Dividends dividends dividends. For all of you investing in the stock market, I’m sure you have heard of the term ‘dividends’. But for many of us, the word ‘dividends’ brings to mind a series of questions: “What even are dividends? How do I ‘get’ dividends? What about the tax implications? Or what about— ?” Now now, let me stop you right there! In this post I shall attempt to answer all your burning questions : ) Let’s begin!

What are dividends?

Well, let us start with the basics. What are dividends? Dividends are a distribution of a company’s earnings to its shareholders. They are paid on a regular basis (which could mean monthly, quarterly, yearly etc) as a reward to shareholders for holding onto their stock. Do note that shareholders need to own the stock before the ex-dividend date.

How do dividends work?

As previously mentioned, shareholders will need to own the stock before the ex-dividend date. However, the dividend process is more complicated than that and is typically broken down into three main dates; the ‘declaration date’, ‘ex-dividend date’, ‘record date’ and the ‘payable date’.

Declaration Date

Firstly, the Declaration date or Announcement date is the date where the company announces a) the amount of dividend to be paid, b) the date on which the dividend will be paid (payable date) and c) the ex-dividend date. The declaration date typically coincides with the earnings report.

Cum-dividend

Secondly, a stock is cum dividend (or with dividend) after the declaration date till the ex-dividend date.

Ex-Dividend Date

Thirdly, the ex-dividend date is the first day on which the stock is trading without the rights to the dividend. Hence, the share price of the stock will also fall by the value of the dividend. For example, if the dividend amount is $1 per share and the share price is $50, the share price on the ex-dividend date will fall to $49. Hence it is required shareholders to own the shares prior to the ex-dividend date. You can read more about the ex-dividend date here.

Record Date

Fourth, the record date is the date on which the stock must be owned in order to receive the dividend. On this date, they will check which shareholders hold the stock cum dividend to ensure they are eligible to receive the dividend on the payment date. That said you would still receive the dividend even if you have sold the stock on the ex-dividend date.

Do note that in the United States, the last day on which the stock can be purchased in order to receive the dividend is three days before the record date. This is because the settlement date (or the date on which the purchaser of the stock officially takes possession) is normally three days after the trade is made.

Payment Date

Lastly, the payable date is the date on which the dividend will be paid to qualifying shareholders (those owning the shares on the record date).

Dividend Yield: What is it?

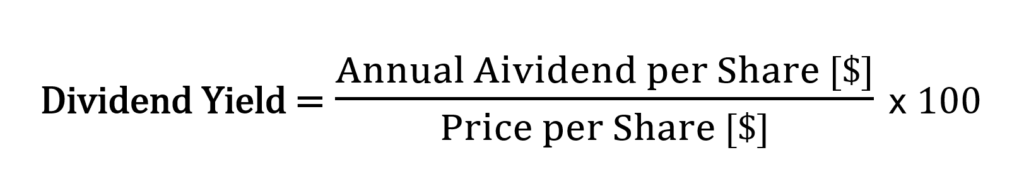

When talking about dividends another important concept to think of is dividend yield. Dividend yield (in %) is estimated dividend-only return of a stock investment. It is calculated by (Annual Dividends per share) / (Price per share) * 100.

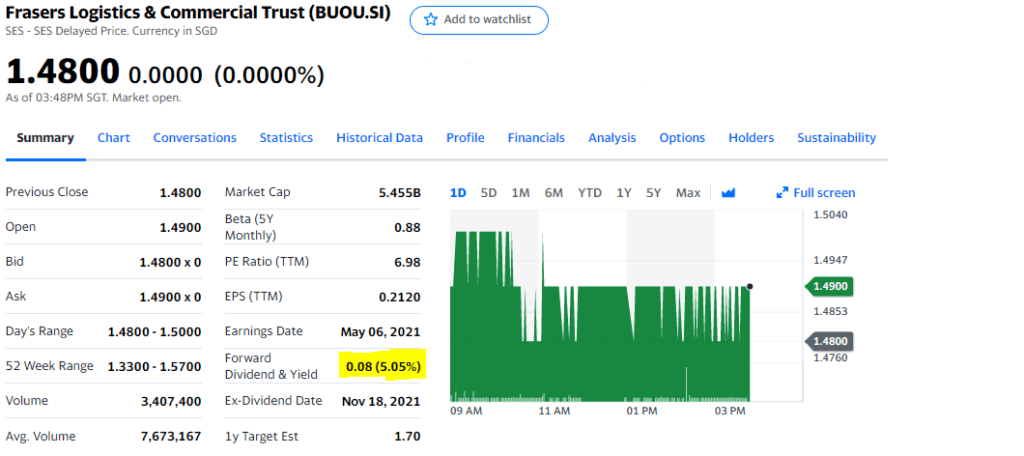

Typically you can find the dividend yield by searching up the ticker symbol on sites such as Yahoo Finance. As you can see the dividend yield for Frasers Logistics & Commercial Trust (ticker BUOU.SI) is 5.05% as listed in the summary.

What to look for in a Dividend stock.

Now you might be wondering, what should we look out for in a good dividend-paying stock? Here are a few aspects (not hard criterias) that we can look out for:

- Dividend Yield of around 2 – 5%

While there is no hard and fast rule of the ideal dividend yield, the general consensus is that the dividend yield should not be too low (too little dividends) or too high (may not be sustainable).

- Increasing share price

Like all investments, we would hope for the share price of the stock to increase on top of paying us dividends. This would suggest that the company is growing as well. A company may have a high dividend yield but this could be due to a falling share price (recall the dividend yield formula).

- Increasing dividend amount

Likewise, we would hope that the company is able to increase the dividend payout amount. An increasing dividend amount would be beneficial to investors and suggests that the company’s earnings are increasing as well (and as such able to afford paying more dividends)

What stocks pay dividends?

Typically we consider companies that pay out dividends regularly ‘dividend stocks’ and high-growth companies ‘growth stocks’. Companies that pay out dividends tend to be mature companies with slower growth. Hence such companies may opt to pay out dividends as they do not have better use of the funds. Increasing their dividends and being able to pay regular dividends also shows the company’s strength (however this is not the case every time). In addition, offering regular dividends will incentivise investors who want a regular passive income to buy the company’s stock.

Another common stock that pays dividends are Real Estate Investment Trusts (REITS). [I hope to cover more on them in a future post : )]

On the other hand, ‘growth stocks’ do not pay out dividends as they seek to reinvest their earnings back into the company through various options (such as acquisition, R&D etc). This will allow them to grow their future earnings which will lead to increases in share price. Typically growth companies experience higher ‘growth’ than dividend-paying companies.

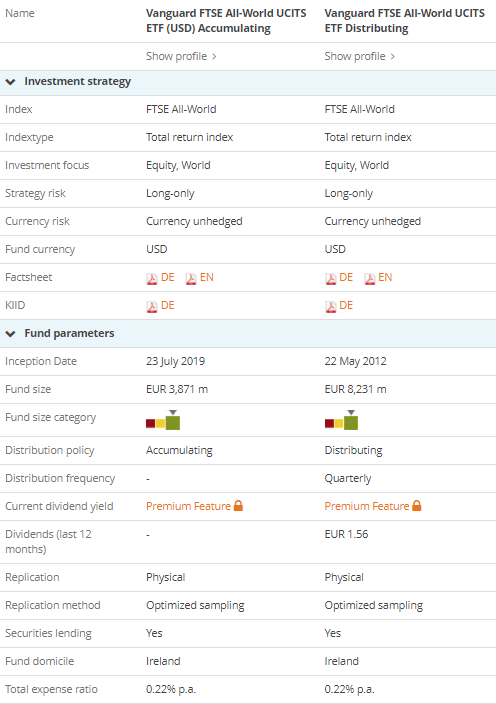

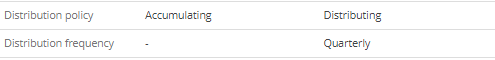

Lastly, exchange-traded funds (ETFs) also pay out the full dividend of the stocks that the ETF holds. Typically they pay out at regular intervals (e.g. quarterly) proportionate to the number of shares the investor owns of that ETF. However, it should be noted that certain types of ETFs do not pay out dividends even though they have holdings in dividend-paying companies. This is because they are ‘accumulating’ ETFs. Accumulating ETFs automatically reinvests the dividends earned rather than paying out to the shareholders. Let’s take a look at two similar ETFs VWRA and VWRD:

As seen above, both VWRA and VWRD are Irish-Domiciled ETFs with an expense ratio of 0.22% and both track the FTSE All-World Index. At first glance, you might think they are the same. Not quite.

Taking a look under distribution policy, we notice that VWRA is an accumulating ETF while VWRD is a distributing ETF with a distribution frequency of quarterly. This means that VWRA automatically reinvests the dividends for you while VWRD distributes the dividends quarterly. Depending on your preference you should pick the ETF which suits your investment needs better.

Tax implications

Lastly, one would also be interested in the tax implications of dividends. I will cover this for Singaporeans only. In Singapore, dividends are typically not taxable even if they are foreign dividends received in Singapore by resident individuals. However, one exception would be if the dividends are derived by individuals through a partnership in Singapore. The full details can be found here.

On the other hand, if you buy stocks of a US company that pays dividends, you will be subjected to withholding tax. A withholding tax is the amount withheld from income payments and is paid directly to the government. In the case of withholding taxes, foreigners would have to pay a withholdings tax rate of 30% for dividends paid out by a US company. More information can be found here. As the 30% withholding tax on dividends is quite a large %, one might consider investing in Ireland-Domiciled funds that track various US indexes rather than their US-domiciled funds. This is because Irish-domiciled US securities are only subject to a withholding tax of 15% (half of what you would have had to pay!). Hence Irish-domiciled funds may be more tax-efficient than their US counterparts. However, it is important to check their cost-effectiveness overall (due to differing expense ratios for example).

[Do note that foreign stocks that pay dividends that are listed on the domiciled are also subject to 30% withholding tax, after whatever withholding tax it might incur from their home country. Aka double taxation]

Hope this article has been useful and has given you a better understanding of dividends. Thank you for reading!

– Rice

very informative!!! thank you for sharing with us rice:)

Thank you for reading!

6/4/2022

Hey all, made an edit to explain the process of how dividends are paid with more clarity. That said you can read below for my previous explanation on the dividend process.

*Old Explanation*

As previously mentioned, shareholders will need to own the stock before the ex-dividend date. That said we will go into the long answer of how it works.

Firstly, we should be familiar with a few terms; ‘declaration date’, ‘cum dividend’, ‘ex-dividend’ date and ‘record date’. Firstly, the declaration date (or announcement date) refers to the date where the company announces the next dividend payment. This typically coincides with the earnings report. In addition, the declaration date announces the size of the dividend, payment date and the ex-dividend date.

Secondly, a stock is cum dividend (or with dividend) after the declaration date till the ex-dividend date.

Thirdly, the ‘ex-dividend’ date is the day the stock starts trading without the value of its next dividend payment. Hence, the share price of the stock will also fall by the value of the dividend. For example, if the dividend amount is $1 per share and the share price is $50, the share price on the ex-dividend date will fall to $49. Hence it is required shareholders to own the shares prior to the ex-dividend date. You can read more about the ex-dividend date here.

Lastly, the record date is the date where they check which shareholders hold the stock cum dividend to ensure they are eligible to receive the dividend on the payment date. That said you would still receive the dividend even if you have sold the stock on the ex-dividend date.