Hi everyone! For this week’s post, I thought we would cover one of the most popular tools for retail investors to invest in the stock market – Exchange Traded Funds!

What are Exchange Traded Funds (ETF)?

Well, it is a type of security that could track an index, sector commodity or asset, but can be bought and sold on a stock exchange (such as the NYSE) like the shares of companies listed on the exchange.

Who are ETFs For?

ETFs are typically targeted at passive investors who do not want to actively manage their portfolios. Having them in your portfolio means that they are automatically balanced based on the target of the ETF (eg tracking an index). In addition, ETFs allow investors to access a diverse range of assets with a relatively low minimum investment, which is suitable for most retail investors who start with a small portfolio.

However, ETFs are less for investors who are looking to actively manage their portfolio, through strategies such as stock picking. That said it does not hurt to have an ETF in an actively managed portfolio if it suits the needs of your portfolio!

Types of Exchange Traded Funds

Before we invest in any ETF, we should note that no one ETF is alike. However they do fall under a few broad main categories, so let us dive right into them to find out which is the best for you!

- Index ETFs

Tracks an index (such as the S&P 500 Index) and aims to replicate the holdings and weightage of each holding to achieve a similar return to that of the index. The ETFs can have securities such as stocks, bonds and even derivatives.

- Actively Managed ETFs

Unlike Index ETFs, the fund is instead actively managed by a (group of) fund managers to achieve the goal of the ETF. This could be done through buying or selling stocks or even through the use of derivatives (for example selling covered calls on the shares owned by the fund).

- Inverse ETFs

Unlike the first two mentioned above, inverse ETFs seek to earn gains by going short on a security (instead of the typical approach of going long). This is typically done through the use of derivatives and the fund will do well if the value of the asset falls.

Understanding the Fund Fact Sheet

All ETFs will have a fund fact sheet which provides various information about the fund itself. In this section I will be using the iShares Core S&P 500 UCITS ETF (ticker CSPX) as an example.

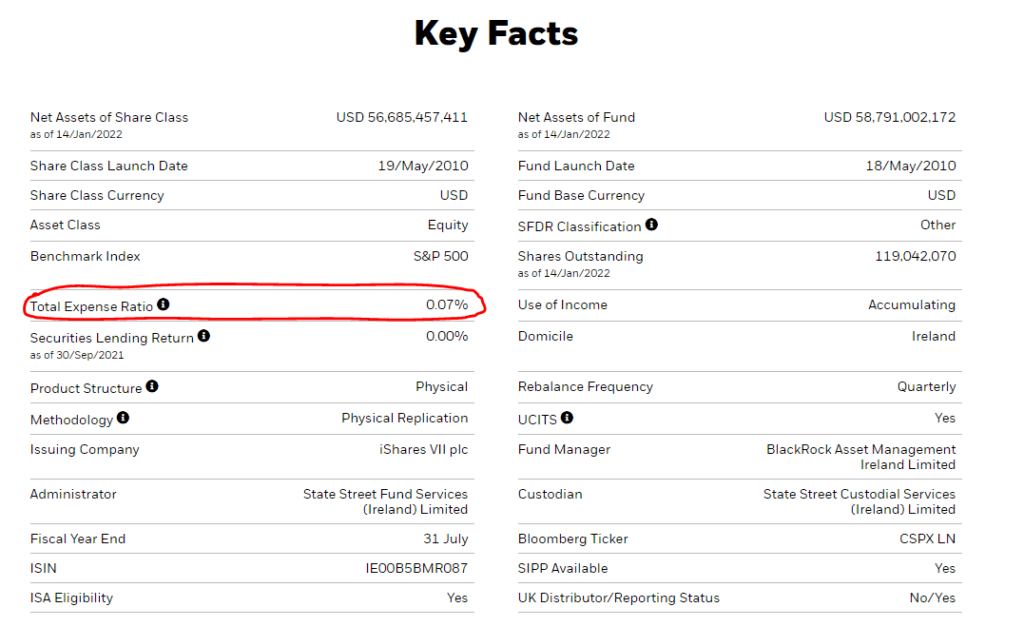

#1 Total Expense Ratio/Ongoing Charge Figure

Probably the most important factor for investors when comparing similar ETFs, would be the Total Expense Ratio (TER) and Ongoing Charge Figure (OCF). Both are similar but OCF is usually used for funds in Europe. Typically it refers to the costs incurred by the fund such as licensing fees, audit fees, custody fees and management fees. The TER/OCF is usually expressed as a percentage and is incurred on an annual basis.

While it is not clearly stated how such fees are incurred, a simple way to calculate the fees incurred yearly would be the amount invested * TER/OCF (not taking into account other fees or returns from the ETF). If we invest $10,000 into CSPX, the rough fees incurred would be $10,000 * 0.07% = $7.

#2 Net Asset Value (NAV)

Net Asset Value (NAV), also known as the value per share, is calculated by the formula above. In an ETF the assets are the shares/bonds/derivatives in the fund while the liabilities is typically the TER/OCF of the fund. The NAV is used to estimate the ETFs’ performance compared to the index it is tracking.

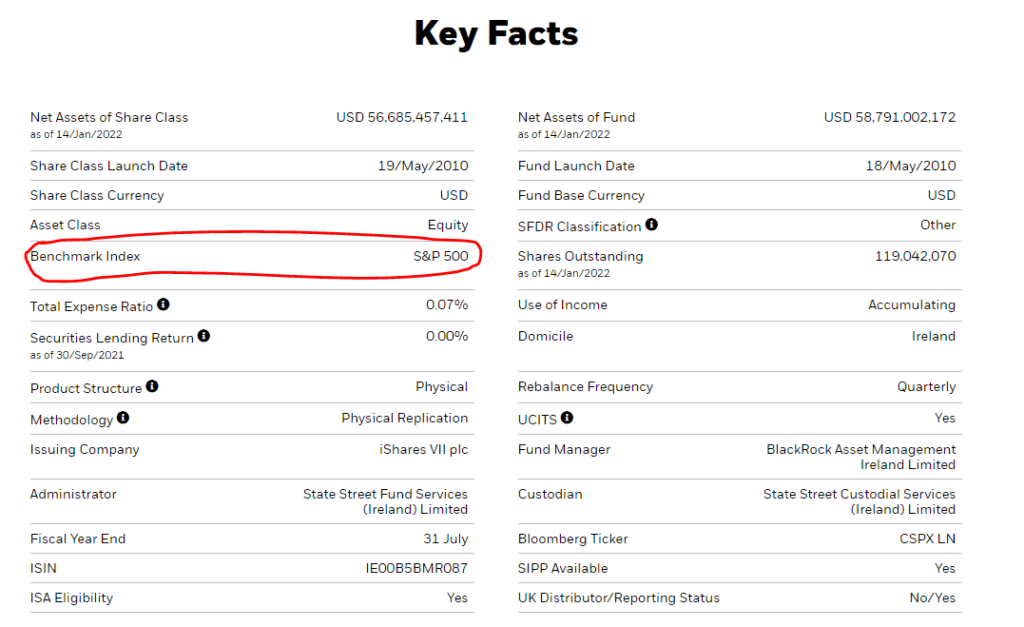

#3 Benchmark Index (for index ETFs)

Benchmark Index, as the name suggests, is an index used as a benchmark for the ETF’s portfolio. Typically, the ETF will track the holdings in the index so as to closely replicate the holdings and weightage (in %) in the portfolio. The goal is for the ETF to achieve a return that is as close as possible to that of the benchmark index it is tracking.

CSPX tracks the S&P 500, which is the index of the 500 leading US publicly traded companies.

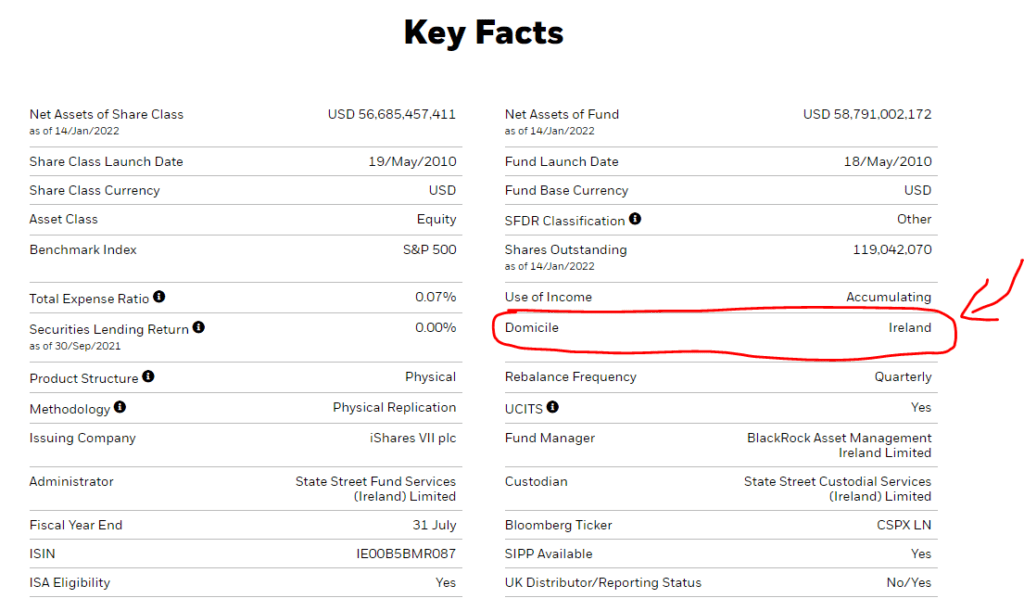

#4 Domicile/Exchange

This refers to the country/exchange the ETF is listed on. For example, an ETF that is domiciled in Ireland means that it is based in Ireland. Additionally, the exchange refers to which exchange the ETF is listed on (for example the New York Stock Exchange, NYSE).

[Do note there is a minor difference in domicile and exchange. For example, a US domiciled ETF can be listed on the NYSE/NASDAQ or both, which are the two main stock exchanges in the United States.]

CSPX is domiciled in Ireland which means that it is listed on the London Stock Exchange (LSE).

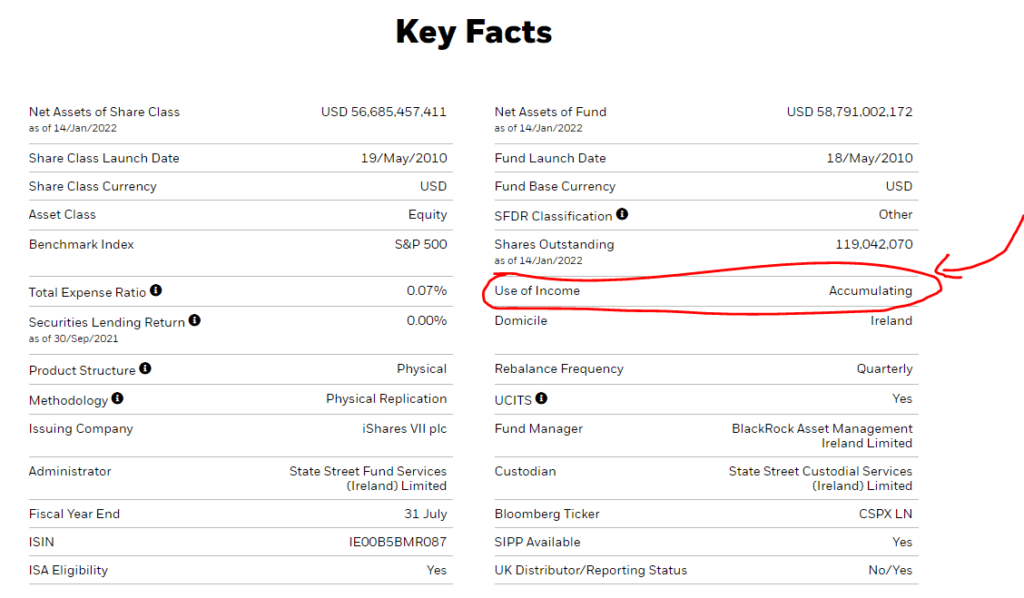

#5 Use of Dividend Income

Accumulating: Automatically reinvests the dividends earned from dividend-paying stocks for you back into the ETF

Distributing: Distributes the dividends earned from dividend-paying stocks to the investor (typically quarterly)

As CSPX is an accumulating ETF, it means the dividends are automatically reinvested for you.

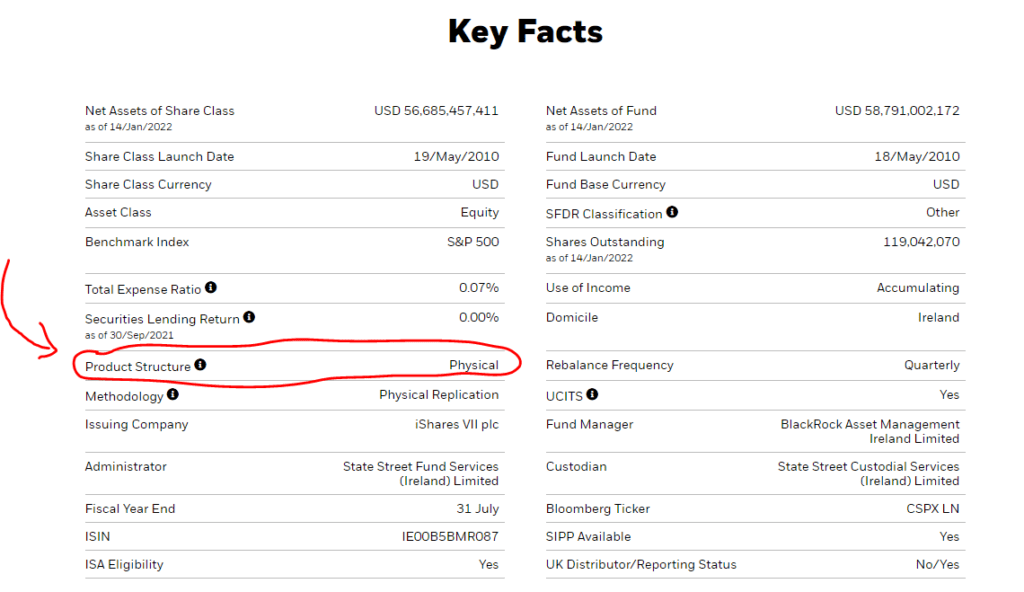

#6 Investment Method/Product Structure: Physical vs Synthetic (for index ETFs)

Under the fund fact sheet, you may notice a section labelled ‘Investment Method’ or ‘Product Structure’. For this section, the two labelled options will be either Synthetic or Physical. So what does it mean?

Well, Physical means that the ETF will directly hold the underlying securities/assets from the Index it tracks. On the other hand, Synthetic ETFs will instead use derivatives (such as swaps) to replicate the returns of the Index.

[For more information on the pros and cons of each type, you can learn more about it here.]

CSPX has a physical product structure, which means its holdings are mostly shares of the companies.

#7 Turnover Rate

Turnover Rate refers to the ratio of how many of the ETFs’ securities are replaced in a year. If an ETF invested in 500 different stocks and 50 of them are replaced during the year, the turnover rate would be 10% (50/500 * 100). Having a higher turnover rate will incur higher turnover costs (commissions, spreads etc from buying and selling the securities).

Pros and Cons of ETFs

Before we dive into how to invest in ETFs, let us consider some of the pros and cons of ETFs. I will try and list them objectively, or make comparisons to similar investment avenues. Let us start with the pros of ETFs.

Firstly ETFs are easily accessible to the retail investor. As they are listed on the various stock exchanges, they can be bought and sold by any investor as long as they have a brokerage account. They also require a low minimum investment amount as typically you would only require the cost of one share of the ETF (some brokers even allow you to buy fractional shares of the ETF as well!).

Secondly, ETFs are generally well diversified as they tend to own a basket of assets. Diversification is crucial as it reduces risk to the investor in the event that a particular asset fails. Additionally, there is a range of ETFs to choose from nowadays (refer to section on ‘Types of Exchange Traded Funds’). From index funds to actively managed funds, there is undoubtedly a fund to suit every investor’s needs.

Drawing from the advantages mentioned above, ETFs are a great way to build an investment portfolio even with limited funds. For example, if you are bullish on a particular industry (take for example the financial industry), you would want to invest in the various stocks in that industry. However, with limited funds, it may not be feasible for you to invest in all of these stocks (you may end up with only a couple of shares each or fractional shares). But you could buy an ETF that tracks the financial industry instead. Furthermore, ETFs will tend to rebalance itself regularly (to match the index/change market cap for example) and hence you will need to do minimal rebalancing on your end, which makes it easier for investors.

That said, there are some disadvantages to ETFs

One main disadvantage of ETFs is the higher fees incurred. Typically ETFs have an expense ratio on top of the brokerage fee to buy the shares of the ETF. Compared to other options such as buying individual stocks, you will incur additional fees as a result.

Another disadvantage is that ETFs do not give you the flexibility to manage your portfolio. Given that most ETFs have a benchmark that they follow, they may not suit the investors needs entirely. (E.g. An investor who is looking to invest in small and mid cap companies may not get the exposure they want if they invest in the SPY, an ETF that tracks the S&P 500 Index).

In addition, if you are buying into multiple ETFs, there might be overlaps in the funds. For example, buying into two ETFs that track the S&P 500 and Nasdaq-100 Index will lead to an overlap in holdings — large cap tech stocks such as Apple Inc. are found in the top 10 holdings of both indexes.

Lastly, ETFs like all types of funds may be susceptible to something known as ‘Asset Bloat’. This is typically a phenomenon for actively managed funds. Asset bloat means when a fund is flooded with new money resulting in lower returns. Funds are flooded with new money when they gain popularity (in part could be due to phenomenal performance in the past) and investors with FOMO, rush in and pump more money into the fund. This creates a problem for the fund manager where they have difficulty investing the new money inflows into the stocks. You can read more about the problems here.

Here is a summary of the pros and cons of ETFs:

How to invest in ETFs?

Investing in ETFs is probably one of the easiest things you can invest in! All you would need is to have a brokerage account and some capital to buy the ETFs. (In the future, I hope to give a detailed breakdown of the best brokers that one could use).

However, to invest in ETFs there are some key considerations beforehand.

- Domicile of ETF

The domicile of the ETF (country of where the ETF is registered and regulated) is a key consideration when investing. Not every broker has access to all the stock exchanges globally. Hence, do check if your broker has access to the stock exchange that the ETF is domiciled in!

- Tax implications

Depending on where you live, buying and selling ETFs may result in you having to pay taxes such as Capital Gains tax. In addition, dividends from dividend-paying ETFs may be subject to withholding taxes as well. I have previously made a post on it, so do check it out to learn more! 😊

Conclusion

ETFs are a great financial tool for many who are looking to start an investment portfolio. Not only is it simple to use, but there are also a variety of ETFs to cater to every investor’s needs. Do always remember to do your due diligence when researching the ETFs before deciding what is best for you.

I hope you have learned more about ETFs and if you found this post useful do consider supporting me by sharing this article with others! Thank you and happy investing : )

Would u be doing a post for mutual funds as well? would live to find out more! thanks rice:)

Will definitely consider doing a post on mutual funds in the near future! Thanks for ur support 😊