Hi everyone! With the seemingly uncertain economy and the poor performance of various markets (e.g. Crypto, the Stock market) on the whole this year, many investors have been looking to other investment options to diversify their portfolios. What if I told you that there is a pretty attractive, risk-free investment out there? Sounds too good to be true? Well, it is none other than the Singapore Savings Bonds (SSB). Read on to find out more!

What are Singapore Savings Bonds?

So what are Singapore Savings Bonds? SSBs are book-entry Singapore Government Securities (SGS) issued by the Singapore Government under the Government Securities Act. It has a tenor of 10 years and pays coupons every 6 months.

Each unit of SSB is $500, and can only be applied or redeemed in multiples of $500 (and the minimum amount is $500). Lastly, each individual cannot hold more than $200,000 across all SSBs issues.

Next, I will go through some of the positives and negatives of SSBs to see if it is a good investment option for you.

Pros of SSBs

Let us start with some of the pros of investing in SSBs!

- Guaranteed Returns

The first and probably the biggest advantage of SSBs is that it generates guaranteed returns. Every month the new issuance lists the bond details and the average return over the 10 years (as well as the yearly return). This allows investors to see and calculate their potential returns over a period of time.

Secondly, unlike typical bonds, the principal of the bond (or par value) is fixed. Unlike other bonds, whose price will trade at a premium or discount of the par value, one who buys SSBs will be able to receive the par value of the bond at any point (of redemption). This is in addition to the various coupon payments the individual has/would have received from the bond. Hence SSBs are suitable for risk-averse investors who do not want to lose their initial investment sum/

- Safe

Secondly, SSB is fully backed by the Singapore Government. It is internationally considered very ‘safe’ as many international credit rating agencies have given the Singapore Government the strongest credit rating. Additionally, monies raised are placed in the Government Securities Fund (GSF). Withdrawals from the GSF may only be for investment and the payment of SGS coupons and principal, not for other purposes such as financing government expenditure. Hence, as investors SSBs are considered safe investments as it is unlikely for the bond to default/monies to be mishandled.

- Non-taxable

Like most investments in Singapore, SSBs are exempted from taxes. This means that investors can realise the full returns of their investments. Yay! Do note however this is only for individuals and is not applicable to those in partnerships.

- Relatively Liquid

Another plus of SSBs is that they are relatively liquid assets compared to other bonds or even fixed deposits. For any redemptions, you will receive the principal amount and accrued interest by the second business day of the next month. (E.g Redeeming on 10 October will allow you to receive the principal + accrued interest on the second business day of November). For comparison, here is a table of other investable assets and their relative liquidity.

| Asset | Cash | Stocks | Bonds/SSBs | Fixed Deposits(with minimum lock-in period) | House |

| Liquidity | Most liquid | Very liquid | Relatively Liquid (SSBs less so than typical bonds) | Relatively illiquid | Illiquid |

Cons of SSBs

That said, there are some downsides to investing in SSBs. Here are some cons:

- Relatively Low Returns (compared to other investment options)

Firstly, SSBs returns have regularly underperformed other securities returns over the long run. For comparison, S&P averages an annual return of 10.5% in the past 10 years. In comparison, October’s SSB issuance will have an average annual return of 3.21% over 10 years. Here are the comparisons of various securities and returns over the past 10 years.

| Securities | SSBs | S&P 500 | NASDAQ (IXIC) | STI Index | Gold |

| Average returns per annum(10-year period)* | 3.21%(Oct Issuance) | 10.5% | 14.8% | 0.83% | 0.84% |

- No or negative real returns

Secondly, SSBs can lead to a situation of no or negative real returns. So what are real returns? Real returns is what earned on an investment after accounting for taxes and inflation. Based on the latest inflation data in August, where the CPI reached 7.5%, investing in SSBs will lead to negative real returns due to the high inflation environment we are facing.

This may not be desirable for those who are looking to grow their wealth for future goals like retirement, as this can lead to an erosion of their wealth.

- Cap on investable amount

Thirdly, SSBs might not be a good choice for those looking to invest sizable amounts of money. There is a limit of S$200, 000 investable amount for an individual across all Singapore Savings Bond issues.

For those looking to invest sums past the $200k threshold, it might be worth exploring other fixed-deposit options or SGS Bonds instead.

- Limited allotment amount

In addition, an extension to the previous con is the limited allotment amount. If SSB is oversubscribed, one may not be allotted the full amount that they have applied for that cycle (not taking into account the $200k cap). This has happened in the past tranches (July and August) where individuals are capped at the allotment they receive and may not receive the full amount applied. I will not go through the method of allotment but for those interested, one can read section 3 of the technical specifications document.

- Not the most liquid investment option

Another con of Singapore Savings Bond is that it is not the most liquid investment option. Now, this may sound like a contradiction to the Pros mentioned previously so hear me out! For those looking for a short-term investment place to park their funds, SSBs may not be the best option for you. Firstly, there is a ~1month wait time after redemption before you will receive your funds. In addition, a good rule of thumb is that SSBs are for funds that you are unlikely to touch in the coming year (taking into account transaction fees and redemption wait time).

For those looking to park their funds for a very short period of time, a high interest savings account might be the better way to go.

- Simple not Compounded Interest

Lastly, like other bond investments, SSBs use simple and not compounded interest rates. The bond pays out coupon payments twice a year. This coupon rate is based on the par (face) value of the bond. Hence, the returns from SSBs are lower than other investments with compounding interest rates where one is paid interest on the interest earned as well. (One example of an ‘investment’ with a compounding interest rate is none other than CPF)

How to Invest in SSBs

Now that we have weighed the pros and cons, we may have decided to invest in Singapore Savings Bond. Now how do we do that? There are 3 ways we can do so, through ATMs, Internet Banking, and our SRS account. Let us go through all the ways to invest in SSBs!

Do note that applying for SSBs, is only applicable to those with accounts in the following banks:

- DBS/POSB

- OCBC

- UOB

This applies to all of the methods that will be discussed in this section. In addition, for the first two methods, you would have to apply for a CDP account. For the last method, you would need to apply for an SRS account.

Through ATMs

Firstly, we can invest in SSBs by applying through the Automated Teller Machines (ATMs)*. This method is more for those who do not have internet banking as it is a rather tedious and harder process. Here are the steps you can do so (based on DBS ATM):

- Insert your ATM/Debit/Credit Card and key in your PIN.

- Select More Services and your preferred Language.

- Select ESA-IPO / Rights Appln/ Bonds /SSB/SGS/Investments.

- Select SGS / Singapore Savings Bonds, followed by Singapore Savings Bond Application.

- Confirm the on-screen T&Cs and select the Bond that you wish to apply for.

- Verify the Bond Details and enter your Application Amount. Press Enter to proceed.

- Select your Debiting Account.

- Select your Nationality and verify that your CDP Account Number is correct.

- Check through all details and select Confirm to submit your application.

- Collect your Card and Receipt.

Through Internet Banking

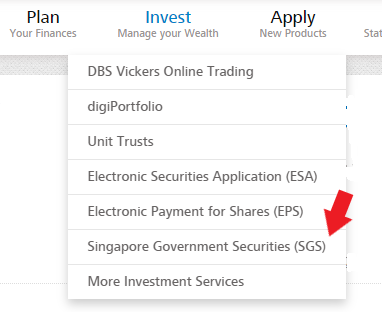

Alternatively, one can do it through internet banking, which is the preferred method for most. In this example, I will be using DBS I-Banking as well.

- Under ‘Invest’ click ‘Singapore Government Securities (SGS)’

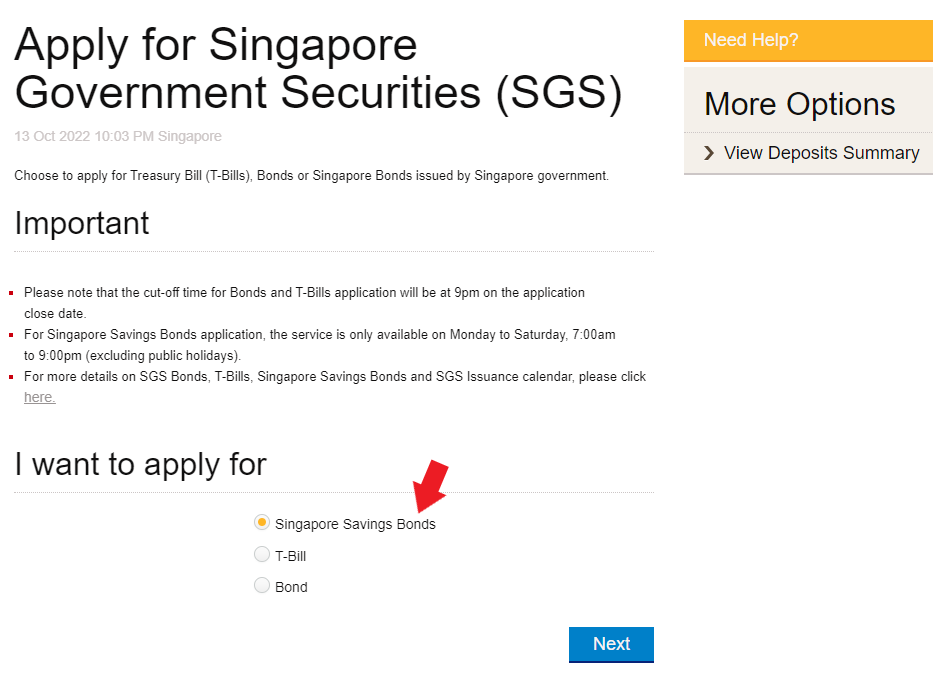

- Under the I want to apply for section, select ‘Singapore Savings Bonds’ and click next

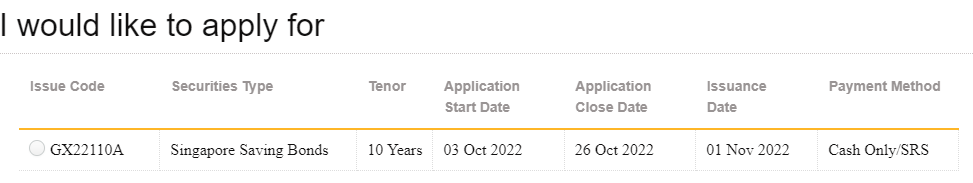

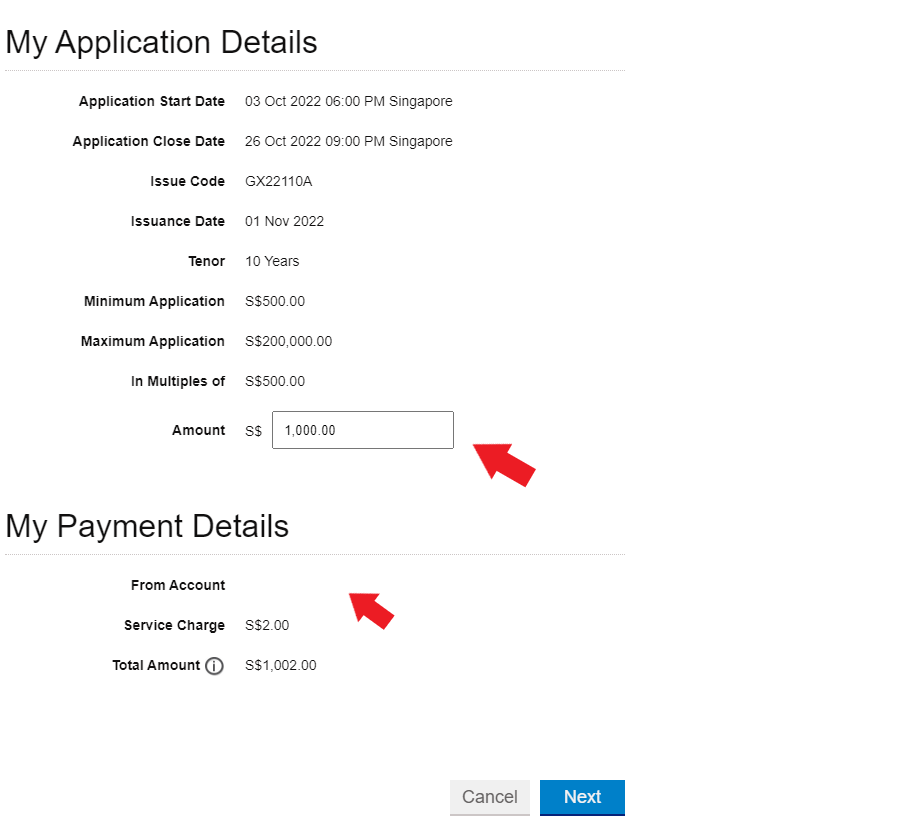

- Select the Issue you are applying for. For example, I will be applying for GX22110A which is October 2022’s issue

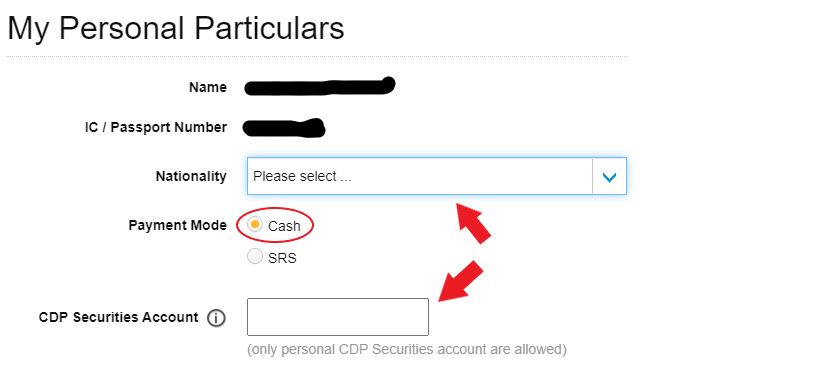

- Fill in your details and under Payment Mode, select ‘Cash’

- Indicate the amount you would like to apply for (Note that you can only apply for it in multiples of S$500)

- Select which account you want the payment to be for under ‘My Payment Details’ and click next

- Check that all the details are correct before submitting

For the ATM and Internet Banking methods, interest will be paid into the bank account that is linked to your CDP securities account.

Through SRS account

For applications using an SRS account, you can follow steps 1 – 4 as above but under ‘Payment Mode’ select SRS instead. Do note that you have to use the i-Banking account of your SRS operator.

Additionally, by investing in SSBs using your SRS account, the interest will be paid into your SRS account instead.

Application and Redemption Process

Now that we know how to apply for SSBs, let us learn more about how the application process works!

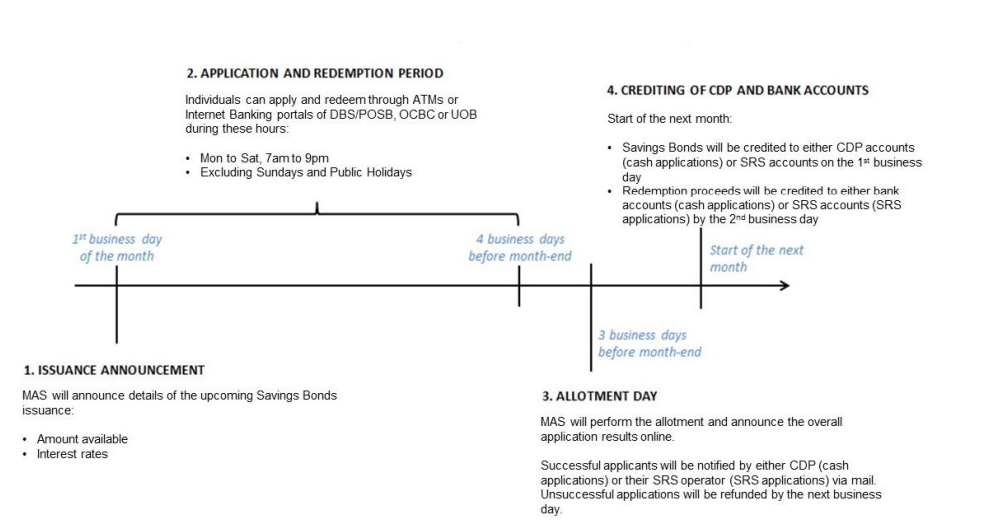

- MAS first announces the details of the month’s SSB issuance on the 1st business day of the month and will include details like the amount available and interest rates.

- Individuals will then apply for SSB through the various methods mentioned above from the announcement date till 4 business days before month-end. Do note that the application can only be done Mon – Sat, 7am – 9pm, excluding Public Holidays.

- The announcement of the allotment will be done 3 business days before-month end.

- From the start of the following month, the Savings Bonds will then be credited to the CDP account or SRS accounts.

- For unsuccessful or partially successful applications, banks will refund the excess amount by the end of the second business day before month-end.

What about the redemption process? Well here’s how it works!

- Similarly to the application process, one can submit redemption requests from the first business day till 4 business days before month-end (the period for application is Mon – Sat, 7am – 9pm excluding Public Holidays as well).

- Settlement of redemption will occur on the first business day of the following month. However, the proceeds will only be paid to individuals by the second business day of the following month.

Below is the summary of the application and redemption process taken from the SSBs: Technical Specifications document.

Predicting SSB rates

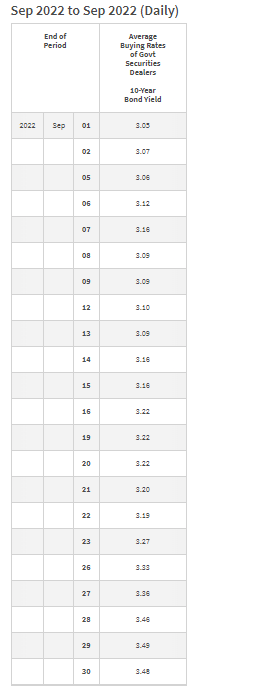

Additionally, did you know that we can predict the following month’s Saving Bonds rates? SSB rates are actually based on the previous month’s Singapore Government Securities (SGS) average 10 year yield. Here’s how you can do the estimate. (For this example, I will be estimating October’s SSB rates)

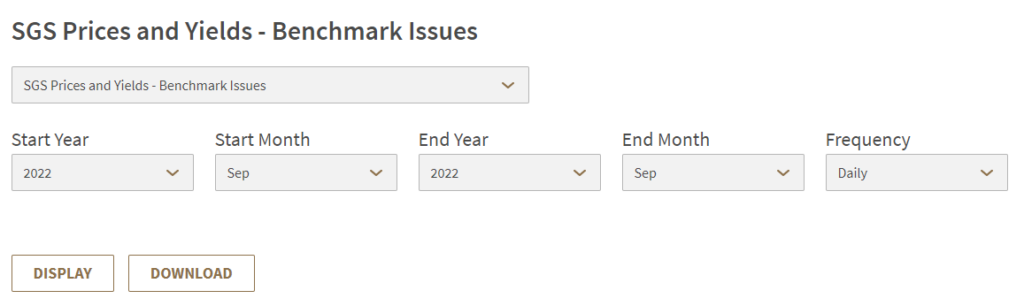

- Go to the MAS website for SGS Prices and Yields – Benchmark Issues

- For the Start/End Year/Month input the current year and the previous month.

- For the frequency, select ‘Daily’. The settings to estimate October’s SSB rates should be as follows

- Scroll down and under Average Buying Rates of Govt Securities Dealers select ‘10-Year Bond Yield’

- Click display and it will show the daily average rates for the whole month

- Find the average of all the daily rates. From my calculation of the data, I got 3.209 (3 d.p.) which is approximately 3.21%, the rate of October’s issue!

If you are interested in estimating the rates, do note that the estimate will only be accurate nearing the end of the month, where u get most of the daily rates. Then you’ll be able to make a better judgement to invest in the current month or wait for the following month’s SSB issuance. In addition, I highly recommend you guys to check out this video on the estimation process, and full credits to Boon Tee for showing us how it’s done!

7 nov edit

If we take a look at the month of October’s daily SGS Yields and find the average, we will get an average yield of 3.4755% which corresponds to November’s SSB yield of 3.47%.

Other important things to take note

Now that I have gone through everything about Singapore Savings Bond, I would like to bring up some additional details that are not covered in the previous sections. SSBs have a minimum age of 18 years old and above and cannot be transferred except in specific situations (e.g. death of the bondholder).

In addition, there is a S$2 fee charged by banks per application and redemption request. This fee is levied regardless of the outcome of the application/redemption. This is applicable regardless of SSBs with CDP accounts or SRS accounts.

SSBs coupon payments are paid out twice a year. However, if it is redeemed before the coupon payment, the amount paid out will be prorated accordingly. The calculation can be found in section 4.8 of the technical specifications document.

Lastly, I will talk about the unique ‘Step-Up’ feature of SSBs.

‘Step-Up’ Interest Feature.

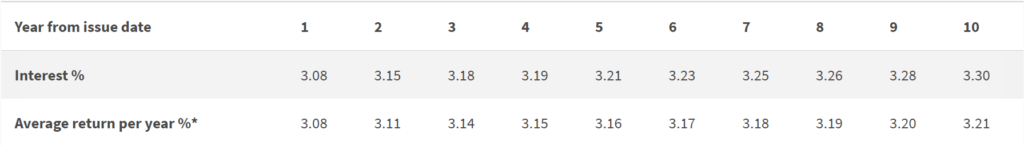

One unique feature of Singapore Savings Bond is the ‘step-up’ feature. This simply means that the longer you hold the bond through its tenure, the higher the interest rate earned for that year.

Taking October 2022’s issuance, we can see that the interest rate in year 1 is 3.08% and this increases to 3.30% in year 10. In short, the ‘step-up’ feature rewards investors who hold SSBs through their tenure, allowing them to earn the average projected coupon rate. Thankfully, we can see the interest rates for the full 10 years prior to subscribing for SSBs.

Conclusion

Hope that after reading this article, you have a better idea of SSB as an alternative, safe investment vehicle. Feel free to ask any questions you might have in the comments below and I’ll try my best to answer them. In addition, I will put some links and resource links below if you are interested in learning more. Once again, thanks for reading.

Cheers!

-Rice

Other Useful Resources

Signing up for SSBs (Instructions for other banks)

SSB: Technical Specifications (PDF)