ADRs, do note that there are some implications and risks involved. Firstly, there are delisting risks associated with ADRs. Such risks have become a large point of contention recently, especially with Chinese ADRs. Just recently, the SEC identified five Chinese companies that could face delisting citing that such firms are not meeting auditing requirements amid a long-running auditing standoff between the US and Chinese regulators.

Another implication is the currency risks. As the brokers buy the foreign stock to be held in custodian banks so that ADRs can be issued, fluctuations in the exchange rate between the US dollar and the foreign currency may have some effect on the share price. This can also have slight implications on the dividends payouts (as they are in USD).

Furthermore, there are tax implications of buying ADRs. Just like buying foreign stocks, there will be a withholding tax on dividends issued for ADRs. I have covered more about this in my dividends post about how withholding tax works, so do check the withholding tax rates and the tax treaties with your country.

Lastly, investors should also be aware of the ADR conversion rate. To set the shares at a price that would appeal to investors, there is an Ordinary Shares to ADR ratio, which refers to the number of Ordinary Shares each ADR represents. Hence in the event that one converts the ADR to the foreign exchange-listed shares, the number of shares you would receive may be different. You can check out some of the ratios for the ADRs here.

[Edit 26/4/2022. In addition to the implications above, holding positions of ADRs would incur periodic fees intended to compensate the agent bank providing custodial services on behalf of the ADR. Such fees range from $0.01 – $0.03 per share and will be reflected on your monthly statement (or deducted from any dividends paid by the ADR). You can read more about it here.]

(Do note that the ratio does not have an implication on the “value” of your shares. The price is adjusted according to the ratio. For example, Alibaba (ticker BABA) is listed as an ADR. However, for one ADR BABA, it represents 8 Ordinary Alibaba Shares. Hence the price of BABA is roughly 8 times the Hong Kong Stock Exchange equivalent (ticker 9988.HK) )

Summary

Now that we have come to the end of the article, I hope everyone has learnt something about ADRs. Do take note of the implications before investing in ADRs. Compared to investing in their foreign exchange alternative, it might be more desirable to invest in ADRs for simplicity’s sake (as you can deal with it in USD). As always, do your due diligence before investing. Cheers!

(For additional resources, I have attached the SEC document on ADR at the bottom of the article)

– Rice

Additional Resources