When we talk about exchange traded funds, we would think about mutual funds and wonder… aren’t they the same? Whilst ETFs and Mutual Funds are similar in nature, we should not confuse the two with each other. Here are some key differences between the two.

Definition

Now, let us first define what exchange traded funds and mutual funds are.

An exchange-traded fund is a security that could track an index, sector commodity or asset, but can be bought and sold on a stock exchange (such as the NYSE) like the shares of companies listed on the exchange. I have done an in-depth of ETFs previously and you can find it here.

On the other hand, a mutual fund is a collective investment that pools together the investments (money) of a large pool of investors to invest in various securities such as stocks and bonds. Buying a share of the mutual fund gives you a small stake in all the securities owned by that mutual fund.

It is important to note that there are many different types of mutual funds and ETFs, some of which are very similar in nature. For example, VSTAX and VTI are both index funds that track the CRSP U.S. Total Market Index, but VSTAX is a mutual fund while VTI is an ETF.

Trading Hours

Like the shares of a particular stock, shares of an ETF can be traded (bought and sold) throughout the trading hours of the stock market. However, Mutual Funds trade only once a day after markets close. Hence ETFs tend to be more liquid than Mutual Funds.

Order Types

ETFs, as they are traded like stocks, allow you to use various order types to buy or sell the shares of the ETF. For example, you can set a limit order to buy the shares of the ETFs at a price that you want (assuming it fills!).

On the other hand, for mutual funds, regardless of what time of day you place your order, you will get the same price as everyone who bought and sold that day. As mentioned in the point above, this price will only be calculated after the markets close.

Minimum Investment

Additionally, ETFs do not have a minimum investment amount (other than the amount needed to buy a single share). On the other hand, mutual funds have minimum amounts ranging from a few hundred to a few thousand (there are mutual funds with no minimums but they are rare).

Expense Ratio

Expense ratio, which is the total costs incurred by the fund expressed as a %, typically includes various costs such as audit fees, custody fees and management fees.

Depending on the type of funds, the expense ratios may vary. Typically, actively managed funds have much higher expense ratios (could be due to higher management fees) than passively managed funds (such as index funds).

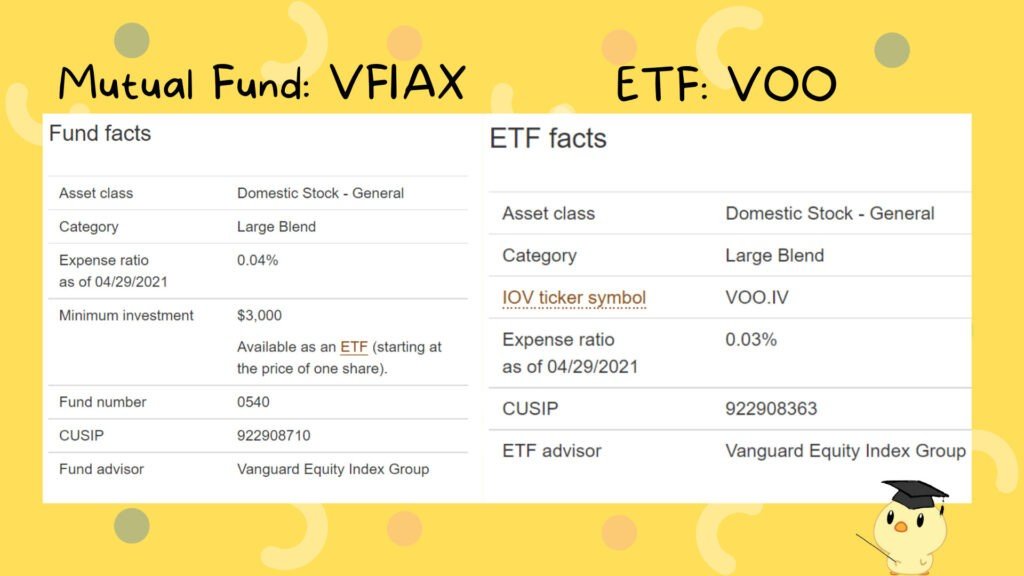

However, when comparing the same type of funds, mutual funds tend to have slightly higher expense ratios than their ETF counterparts. Let us take for example VFIAX vs VOO. Both track the S&P 500 index and are by the same fund advisor (Vanguard Equity Index Group) but VFIAX is the mutual fund while VOO is the ETF.

As can be seen from above, VFIAX has a marginally higher expense ratio of 0.04% compared to VOO’s expense ratio of 0.03%. While a 0.01% may seem like a marginal difference, it may be a sizable amount in the long run if we take into account large amounts of investment and compounding costs.

Auto Investing

Another difference between mutual funds and ETFs is the ability for auto investing. Auto investing is a feature offered by some brokers to automatically make monthly purchases of securities. This is a desirable feature for investors who like to dollar-cost average (DCA) at regular intervals as they do not need to manually go in and place orders themselves.

Unfortunately, most brokers/platforms do not offer the feature to automatically invest in ETFs through buying a fixed amount. However, mutual funds give investors the feature to automate regular investments. This may be a point for consideration especially for those who would like to save time making regular investments.

Which is better?

So after going through the differences in ETFs and mutual funds you might ask: Which is better? Well, let us go through some key considerations that would (hopefully) allow you to make your decision!

Goal of investing in the fund

Probably the most important consideration would be your goals. Before investing in any fund we should be clear on what type of fund you would want to invest in. There are thousands of mutual funds and ETFs out there, many with different goals in mind. It is important to find a fund that meets your investing needs as no two funds are completely alike. That being said, if you are looking at funds with both mutual funds and ETFs options, let us move on to the next point!

Liquidity

Another point of consideration is liquidity. As previously mentioned, ETFs are generally more liquid than their mutual fund counterparts. Hence, for those who are taking a more active approach and tends to buy/sell often, ETFs might be the better choice for you.

However, for passive investors, liquidity may be a double-edged sword. Firstly, having such liquid options may give inexperienced long term investors the notion of trying to “time the market”. However, it is inherently difficult to find the lowest points of the market and may lead to the investor losing out on more gains instead. Secondly, the ease of buying and selling may cause said investors to sell out of their investments on days of large falls in the market out of fear. Lastly, ETFs give investors access to options and those lacking the expertise may buy/sell options only to have their investment account wiped out as a result. Some of these drawbacks have been discussed here which is good for us to read up on.

Ease of investing

In extension to the previous consideration, both mutual funds and ETFs have slightly different aspects that investors may find easier. For ETFs, it may be easier for new investors to invest as they have lower starting amounts, and this will not allow them to invest in mutual funds if they do not meet the minimum amounts. On the other hand, mutual funds might be easier as it saves time through the use of automatic investing.

Costs incurred

Lastly, we should also consider the costs incurred. The way of maximising our investment returns comes in two overarching forms. Increasing gains from investment and reducing the costs incurred. Hence, if we are offered mutual funds/ETFs of similar nature, it would be advisable to choose one with lower costs (as this will also lead to slightly better returns).

In sum, both mutual funds and ETFs cater to slightly different needs of investors. There is no clear cut ‘which is better ‘. Rather, we should focus on finding the specific fund that checks most, if not all of our investment needs. Hope you found this article useful and do share it with others who are looking to start their investing journey. Cheers!

-Rice