For all of you dipping your toes into the various markets (stocks, forex, crypto etc), one might have heard the terms “Investors” vs “Traders” and “Investing” vs “Trading” being used interchangeably. For many who are unfamiliar with these terms, one might wonder….aren’t they the same? While there are similarities, such as the assets one deals in or the platforms one uses….not really. In this post, we will discuss what is the difference between trading and investing and determine if we are a trader or investor. Let’s take a look!

Time Period

In investing, the time period is significantly longer than trading. Normally investors tend to adopt a buy and hold strategy, and whilst there is no definite time period, many hold for a time horizon of a minimum of two years with some holding as long as 10 – 20 years or as long as fundamentals don’t change. On the other hand, traders typically have a much shorter time horizon, with many trading intraday (during the market’s trading hours), while others might have a slightly longer time horizon of a few days/weeks.

Number of Trades

In general, the number of trades done by a trader is higher than an investor in a single day. Many traders tend to do 10s or 100s of trades in a single market session while an investor will likely only do a few trades in the same time period.

That said, the number of trades varies depending on the strategies the Trader/Investor employs, which we will talk more about later.

Types of Strategies

Another aspect that varies significantly between trading and investing is the type of strategies used.

For most types of investors, they will employ the “buy-and-hold” strategy. This strategy allows them to express their long interests in the assets they are holding. For example if an investor is bullish on a company, he would buy their stock and hold till he is no longer bullish the company (due to a change in fundamentals etc). Another common strategy is to buy long dated call options on the underlying (commonly known as LEAPS).

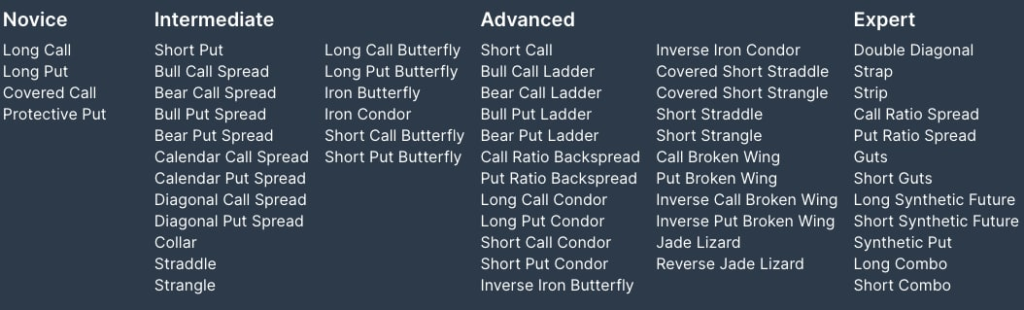

On the other hand, traders typically have access to more strategies to aid in their trading. For example, options traders have various options strategies. Here are some of the more common ones:

Another common trading strategy is scalping, where one sells immediately once the trade becomes profitable.

That said investors and traders are not limited to the strategies mentioned above; depending on the market they are in, there are other strategies that can be employed as well.

Knowledge of Market

Typically a successful trader requires a good knowledge of the market they are trading in as well as other related (directly & inversely) markets. They also tend to be acutely aware of market and economic news.

On the other hand investors will require varying knowledge of the market depending on their style of investing. Passive investors employ the buy-and-hold strategy where they typically track an Index (e.g. S&P 500 Index). More hands-on investors may choose to research on and pick their investments, such as stock picking. This is usually done through extensive research and looking at the company’s fundamentals. Such a form of investing requires more knowledge on how to identify and research to determine if the company is worth investing in.

Time Spent

Traders typically spend more time analysing their trades than investors. This is because traders are more concerned about the short-term fluctuations and can enter/exit their trades when required. Meanwhile investors are not too bothered by short term fluctuations as long as their investment pays off in the long run.

That said, investors should do periodic checks on their portfolio and do rebalancing (such as increasing/decreasing the weightage of a particular asset) or sell assets that are no longer bullish on.

Which is for you?

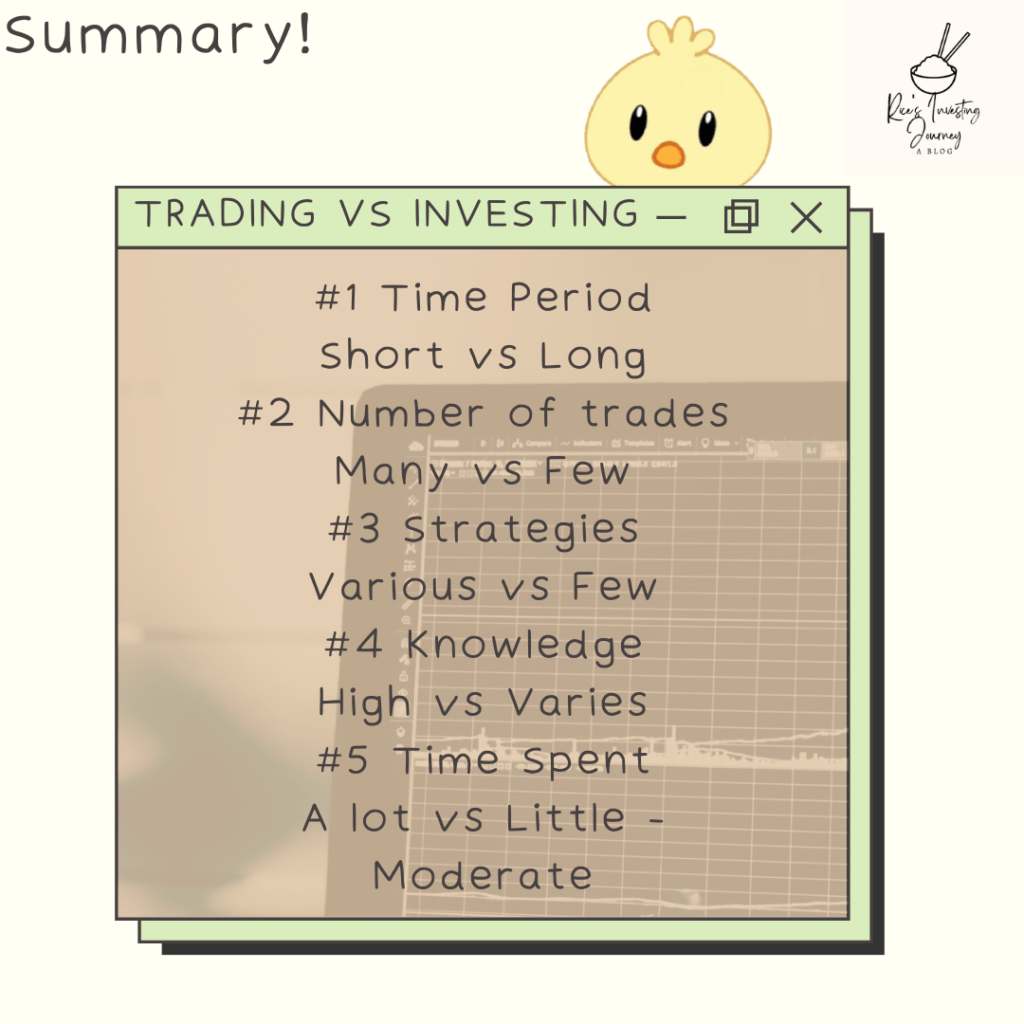

Here is a summary of the various differences:

| Trader | Investor | |

| Time Horizon | Short | Long |

| Number of Trades | Many | Few |

| Strategies | Various strategies | Typically long asset, buying call options |

| Knowledge | High | Varies |

| Time Spent | A lot | Little to moderate |

After covering the various differences between trading and investing, now you might ask…which is the one for you? The short answer is there is no clear answer. Based on the few points mentioned, it might give you a better idea of which type you might want to pursue. However, it is imperative to consider the limitations, such as your current lifestyle, knowledge, available time and more!

A recommendation would be to read up and gain knowledge on how to start on either. There are many markets out there with various derivatives and knowing which market(s) you would like to invest/trade in would be important as well. Afterwards, you can try out trading & investing (either using a small starting capital) or through paper trading (a form of simulated trading) for a couple of months or more to get the feel of both. Do note that investing and trading is not mutually exclusive and you can do a combination of both as well!

Thank you for reading! Hope this helped! As usual, feel free to drop me any questions and share this if you found it informative. Merry Christmas!

– Rice

every informative! thanks for sharing:)

Thank you! 🙂