Hey everyone! In this week’s Phrase of the Week, I will be going through what share dilution is! Share dilution is a very common concept as it happens frequently in the real world, especially to the shares of high-growth companies.

What is share dilution?

Share dilution occurs when a company issues new shares resulting in a decrease in existing shareholders’ ownership of the company. When a company issues new shares, it causes the number of shares outstanding to increase. The opposite of a share dilution is share buybacks.

Identifying Share Dilution

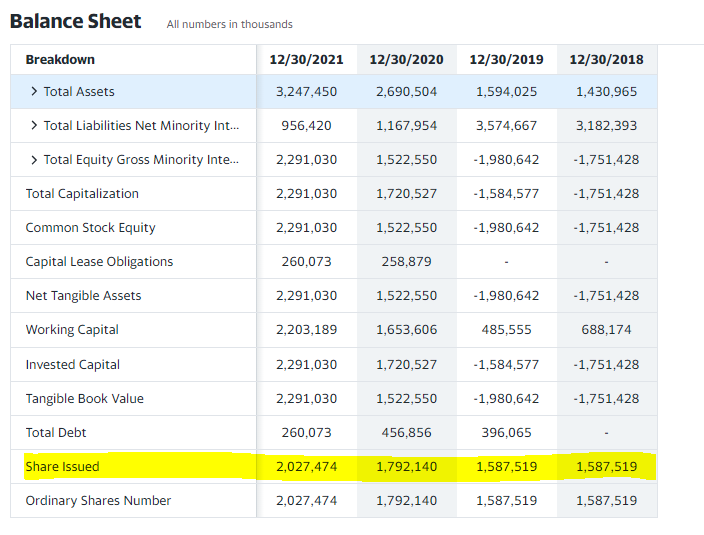

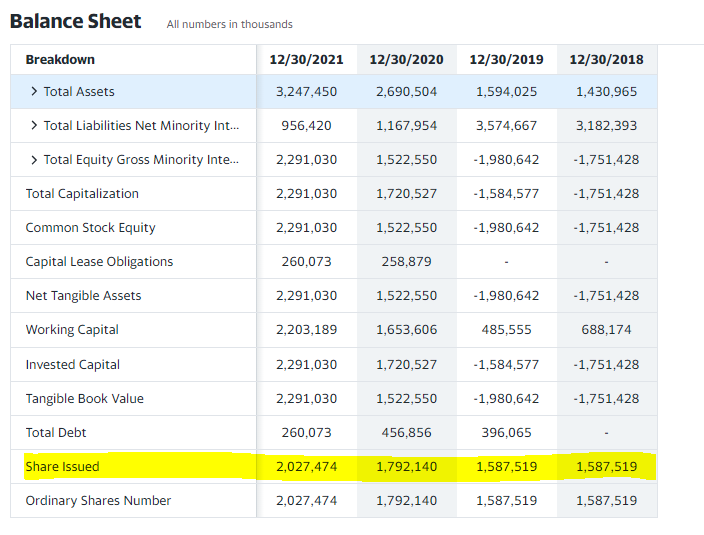

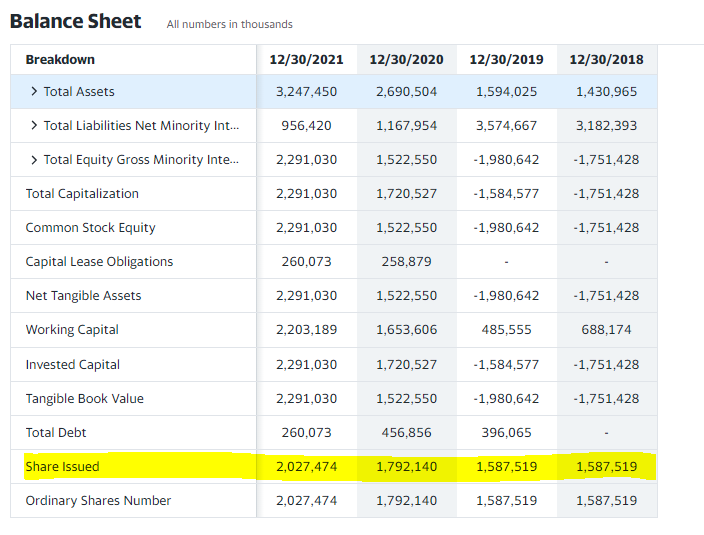

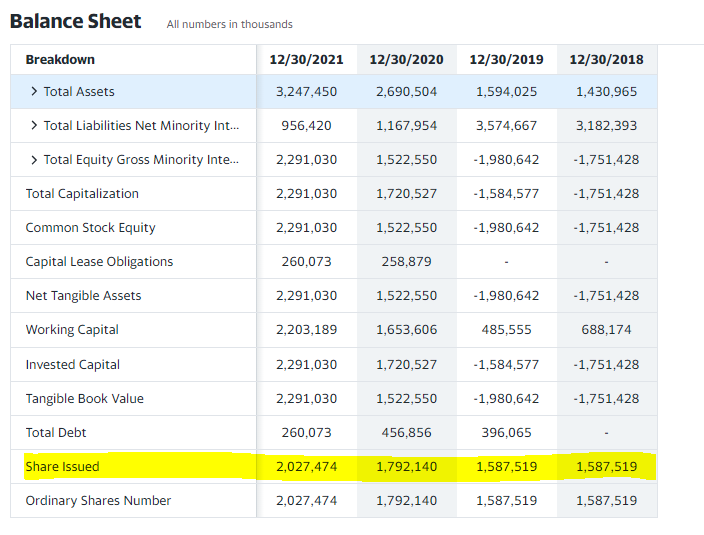

Before I explain how share dilution occurs, I will talk about a simple indicator of a possible ‘dilution’. Firstly, the shares outstanding will increase over time. A quick way to observe share dilutions from financial statements would be to look at the number of shares outstanding under the balance sheet (sometimes it will also be known as ‘shares issued’).

Another way would be to look at the diluted shares outstanding on the income statement. Specifically, one can observe the weighted-average diluted shares number on macrotrends (labelled as shares outstanding).

Basic (or common) shares: The total amount of shares held by all shareholders. On the other hand, the diluted shares are basic shares + shares from convertible securities assuming that they were exercised. A large number of shares from convertible securities could mean a large dilution that may have in the future (as such securities get exercised).

Lastly, share dilution can also be observed from reports, such as secondary (additional) listings, employee compensation and more. I will talk more about this in the next section.

How does dilution occur?

So how does share dilution occur? It occurs mainly through three main ways; dilution to raise capital, employee compensation and merger and acquisition. Let us learn more about them.

Raise Capital

Capital can be raised through two main methods, follow-on offering and convertible securities.

A follow-on offering is when a public company issues more shares after their initial public offering (IPO). While a follow-on offering can be dilutive and non-dilutive in nature, I will go through the dilutive type for the purpose of this article A diluted follow-on offerings happen when a public company issues new shares for anyone to invest in. This is so that they can raise more capital for a firm. However, this increases the shares outstanding, resulting in share dilution.

An extension to a follow-on offering would be an additional listing of a company. What this means is that the company will list on another exchange other than the current exchanges it is currently listed in. Most notably, NIO recently did an additional listing of their stock on the Singapore Exchange (SGX). They were previously already listed on the HKEX and the NYSE. Such additional listing means that the company is offering new shares (that previously did not exist) and hence will dilute the fractional ownership of existing shareholders.

A convertible security is an investment that can be changed from its original form to another. An example of a convertible security is a convertible bond. In short, it is a fixed-income corporate debt security that yields interest payments like a typical bond but can be converted into a predetermined number of common stock.

Stock Compensation

Secondly, dilution can occur as a result of stock compensation. In addition to the typical bonuses and perks that an employee can receive, an employee may also receive stock options as a form of stock compensation. Stock options are like regular call options and give the employee the right to buy the company’s stock at a specified price for a finite period.

Merger and Acquisition

Lastly, a dilution can occur due to mergers and acquisitions. When another company merges or acquires another company, payments will typically be either in cash, securities or a mixed offering. The acquiring company can pay in securities (i.e stock) or a mixture of stocks and cash. This means that the acquired firm will have equity in the ‘new’ company post merger/acquisition. However, this means that the acquiring company would have to issue new shares to the acquired, increasing the shares outstanding.

What does dilution mean for investors?

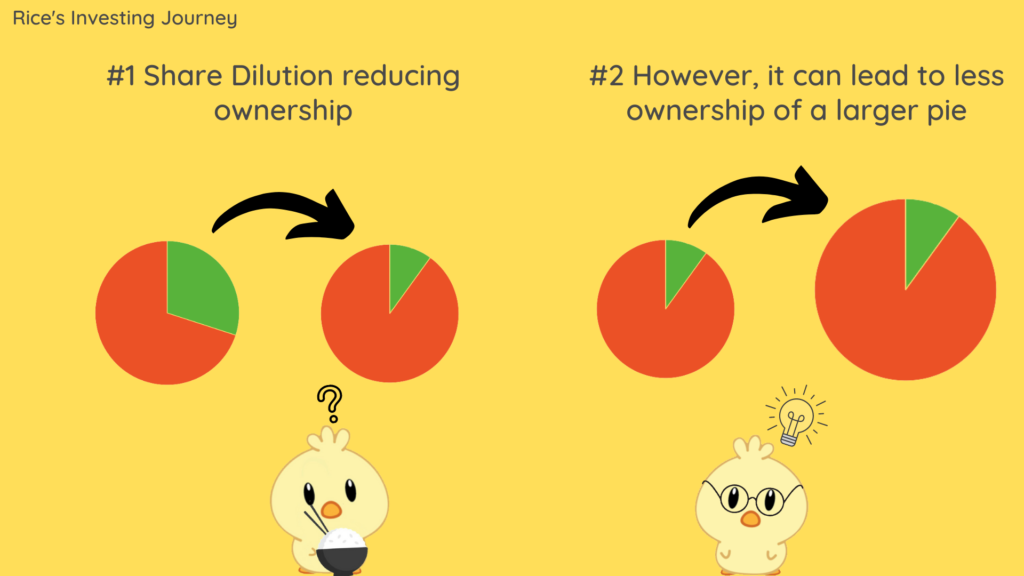

A dilution is seen as a negative to investors as it means their existing ownership of a company will shrink. However, this may not be all bad depending on the reasons and results of a dilution.

For example, if the purpose of share dilution is to achieve significant future growth in the future, it might be deemed useful. While there may be a short-term fall in earnings-per-share (EPS), if the additional capital or acquisition can increase the company’s earnings in the future, it may lead to a long-term increase in the company’s EPS (which will benefit stock price and hence investors). Below is a simple example of this concept.

Imagine the pie represents the total ownership of the company. While share dilution may be bad as it decreases the ownership of the pie, it may be beneficial if it increases the overall size of the pie such that you get a smaller slice of a much bigger pie.

Example

Before I end the article, I will go through a model example of share dilution Palantir (ticker: PLTR). For those that do not know, Palantir is a software company that allows organisations to effectively integrate their data, decisions, and operations. Over the past few years, Palantir has been experiencing significant share dilution (typically through generous stock-based compensation for the executives). The image below shows stock dilution as the number of shares issued increased significantly over the years.

Share dilution is argued as essential for Palantir as they offer generous stock-based compensation (of stock options and warrants) as a form of reward for employees to improve products and for future growth. However, such a strategy is a big IF it is successful where the increase in earnings makes up for the increase in shares issued. Else, this will significantly depress PLTR’s share price and cause it to lower.

As of writing, PLTR is down nearly 60% YTD and more than 70% from its all-time highs. It remains to be seen if the stock-based compensation will help future growth although they have been growing their earnings steadily in the past year.

Anyways that is all for this week’s phrase of the week! If you found such posts useful do consider sharing this article and suggest what other content you will like me to cover next.

Cheers!

-Rice

Insightful post!

Thanks for reading!